Ripple Labs, one of the most well-known companies in crypto, is making a big move. Its CEO, Brad Garlinghouse, confirmed that Ripple applies for US banking license by applying for a national trust bank charter from the Office of the Comptroller of the Currency (OCC). If approved, this would place Ripple under direct federal oversight, just like traditional banks.

Source: X

This step is not just about regulation—it’s also about trust. Ripple stablecoin RLUSD, is already regulated by the New York Department of Financial Services. But if this national license is approved, Ripple could hold RLUSD reserves directly with the US Federal Reserve, offering more safety to users and institutions.

Garlinghouse also shared that Ripple has applied for a Federal Reserve master account, which would give it a direct access to the US central banking system. That would help the company manage its stablecoin reserves without relying on third-party banks.

This move comes shortly after Circle Internet Group, the issuer of Circle stablecoin USDC, also filed an application to become a national trust bank. It’s clear that big crypto players are now taking steps to work inside the system, not outside it.

So what does it really mean when Ripple licenses as a national trust bank?

It’s different from becoming a full bank. National trust banks cannot take deposits or issue loans, but they can offer custody services and operate across all US states under a single federal license. That means Ripple wouldn’t need to go state-by-state to get 50+ money transmitter licenses. This simplifies its expansion plans across the country.

It also means that Ripple, like Anchorage Digital before it, could operate with clear federal guidelines while avoiding some of the heavy rules that come with being a full bank—like the Bank Holding Company Act or FDIC requirements. This gives Ripple flexibility while still being under trusted regulation.

In short, Ripple banking license means more legal clarity, stronger consumer protections, and the ability to operate at a national level—without getting stuck in legal red tape.

This move by Ripple could mark a turning point in the long-running cryptocurrency vs traditional currency discussion. Here's how:

1. Seamless Crypto-Fiat Bridge Through Direct Fed Access

If Ripple gets both the OCC license and Fed master account, it can hold RLUSD reserves directly with the central bank. That means it won’t need third-party banks. This direct link would make using Ripple stablecoin RLUSD just as trustworthy as using US dollars. People could send stablecoins through regular banking rails, making crypto and fiat feel like the same thing.

2. Stablecoins Could Gain Federal-Backed Trust

Right now, many people still don’t fully trust stablecoins. But if XRP applies for a banking license and if it gets it, RLUSD would be monitored by federal regulators. That level of oversight is usually only seen with banks. As a result, RLUSD could start to feel like a “digital dollar,” closing the trust gap between crypto and fiat.

3. One Nationwide Charter Reduces Crypto Fragmentation

Most crypto firms need dozens of licenses to work in all US states. With one national charter, Ripple can offer its services across the entire country. This means no more slowdowns due to legal confusion. As RLUSD becomes available nationwide, more businesses and people might start using it instead of traditional cash.

4. Banking-Level Protection for Users

Getting regulated by the OCC means Ripple would follow strict rules about anti-money laundering, cybersecurity, and consumer rights. That’s the same kind of protection people expect from their banks. As Ripple licenses under national rules, public hesitation toward crypto could start to fade. People may start trusting regulated stablecoins like RLUSD more than cash.

5. Other Crypto Firms Will Follow Ripple’s Path

If Ripple is successful, other crypto companies will likely try the same route. Over time, more crypto projects could connect directly to the Federal Reserve. As crypto becomes part of the traditional banking system, the battle between crypto vs fiat currency might simply disappear. Both systems could merge into one.

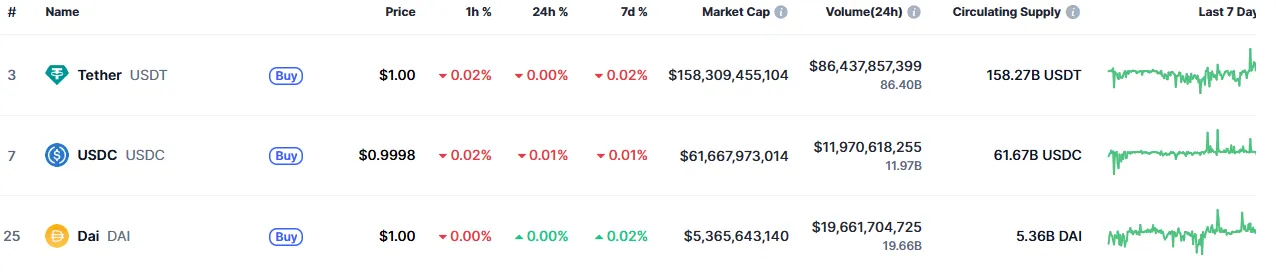

Right now, the stablecoin market is led by Tether (USDT) with a market cap of around $158.33 billion, USDC with $61.65 billion, and DAI with $5.36 billion. Meanwhile, Ripple stablecoin RLUSD ranks 9th with a market cap of just $468.89 million.

Source: CoinMarketCap

But this could change.

If Ripple receives the OCC license and master account approval, RLUSD could grow fast. It would become one of the top 10 stablecoins with legal backing and national reach. That could push RLUSD on the first ranking.

However, this could spark competition. Circle Internet Group is also applying for a similar license. We may see a stablecoin race between Ripple and Circle in the coming months, as both firms work to become the best stablecoin in the market.

Ripple’s national banking license may also impact XRP price.

Currently, XRP trades at $2.25 with a market cap of $133.22 billion. If Ripple’s application is approved, along with its upcoming IPO and a clear US regulatory framework, analysts like EGRAG CRYPTO believe XRP could hit $40. That would be a significant step and illustrate how regulation can influence not only stablecoins but even the underlying coins themselves.

Source: X

Ripple is applying for US banking license, and that is not a news title. It's a strategic move that would change how people view digital currency. If successful, Ripple would be more or less like an established bank but continued to provide crypto services.

By acquiring a Ripple banking license, the company would finally build a robust bridge between fiat currencies and crypto payments. And if there's enough market confidence in Ripple's RLUSD stablecoin, we may have seen the end of the crypto vs fiat currency fiasco.

Either by better regulation, faster take-up, or increased trust, Ripple's work today could decide how we all use money in the future.

Sourabh Agarwal is one of the co-founders of Coin Gabbar and a CA by profession. Besides being a crypto geek, Sourabh speaks the language called Finance. He contributes to #TeamGabbar by writing blogs on investment, finance, cryptocurrency, and the future of blockchain.

Sourabh is an explorer. When not writing, he can be found wandering through nature or journaling at a coffee shop. You can connect with Sourabh on Twitter and LinkedIn at (user name) or read out his blogs on (blog page link)

6 months ago

🙃🙃🙃🙃