Is the crypto market Santa Claus rally really coming, or is this year setting up a very different ending? History supports a late-December bounce, but current macro data and charts are telling a much colder story.

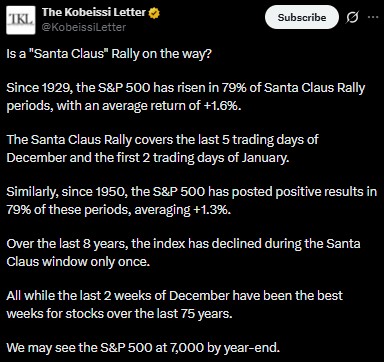

The Santa Claus rally refers to the last five trading days of December and the first two of January. Since 1929, the S&P 500 has risen in 79% of these periods, averaging gains of 1.6%. Over the last eight years, stocks fell only once during this window, according to The Kobeissi Letter. This seasonal optimism has fueled hopes of a rally as well.

Source: X

But 2025 is not following the usual script.

One major reason analysts doubt a crypto market Santa Claus rally is falling US consumer strength. In November, Americans expected to spend just $778 on holiday gifts, down $229 from October. This is the largest November drop since 2006 and even worse than the $185 decline seen during the 2008 financial crisis.

Spending expectations are also $234 lower than last year. Both high- and low-income households are pulling back, signaling stagflation pressure. Weak consumer demand reduces liquidity and risk appetite, directly impacting digital assets.

Another red flag comes from US small caps. Around 40% of Russell 2000 companies reported negative earnings over the last 12 months in Q3 2025. This matches post-2008 crisis levels and shows broad fundamental weakness beneath headline indexes.

Source: The Kobeissi Letter

At the same time, global liquidity is shrinking. While the Fed has ended QT, the ECB, BOJ, and BOE are expected to cut balance sheets by $1.2 trillion in 2026. From 2023 to 2026, central banks will unwind about $5 trillion, reversing nearly 65% of pandemic stimulus. Tight liquidity rarely supports a Santa Claus rally.

The market news is also bearish. Total market cap has dropped 2.12% to $3.07 trillion. Bitcoin is down 1.75% weekly and over 7% monthly, trading near $89,629 with a $1.78 trillion market cap. Ethereum sits near $3,120, with mild weekly and monthly declines.

Analyst Ali Martinez warns of a supertrend bearish cross. In 2022, a similar signal preceded a 60% BTC crash and an 80% drop in Cardano. If repeated, Bitcoin price prediction models suggest a fall toward $70,000.

Source: TradingView

Technically, Bitcoin has broken a bearish flag after dropping from $106,000 to $80,000 in one month. The measured move points to $60,000–$75,000. RSI remains below 50, showing weak momentum. Without reclaiming $95,000–$98,000, downside risk dominates.

This week could shape the crypto Santa Claus rally narrative. Key events include retail sales, jobs data, CPI, PCE inflation, housing data, and multiple Fed speakers. Any inflation surprise or hawkish tone could pressure Bitcoin and Ethereum further.

The crypto market Santa Claus rally 2025 faces strong historical support but even stronger current headwinds. Weak consumers, fragile small caps, tightening global liquidity, and bearish charts suggest caution. A surge is possible, but risks clearly outweigh seasonal optimism right now.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto are highly volatile and speculative. Always do your own research, verify data from reliable sources, and consult a qualified financial professional before making any investment decisions. Never invest money you cannot afford to lose.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.