The debate over safe-haven asset has reignited after gold and silver prices again surging to historic highs, while the U.S. dollar weakened and job growth slowed.

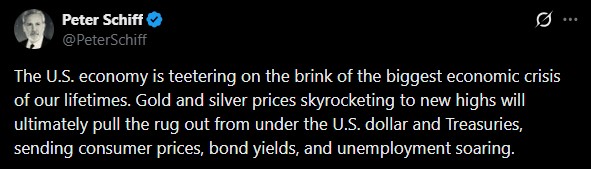

Veteran economist Peter Schiff argues that surging precious metals prices signal deep structural stress in the U.S. economy. According to Schiff, rising gold and silver could eventually undermine confidence in the U.S. dollar and Treasuries, pushing bond yields, consumer prices, and unemployment higher.

Source: Peter Schiff Official

While not everyone agrees with this outlook, critics argued that gold rallies alone do not collapse reserve currencies, especially while the Federal Reserve retains monetary flexibility and the dollar remains dominant in global trade.

Still, the price action suggests investors are actively hedging against inflation, and fiscal risk as they rotate into traditional hedges. Here crypto is increasingly being evaluated as one of those tools, not as a replacement for gold, but as a parallel hedge shaped by very different mechanics.

Understanding how this surge and crypto’s positioning interact is key to separating justified concern from exaggerated narratives.

Gold has been moving to reach fresh all-time highs, currently trading above $4,337 per ounce (running close to its all time high of $4,381 in October), while silver recently touched $66.87, its highest level ever. Over the past year, gold has climbed over 67%, while silver, impressively, showed a surge of more than 124%, underscoring intense demand for hard assets.

Source: Trading Economics

At the time, questions arise on the reason behind the continuous rise or is any of them specific?

The current rally is tied closely to macro pressure points rather than crisis-level events. Since April, U.S. job growth has largely stalled. November added 64,000 jobs, but the unemployment rate rose to 4.6% (exceeding expected 4.5%), the highest since September 2021.

Factors such as tariffs, AI-driven automation, and aggressive cost-cutting are increasingly cited as pressures on employment.

The U.S. Dollar Index (DXY) offers additional context. Although the dollar is marginally higher on the day at 98.366, its broader trend remains weak with -0.90 in monthly and -9.36% in Year-to-date

The weakening dollar explains the metal’s new highs and growing interest in alternatives. A declining DXY typically boosts non-dollar assets, including commodities and crypto, by reducing the purchasing power of fiat currency.

As gold-silver set new goals, attention is shifting toward whether crypto, especially Bitcoin, could follow as the next safe-haven trade. Bitcoin recently rose 0.78% to around $86,854, despite a 5.65% weekly decline, suggesting buyers are defending key levels.

Unlike hard metals, Bitcoin combines scarcity with portability and a fixed supply, making it attractive during periods of monetary uncertainty. Supporters argue that while hard assets reflects fear of inflation, Bitcoin represents distrust in the long-term sustainability of fiat systems.

Institutional momentum is also strengthening the crypto narrative. Recent developments include Bitcoin staking initiatives in Japan and expanding regulatory clarity in the U.S., including approvals for bank crypto trading activities and renewed discussion around a Texas Bitcoin reserve bill.

Historically, shifts toward alternative stores of value begin before recessions are officially declared, and Gold’s rally suggests that phase may already be underway. Adding to narratives, Bitcoin is also showing early stabilization signals, including a bullish MACD crossover near key Fibonacci levels.

However, this is not yet a full-blown recession. Economic growth remains positive, with GDP rebounding to 3.0% from a prior contraction, even after the downturns.

Whether crypto becomes the next dominant safe-haven trade will depend on how inflation, monetary policy, and employment trends evolve in the coming months.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.