With the sale of its native token $RDO in a Token Generation Event (TGE) on 29 May 2025, from Binance Wallet and PancakeSwap, Reddio is all set to redefine blockchain scalability. Since it is termed as the first project to go live on the Parallel EVM, Reddio's initiative is to solve all issues through GPU acceleration, parallel execution, and zkEVM technology for hungry high-performance sectors such as DeFi, on-chain AI, and real-time gaming.

Prior to this occasion came the TGE celebration held exclusively by Binance, marking this historic moment as more than just a mere token release-The emergence of a new world in Ethereum Scalability.

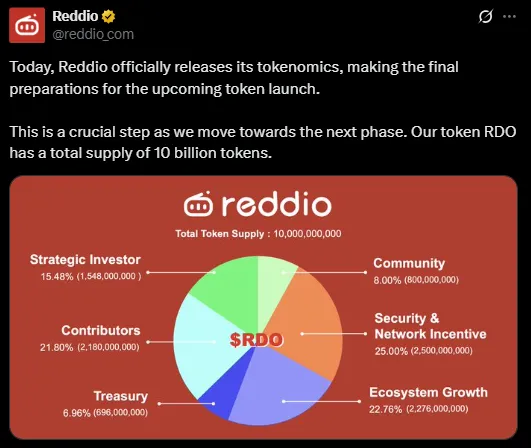

An introspective look into Reddio's tokenomics reveals that it is cautiously and well balanced in all six main segments:

Security & Network Incentives – 25%

Ecosystem Growth – 22.76%

Contributors – 21.80%

Strategic Investors – 15.48%

Community Allocation – 8%

Treasury – 6.96%

These assignations bring forth an ecosystem that supports long-term sustainability, provides incentives for early contributors, and fosters community engagement. In doing so, it trails the success stories of zk rollups like StarkNet and zkSync, thus paving the way for Reddio to gain quick adoption and liquidity.

Going by the price benchmarks set by Layer 2s and zkEVM tokens, the token is expected to launch somewhere between $0.02 and $0.05. If the circulating supply is anywhere between 1 billion to 2 billion tokens at TGE, then the initial market cap would range from $20 million to $100 million, which is modest for a latest-high-tech-first-mover zkEVM project backed by Binance.

This presents early backers an opportunity to get in before the rest of the retail and institutional world jump on.

The trajectory of price post-launch will depend on real adoption and developer integrations, as well as actual ecosystem traction. If the platform gets to actually demonstrate the utility of $RDO in DeFi protocols, on-chain AI applications, and gaming, the token price may very well be between $0.05 and $0.10 as utility and demand increase.

One may see some degree of short-term volatility in $RDO due to these initial unlocks by investors and contributors. The better these unlocks are managed, along with staking incentives, the smoother will be price actions.

Reddio's biggest factor for success in the long term remains Layer 2 adoption and continued performance leadership in the zk-rollup space. If $RDO gains traction amongst developers and enterprises as zkEVM parallel infrastructure, then the price of $RDO could head upwards to $0.15 and $0.30 with the fully diluted capitalization standing extremely near at $1.5 billion and $3 billion, respectively.

This seems to be the case for other large-scale Layer 2s like Arbitrum (ARB) and Optimism (OP), where exponential growth came along with ecosystem expansion and institutional onboarding for the protocol.

Since Reddio is just starting out, it is truly an intriguing project, and a must-watch from 2025 onward, whether you are a developer, investor, or just simply a crypto enthusiast.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.