Is XRP on the verge of a deeper crash, or is the market preparing for yet another explosive rally like in earlier times? The latest Price Prediction paints a complex picture, combining bearish technical warnings with historically bullish signals that demand investor attention.

Professional trader Peter Brandt has put the asset on the map by spotting a double-top pattern in the weekly chart — the most reliable bearish reversal patterns among the technical charts. According to Brandt, the asset has created two separate peaks during 2024, with the main neckline sitting about the $2.00 support zone.

The recent drop under $2 confirms the pattern, pointing to the possibility of an escalation in bearish momentum. In the event of a failure on the part of bulls to get back the neckline in this XRP Price Prediction scenario, it may very likely lead to a sharp decline towards $1.00, which is also the area where historical support zones exist.

Brandt did not deny that chart patterns may sometimes not work but, at the same time, he asserted that traders have to acknowledge the visuals until price movements tell a different story. His viewpoint echoes a worried short-term outlook, particularly since the altcoin is yet to go through the major resistance levels.

“It might not work out, and I will handle the situation if it does. But for now, this is viewed as a bearish scenario. Love it or hate it – you just can't ignore it," he remarked.

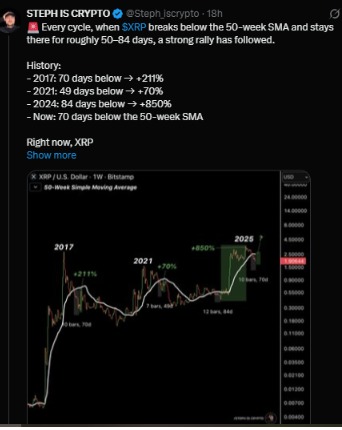

Although the overall market sentiment is negative, the Price does not entirely indicate the same. Additionally, the chart points out the same old historical pattern that recurs, which is linked to the 50-week simple moving average (SMA)—a price level that has always served as a launchpoint for significant uptrends in the past.

2017: about 70 days under the 50-week SMA resulted in a +211% rally

2021: 49 days below triggered a +70% move

2024: 84 days below resulted in a massive +850% surge

The coin is again close to the 50-week SMA, implying that the market could be close to a very important decision point. A long-lasting stay above or a robust reclaiming of this average could pivot the momentum steeply towards bulls, thus challenging the from-hence-determined bearish narrative if history is to be repeated.

On-chain data supports the Price outlook with more complications. According to the analyst Ali, the whales have concluded the sale of approximately 1.18 billion coins in the last four weeks, which has resulted in a substantial increase in the sell-side pressure.

The reported large wallet holdings have fallen from 4.8 billion coins at the end of November to 3.6 billion by the middle of December which reflects the increasing distribution by the big players.

This aggressive selling has been on the same side as XRP’s drop below $1.92 thus making it more likely that the price will go down to $1.00 if demand does not recover.

However, if XRP manages above $1.90 and reclaim $2.00, the bearish pressure could vanish. In that case, this XRP Price can rebound toward the $2.50–$3.00 range, particularly if crypto market sentiment turns.

Disclaimer

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.