Highlights

Depinsim ($ESIM) is the first with its decentralized eSIM network.

LegalTech Innovation Juris Protocol ($JURIS) is a blockchain-based approach that uses smart contracts.

Brevis ($BREV) is a zero-knowledge proof-based off-chain computation platform

Some promising crypto tokens will be launched on major exchanges at the beginning of January 2026, and the investors will have a chance to be early adopters. These listings are Depinsim ($ESIM), Brevis ($BREV), CodexField ($CODEX), Juris Protocol ($JURIS), and CatWifMask ($MASK), all with different utility and ecosystem value.

Depinsim (ESIM) is a DePIN-based blockchain network that enables decentralized eSIM infrastructure, and it links millions of devices and rewards users with real-world data mining.

Brevis ($BREV) is a project in Ethereum scalability that involves the use of zero-knowledge proofs to allow verifiable off-chain computation, quicker blockchain validation, and enhanced infrastructure efficiency.

CodexField (CODEX) is a blockchain venture that aims to ensure safe ownership, storage, and monetization of digital content in a decentralized creator economy that is expanding.

Juris Protocol ($JURIS) takes law to blockchain by transforming legal agreements into smart contracts, which guarantee automated compliance, trust, and transparency to crypto users.

CatWifMask (MASK) is a decentralized community-based meme token whose core value is to engage socially and invest in the future through speculative investment in the meme token economy.

1. Depinsim ($ESIM) Listing Details

Depinsim will undergo an airdrop listing on January 5, 2026, at 1:00 PM UTC. The token of the SIM will also be launched on Binance Alpha, KuCoin, MEXC, Bitget, and SuperEx. Tokens can be claimed by eligible users using supported wallets and apps, which are guaranteed to have liquidity and early price discovery. The multi-exchange launch increases the availability to international traders.

Why is this listing important to investors?

Listing on multiple exchanges increases liquidity, visibility, and price transparency, and thus $ESIM will appeal to early investors who will be looking to monitor the adoption of DePIN and the real-world use of blockchains.

2. Brevis Crypto launch Tomorrow

BREV will be listed on the Binance Alpha on January 6, 2026. Eligible users will be able to trade through Alpha Points, and Binance will have all the information about trading mechanics. This is the first platform to support BREV, which guarantees its worldwide presence and initial adoption in Ethereum-centric scalability solutions.

Why is this listing essential to Investors?

The Binance Alpha listing can increase the visibility, credibility, and liquidity of Brevis, which can be considered a promising infrastructure project in its early stages in the Ethereum scalability ecosystem that is rapidly developing.

3. CodexField Token Listing Date and Details

CODEX is listed on the BitMart Exchange on January 5, 2026, at 1:00 PM UTC, with the trading pair of CODEX/USDT. The listing provides access to the exchange at a central point, which enhances liquidity, market visibility, and trading ease for the global users who might be interested in owning digital content.

What Is the Essentiality of This Listing to Investors?

The BitMart listing will improve the liquidity, credibility, and exposure of $CODEX, providing investors with easier access and putting the project in a position to expand the exchange further and grow the ecosystem.

4. Juris Protocol ($JURIS) Listing Details

Juris Protocol will be traded on AscendEX (BitMax) on January 8, 2026, at 10:00 AM UTC under the trading pair JURIS/USDT. The listing offers centralized exchange services, worldwide accessibility, and established credibility, allowing users to conduct trade effectively and guarantee legal-tech-oriented blockchain implementation.

Why This Listing is Essential for Investors?

The AscendEX listing enhances liquidity, trading accessibility, and global exposure, offering investors a secure platform to participate in a legally focused, high-potential blockchain project.

5. CatWifMask ($MASK) Launch Details

CatWifMask will go to trade on GroveX Exchange on January 8, 2026, at 08.00 AM UTC. Spot trading will enable the international community to trade in $MASK even though the precise trading pairs and deposit schedule are still to be released. GroveX official channels expect investors to get live updates.

Why is this listing necessary to Investors?

The GroveX listing will increase accessibility and visibility to CatWifMask, providing investors with structured access to the spot market, better liquidity prospects, and exposure to a centralized trade platform.

1. Depinsim ($ESIM) Tokenomics:

The supply of $ESIM is 1 billion tokens. The distribution of Airdrop is split with 75% according to network usage and 25% on task-based points. BNB support of this ecosystem is 3.7M, traded data is more than 2.4 PB, and daily mining activity, which offers a real-world use and maintains the engagement.

