Bitcoin (BTC) has smashed through the $112,000 barrier for the first time ever, buoyed by revived whale activity and accelerating institutional inflows. The digital asset’s parabolic rise—up over 18% since the start of 2025—has reignited bullish sentiment across the crypto market, with some analysts now eyeing $150,000 as a viable target by year-end.

Bitcoin’s latest rally has pushed its total market capitalization beyond $2.21 trillion, reaffirming its dominance in the digital asset space. As of mid-July, BTC was trading just above $111,100 on elevated daily volume exceeding $59 billion, signaling broad market participation.

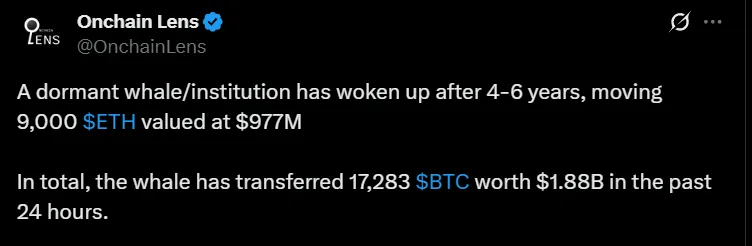

The price jump follows a string of high-value transactions by previously inactive wallets. One such dormant address—long silent—transferred 17,283 BTC (valued at $1.88 billion) within a single day, according to data from OnchainLens.

Source: OnchainLens

Long-dormant Bitcoin wallets—some dating back to the Satoshi era—are suddenly springing to life. Last week, two such wallets moved a combined 20,000 BTC for the first time in 14 years. While the motives remain unclear, the transactions have sparked speculation about long-term holders adjusting their positions ahead of further market upside.

In another notable development, the Royal Government of Bhutan sent over 350 BTC (approximately $38.5 million) to Binance over a 10-day span, according to Arkham Intelligence. The move underscores the growing role of sovereign players in crypto capital flows, potentially for liquidity management or macro diversification

Source: Arkham explorer

Despite its meteoric rise, Bitcoin may not be overbought just yet. Key technical indicators continue to suggest room for further upside:

Relative Strength Index (RSI): Currently sits at 63.62—bullish but still shy of overbought territory.

MACD: Shows a bullish crossover at 172.51, commonly interpreted as a buy signal.

Moving Averages: The 10-day SMA remains above the 100-day SMA, confirming short-term upward momentum.

However, caution remains warranted. The stochastic oscillator has reached 86.46, a level typically associated with short-term consolidation or pullbacks. Analysts are watching resistance levels at $117,498 and $127,279. A decisive break above these zones, ideally with strong volume, would solidify the path to $150,000.

Institutional sentiment continues to strengthen amid expectations of Federal Reserve rate cuts and growing distrust in fiat currencies. Bitcoin exchange-traded funds (ETFs) are seeing consistent inflows, while inflation-hedging portfolios are increasingly incorporating BTC as a strategic asset.

Analysts at Cryptona.co argue that $150,000 is no longer a stretch if BTC can breach the $117K resistance with conviction. Sovereign interest—such as Bhutan’s recent activity—adds another layer of legitimacy to Bitcoin’s evolving macro narrative.

Bitcoin’s historic surge above $112,000 reflects a shift in the behavior of long-term holders and institutional investors alike. While short-term corrections are inevitable, both technical and fundamental conditions suggest BTC’s bull cycle is far from over.

With whales reawakening, governments joining the ledger, and macro forces aligning, the $150,000 mark may be the market’s new consensus target.

Mona Porwal is an experienced crypto writer with two years in blockchain and digital currencies. She simplifies complex topics, making crypto easy for everyone to understand. Whether it’s Bitcoin, altcoins, NFTs, or DeFi, Mona explains the latest trends in a clear and concise way. She stays updated on market news, price movements, and emerging developments to provide valuable insights. Her articles help both beginners and experienced investors navigate the ever-evolving crypto space. Mona strongly believes in blockchain’s future and its impact on global finance.

6 months ago

😁