Overall Crypto Market Update: 17 December 2025

Key Highlights:

The overall cryptocurrency capitalization increased by 1.3% to reach $3.06 trillion. The Fear & Greed Index remained at Extreme Fear (16).

Bitcoin is gaining modestly, whereas mid-cap and meme tokens experienced a spike in volatility.

Regulatory clarity, funding rounds, and the development of stablecoins influenced the industry sentiment.

Summary: Cryptocurrency demonstrated weak recovery, with Bitcoin in the lead. Even though the degree of fear was extreme, the performance of altcoins was mixed, with regulatory news and increased attention to stablecoins, DeFi, and institutional Bitcoin plans.

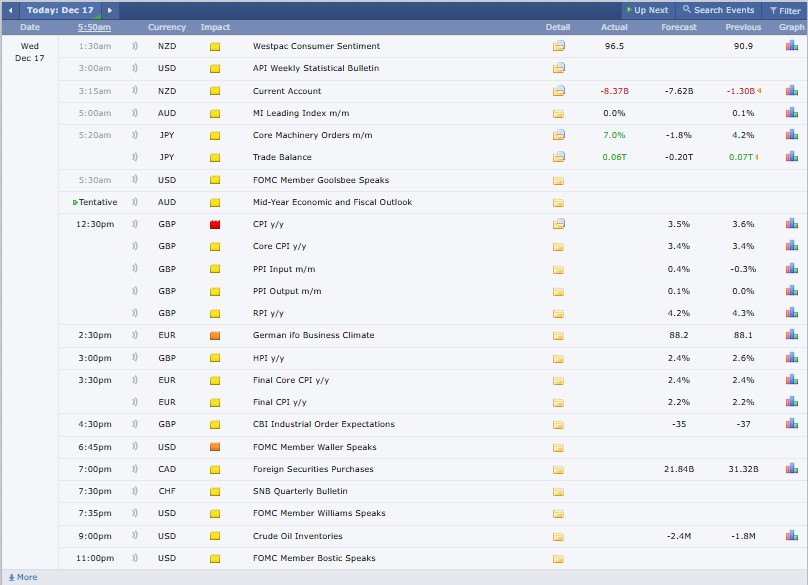

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $3.062 trillion, reflecting a 1.3% increase over the last 24 hours. Total trading volume across all cryptocurrencies was $116.34 billion, showing steady market activity.

Bitcoin (BTC) remains the largest crypto, commanding 57.1% market dominance, while Ethereum (ETH) holds 11.6%. Currently, 19148 cryptocurrencies are being tracked, with Polkadot and XRP Ledger tokens showing the strongest gains in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price:

Bitcoin (BTC) price today is at $87601.89, up 1.42% in the last 24 hours, with a trading volume of $41.98 billion and a market cap of $1.74 trillion.

Source: CMC

Ethereum (ETH) price at $2950.85, down 0.8% in 24 hours, with a trading volume of $22.3 billion and a market cap of $356 billion.

Source: CMC

Note: BTC and ETH are often viewed as less volatile historically, but still risky.

Top 5 Trending Coins in 24 Hours:

Bitcoin (BTC) is trading at $87,443.60, up 1.43%, with a trading volume of $42.2 billion.

Yooldo Esports (YOOLDO) stands at $0.4063, down 0.76%, recording a volume of $663.55 million.

SentismAI (SENTIS) is priced at $0.3295, dropping 11.57%, with $237.86 million in trading volume.

Theoriq (THQ) trades at $0.08903, plunging 50.53%, while posting a volume of $47.63 million.

ELLIE (ELLIE) is trading at $0.0007868, gaining 27.52%, with a trading volume of $122.95K.

Top 3 Gainers in 24 hours

Monero (XMR) rose 4.65% to $428.21, recording a TV of $168.4M.

Morpho (MORPHO) gained 3.79%, trading at $1.18 with a TV of $36.6M.

Kaspa (KAS) increased 3.50% to $0.04455, posting a TV of $30M.

Top 3 Losers in 24 hours

MemeCore (M) fell to $1.64, down by 7.84%, with a TV of $14.46M

Pump.fun (PUMP) dropped to $0.002315, losing 7.57%, recording a TV of $123.87M.

AB (AB) declined to $0.005008, down 5.32%, with a TV of $15.92M.

Note: Date Taken From CoinMarketCap.com

Stablecoins and Defi Update:

Stablecoins recorded a 0.3% negative change in the past 24 hours, with a market cap of $312.8 billion and trading volume of $89.2 billion.

The Decentralized Finance (DeFi) market dips 0.5% in the last 24 hours, reaching a market cap of $105.8 billion, while total value locked (TVL) stands at $5.15 billion.

Source: Alternative Me

The current Crypto Fear and Greed Index is 16 (Extreme Fear), indicating that the risk is very high as the price decreases, and the purchasing volume is low. Yesterday: 11 (deeper fear), last week: 26 (fear easing), last month: 14. This implies the existence of long-term bearishness, panic selling in the short run, and a wary investor attitude in the face of uncertainty.

1. SEC halts Aave Investigation, enhances DeFi Transparency.

Aave founder Stani Kulechov confirmed that the U.S. SEC has closed its four-year investigation, which removes regulatory strain on DeFi and provides developers with a better sense of operating conditions to proceed.

2. Tether Leads 8M Speed Funding Round.

Tether headed a financing round of 8 million dollars in Speed1, which is constructing instant global payment rails with the help of the Bitcoin Lightning Network and stablecoins to allow quick BTC and USDT settlements.

3. RedotPay Raises Series B Funding of $107M.

RedotPay, a stablecoin payments company, raised 107 million in an all-equity Series B round, led by Goodwater Capital, and including Pantera Capital, Blockchain Capital, Circle Ventures, and HSG.

4. U.S. Job Market Shows Mixed Signals in November

U.S. unemployment rose to 4.6% in November, its highest since 2021, beating forecasts. Nonfarm payrolls added 64,000 jobs, surpassing expectations of 50,000.

5. Hyperscale Data’s Bitcoin Bet Nears Market Cap

Hyperscale Data said its Bitcoin treasury reached $75.5 million, nearly its full market value, holding 498.46 BTC and reserving $31.5 million for future purchases.

6. FTC Moves on Nomad Hack

In 2022, the U.S. FTC suggested a settlement with Nomad bridge operator Illusory Systems regarding a 2022 crypto scam requiring security reforms, audits, truthful claims, and restitution of unclaimed recovered funds to affected users.

7. MoonPay, Exodus to launch USD Stablecoin.

In January 2026, Exodus partnered with MoonPay to release a fully reserved USD stablecoin, Exodus Pay, and allow it to make payments in digital dollars without centralized exchanges, directly within its self-custody wallet.

Important to note: All these updates affect traders in terms of liquidity, sentiment, and potential returns, which is why they should be carefully monitored.

The sentiment is worse than it was last week, when the fear index stood at 26, although prices are improving. The bitcoin dominance is still high, and the altcoins are being subjected to stiffer corrections, a phenomenon that underscores the flight to safety as uncertainty prevails.

The crypto users will be advised to anticipate more volatility as the fear takes center stage, even with an increase in the price. High Bitcoin control implies defensive positioning, and altcoins are riskier. Clear regulation and the development of stablecoins provide long-term prospects, yet short-term precautions are needed.

It is wise to build fundamentally strong assets over an extended period, not overly hyped, and to monitor macro and regulatory indicators. The stage of extreme fear tends to pay off in terms of patience. However, risk management and diversification are essential in uncertain environments.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment. Some services or assets discussed may not be available in all regions.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.