Highlights

The U.S. SEC has sued Shima Capital founder Yida Gao for allegedly defrauding investors.

Gao has resigned and announced an orderly wind-down of Shima Capital’s funds.

The case highlights growing regulatory pressure on crypto venture capital firms.

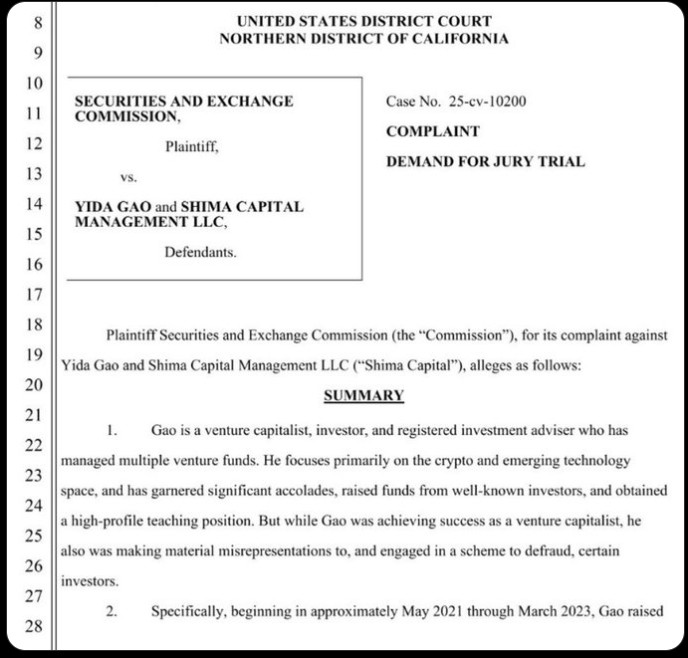

The U.S. Securities Exchange Commission has accused Shima Capital founder Yida Gao of carrying out a scheme to defraud investors by exaggerating investment returns while raising investments for the firm’s crypto fund. The complaint states that Gao had raised more than $158 million by providing fraudulent performance reports in investor pitch documents.

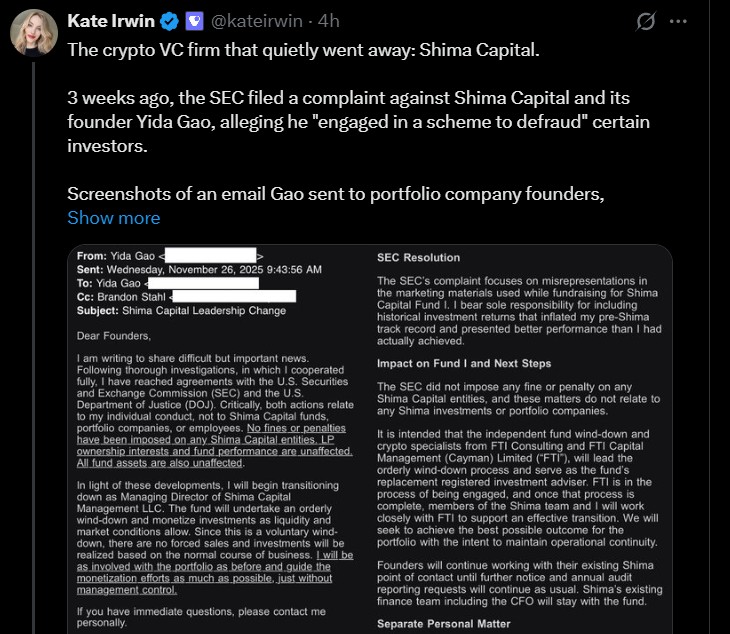

Soon after the case was filed, the founder admitted to the lawsuit, resigned as the head of the fund, and declared that he would close the fund. Internal e-mail messages addressed to portfolio companies verify his resignation and regret his actions.

Source: Kate Irwin Official X

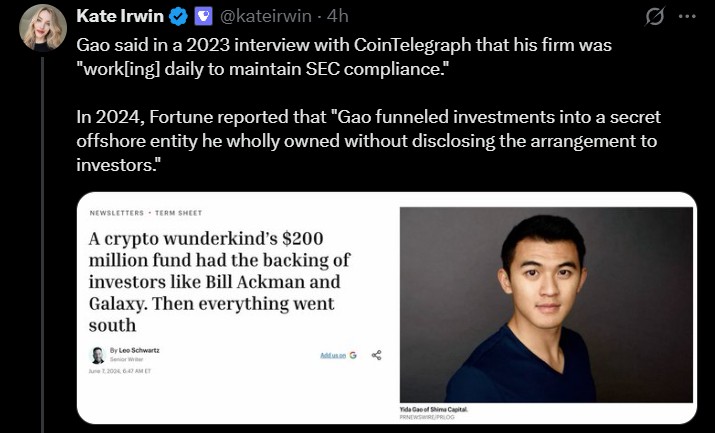

It is a venture capital firm that is crypto-oriented and was established in 2021 by Yida Gao. The company had close to $200 million in assets and had invested in a number of high-profile blockchain and Web3 projects, such as Berachain, Monad, Pudgy Penguins, Sleepagotchi, and Gunzilla.

The SEC claims that Yida was is deceiving investors by exaggerating the performance of his past investments in marketing materials.

Regulators also state that one of the earlier crypto investments was purported to have yielded a 90x, when it actually returned approximately 2.8x. These claims were reportedly used to attract investors and raise large sums for Shima Capital’s first fund.

In addition, the SEC stated that Gao failed to disclose personal profits made through a BitClout-related investment.

Regulators assert that Gao made about $1.9 million in a privately-run offshore company, without notifying fund investors of such a deal. The SEC claims that these acts were against the federal antifraud laws, and they compromised investor confidence.

Source: X

The SEC pressed its complaint on November 25, 2025. The following day, Yida admitted the case and said that she would pay the case without refuting the claims. As part of the settlement, he agreed to pay around $4 million in disgorgement and interest and accepted permanent injunctions, including restrictions on serving as an officer or director.

Importantly, the SEC did not impose penalties on Shima fund entities themselves. Investor assets were not frozen, and the firm stated that portfolio companies would not be directly impacted. However, the fund is now being voluntarily wound down under the supervision of third-party advisors.

In a letter to the founders of projects funded by Shima, which was sent internally on November 26, 2025, Yida announced that he would resign and start an orderly liquidation of the fund.

He admitted his mistakes, terming them as misguided decisions, and showed remorse for having failed founders and investors. He insisted that the wind-down process would be done professionally to take care of portfolio companies and make sure assets are dealt with responsibly.

Source: X

This crypto scam illustrates that the SEC is becoming more and more critical of crypto venture firms, rather than exchanges or token issuers. It sends a powerful message the fact that false performance claims and hidden conflicts of interest will be severely punished, even in the case of famous investors with good reputations in the industry.

The case is a warning to crypto investors and fund managers that transparency, honesty, and compliance are paramount as regulation of the crypto market only becomes stricter.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.