The U.S. jobless claims report – one of the most important pieces of data for crypto traders, is to be released today by the Fed. Because weekly unemployment filings now move markets more than some Federal Reserve speeches, it became a key watchmark for both traditional and crypto markets.

Source: CryptoRover

Source: CryptoRover

Last week’s 191,000 claims marked a three-year low, but economists expect today’s number to rise around 220,000, with 223,000 as the key threshold that may determine whether markets interpret the report as cooling or resilient for the week ending December 6.

But exactly how the U.S. jobless claims report binds volatility, directly or indirectly, in digital assets marketplace

Here’s what a surprise reading could mean, especially for cryptocurrencies:

A lower-than-expected U.S. jobless claims report would signal a still-tight labor market, reducing the chances of aggressive rate cuts and creating short-term volatility for Bitcoin and equities.

A higher reading, however, suggests hiring is slowing, giving the Fed more room to ease monetary policy, which can create a more favorable environment for crypto and other risk markets.

Either way, the broader trend is becoming clearer: the Fed is slowly shifting from fighting inflation to maintaining economic stability. One data point won’t change the long-term direction, but it can definitely set off intraday volatility.

This comes at a delicate moment for markets following the Federal Reserve’s recent 25-bps rate cut, its third of 2025. Despite expectations being met, the Fed’s message was mixed. Internal disagreement, with some officials wanting no cut and others pushing for 50 bps, left investors uncertain about the January meeting.

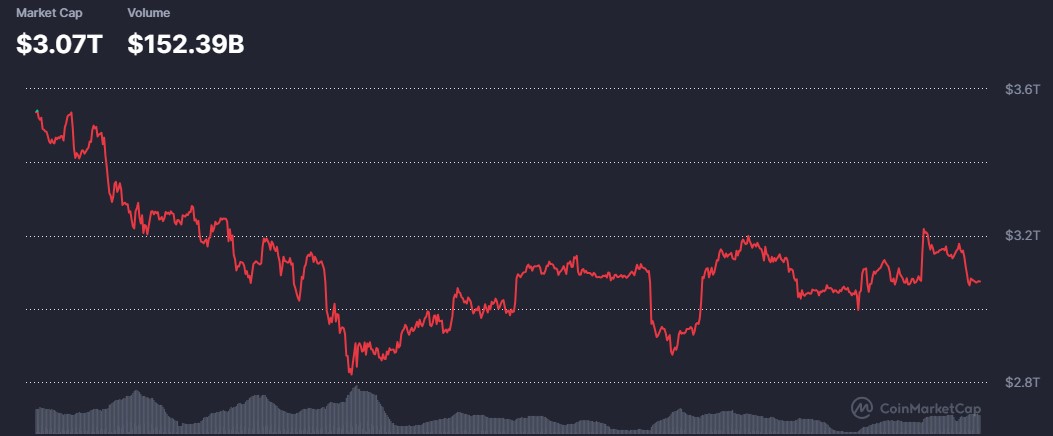

As a usual reaction, the broader crypto market reacted immediately. The global market cap fell 2.57% in 24 hours, extending a 7-day drop of 3.46%. Bitcoin also dropped 1.88% to $90,258, while Ethereum –3.5% to $3,195.

Source: CoinMarketCap

Along with this the key points that matters:

Leverage Unwind: $169M in BTC liquidations (+327% long squeeze).

Weak Technical Structure: Market cap fell below its 7-day SMA (simple moving average) to around $3.09T.

Macro Mismatch: The Fed injecting liquidity through $40B in Treasury purchases, still risk assets did not rally.

This environment makes today’s U.S. jobless claims report even more critical. A surprising print could accelerate volatility already fueled by leverage flushes and cautious Fed rate cut signals.

Today’s U.S. jobless claims report is a direct signal for markets, Fed expectations, and crypto volatility. With leverage still high and macro uncertainty growing, even a small surprise in this data could define the broader reactions in both traditional and crypto markets.

Despite today’s uncertainty, oversold technicals, RSI (Relative Strength Index) is nearing 40, and solid ETF inflows suggest that long-term fundamentals remain intact.

The real question is whether Bitcoin can stabilize enough to prevent further liquidation cascades — and whether altcoins can decouple if Bitcoin dominance continues to rise.

Crypto traders should stay alert. At 8:30 AM ET (7:00 PM IST), the jobless claims report will set the mood for the entire trading day.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Crypto markets involve risk; always conduct your own research before making investment decisions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.