Depinsim seeks to increase the connectivity of devices worldwide, decentralize data infrastructure, enhance partnerships such as OptimAI, and deploy more reward batches and ecosystem upgrades in 2026.

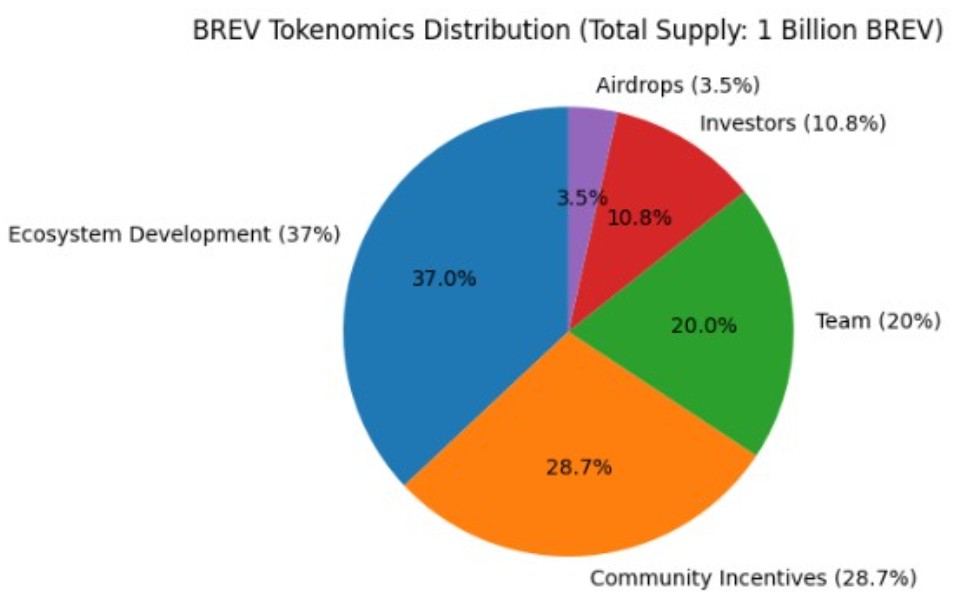

2. Brevis ($BREV) Tokenomics:

There is a fixed total number of 1 billion BREV tokens in Brevis. Ecosystem development: 37% Community incentives: 28.7% Team holdings: 20% Early investors: 10.8% (under vesting schedules) Airdrops: 3.5%. The framework guarantees sustainable development, community balance, and gradual implementation.

Source: Website

Brevis will be extending the Ethereum scalability through its ZK Data Coprocessor, Pico zkVM and ProverNet with the aim of creating faster proof generation, adoption of the Ethereum ecosystem, and collaborating with key blockchain infrastructure partners.

3. CodexField (CODEX) Tokenomics:

Codex is the native utility, which allows access to the platform, ecosystem transactions, and governance. Extensive tokenomics, such as supply distribution, lock-ups, and distribution plans, have not been published fully, focusing on transparency and long-term strategic planning.

CodexField has the following roadmap: expansion of ecosystem, wallet integrations, improved storage on BNB Greenfield, exchange listing, and product releases, including the Permax trading app to reinforce usability and adoption.

4. Juris Protocol (JURIS) Tokenomics:

The payments made with the help of $JURIS are services, small fees, governance voting, network operations, and user or developer rewards. The release of official token information is being done at a steady pace so that there is transparency and responsible adoption. Investors need to always confirm participation on the official site.

Juris Protocol is concerned with improving its platform, integrating with legal systems, partnering with Web3 games, building out developer tools, and going global to build a compliant and user-trusted ecosystem.

5. CatWifMask ($MASK) Tokenomics

As of the listing, comprehensive tokenomics, including total supply, allocation, or emission schedules, remain undisclosed. Investors are advised to verify circulating supply, contract details, and distribution metrics via official channels to ensure informed participation.

Formal plans are not published, but CatWifMask can seek community engagement opportunities, experimental utilities, and possible ecosystem partnerships depending on social token trends and community response.

The future crypto listings provide a variety of opportunities. Depinsim ($ESIM) is unique in terms of practical use, multi-exchange access, and high user acceptance. Brevis and Juris Protocol offer new technology exposure, and such listings are appealing to early investors who want to grow and utility-based projects.

The upcoming binance new coin listing announcement of Depinsim and Brevis present significant opportunities for investors. These projects combine real-world utility, innovative technology, and growing ecosystems, making early adoption a strategic consideration in 2026.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.