As Christmas gets closer, global markets are entering one of the most closely watched seasonal windows: The Santa Claus Rally Stock Market phase.

After fear, volatility, and sharp corrections, a seasonal bounce often appears, and now crypto investors are closely watching whether digital assets will follow the same path

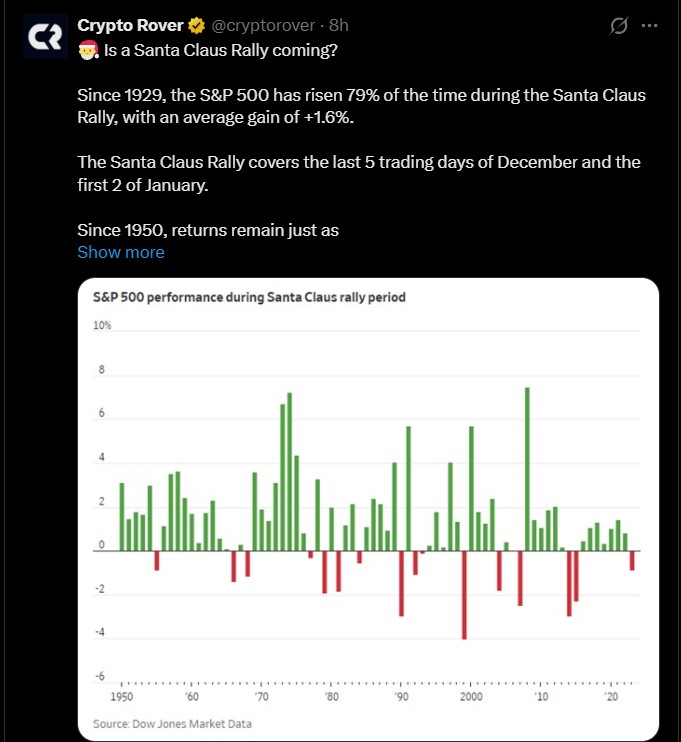

According to Crypto Rover , a well-known analyst, the numbers are clear. Since 1929, the S&P 500 chart history has risen 79% of the time during this window, with an average gain of +1.6%.

Looking only from 1950 onward, results remain strong with a 79% win rate and an average gain of +1.3%. This data clearly shows that this period has a strong historical track record in the Santa Claus Rally Stock Market data.

Even more important for traders, as per S&P 500 December forecast, it has fallen during this period only once in the last eight years, making this window historically very strong for the financial marketplace.

Over the last 75 years, the final two weeks of December have been the strongest two-week period for stocks.

This long-term history keeps the Dec 2025 breakout analysis narrative alive every year. Now the question is: If this financial industry breakout begins, then will the cryptocurrency marketplace also follow?

Digital assets do not move in isolation. When stocks turn positive, risk appetite usually increases. That is why many traders simply look at how crypto and the S&P 500 move together during the Santa Claus bullish period.

Political headlines are also adding fuel. President Trump recently said he plans to sign a landmark Bitcoin and crypto structure bill this year. This statement is being seen as a major shift.

Source: Crypto Tice Official X Account

Clear rules could reduce uncertainty, encourage institutional participation, and improve long-term trust in the industry. For many, this aligns with broader Trump crypto bill news and strengthens the case for a crypto Santa rally 2025.

Many analysts point out that big altcoin rallies usually start after pain. The same structure often appears:

The Fed stops quantitative tightening (QT)

Liquidity slowly returns

Altcoins move fast

Before that happens, industry retest support, trigger liquidations, and push weak hands out. This happened in 2020. After the Fed ended QT, altcoin market cap tested support multiple times, liquidations scared investors, and then many altcoins surged over 1,000%.

Supporters of the December breakout believe 2025–2026 is starting to look similar. QT is ending again, altcoin market cap is sitting on multi-year support, and liquidations are already happening.

After a deep correction yesterday, digital assets prices are showing early recovery:

Bitcoin price surged back from $85 yesterday to $87k today, a 2% increase in the past 24 hours.

Ethereum price today rose from $2,899 to $2,936.86 reflecting slight strength in the chart.

XRP rallied to $1.92, gaining about 3%, adding momentum to the altcoin rally

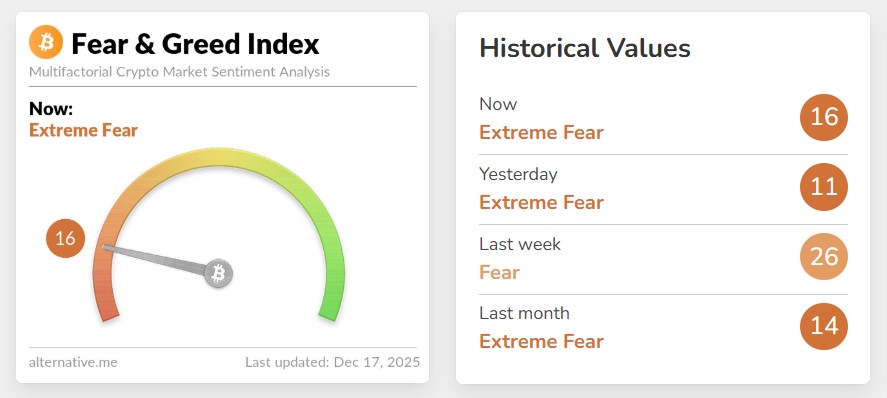

Market sentiment also improved slightly. The fear index rose from extreme fear at 11 to 16 today, as seen in the above chart, still in fear but less panicked.

From a market perspective and analysis, this type of price and sentiment setup often appears before short-term rallies ahead of the potential Santa Claus Rally Stock Market window.

History shows that the Santa Claus Rally Stock Market is one of the most reliable seasonal trends in finance. With strong historical data, improving liquidity conditions, supportive political signals, and early cryptocurrencies price rebounds, the case for a crypto santa rally is growing stronger.

Still, volatility remains high, and fear has not fully left the industry. Whether this turns into a full btc santa rally or just a short bounce will become clear as the final trading days of December unfold.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.