Highlights:

Five potential crypto tokens, MEZO, Rainbow, TEA, Acurast, and MaxFi, are preparing to be listed on major exchanges.

MEXC and BitMart are the most popular choices when launching tokens on early stages.

These upcoming listings are characterized by strong tokenomics, controlled supply unlocks, and roadmaps.

There are a number of crypto projects that are preparing to list on exchanges, such as MEZO, Rainbow, TEA, and Acurast on MEXC, and MaxFi on BitMart. These listings are meant to enhance liquidity, accessibility, and early price discovery and provide traders with exposure to new Web3, DeFi, and infrastructure-oriented tokens.

Mezo is a Bitcoin-based finance platform that allows users to borrow, spend, trade, and earn yield on Bitcoin without selling it.

Rainbow is a non-custodial crypto wallet that is designed to make on-chain finance easy, friendly, and reachable on Ethereum and other EVM-compatible blockchains.

TEA (TEA) is a token of governance balance, which is intended to promote open-source software by rewarding contributors, ensuring the supply chain, and decentralizing governance.

Acurast is a decentralized compute network, which turns ordinary smartphones into secure cloud infrastructure, making it possible to do private, affordable, and Web3-native computing without centralized data centers.

MaxFi is a cryptocurrency (MAX) used to operate the MaxFi ecosystem, which aims at DeFi-oriented utility, staking, and value creation over the long term, based on deflationary principles.

1. MEZO ($MEZO) Listing Coming Soon Details

Mezzo (MEZO) will be listed on the MEXC Exchange in the pre-market. On January 17, 2026 (UTC), MEXC opened MEZO pre-market trading, with early buyers and sellers trading prior to the launch of spot markets. This pre-market is an OTC-style market that assists in price discovery and provides early exposure to traders. MEZO will be classified as a Bitcoin finance utility token.

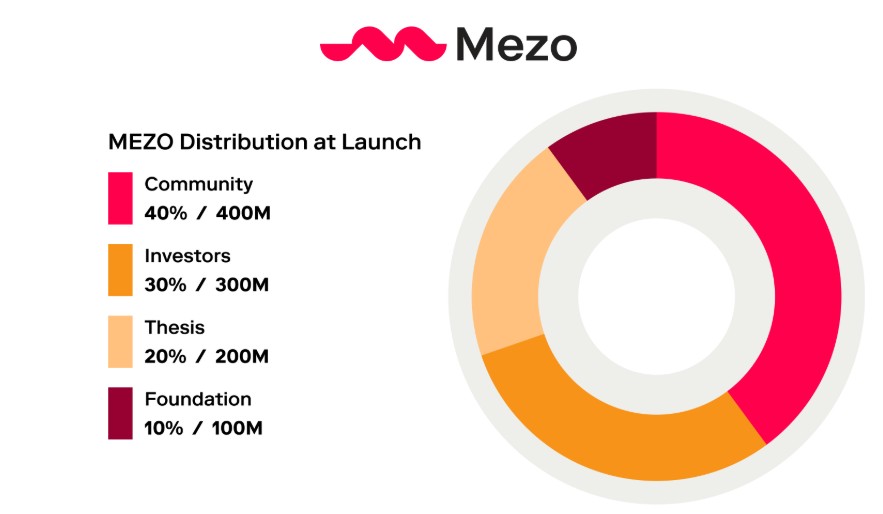

MEZO Tokenomics & Airdrop

Source: Official Website

The roadmap of Mezo involves the mainnet development based on Bitcoin, the introduction of its stablecoin MUSD, which is backed by BTC, decentralized swap, and vault incentive programs to increase liquidity and involvement in the ecosystem.

2. Rainbow ($RNBW) Listing Coming Soon on MEXC

Rainbow ($RNBW) will be listed on the MEXC Spot Exchange, and it will be traded after the Token Generation Event (TGE) on February 5, 2026. The listing will expand access and liquidity of $RNBW in the market. MEXC will announce exact trading pairs and start times nearer to launch.

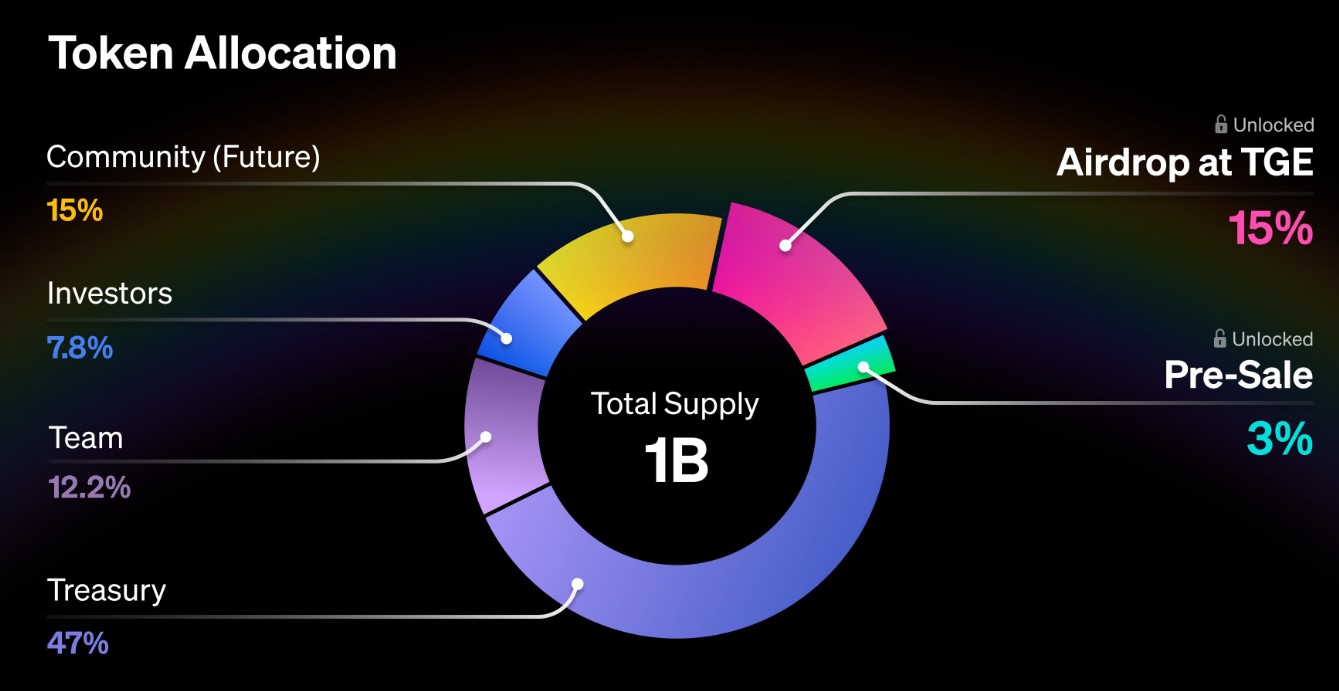

RNBW Tokenomics & Roadmap

The overall supply of RNBW is 1 billion tokens, and the supply was well controlled at the beginning. The entry of airdrop and token sale tokens is only at TGE. The allocation of the Tokens consists of 47% Treasury, 15% Airdrop, 15% Community, 12.2% Team, 7.8% Investors, and 3% Pre-Sale, which mitigates the risk of early dumping.

Source: Website

The roadmap emphasized by Rainbow is centered around the addition of wallet functionality, more in-depth DeFi integrations, cross-chain support, and better mobile-first on-chain experiences, making Rainbow an all-in-one crypto finance app for every user.

3. TEA ($TEA) Listing Coming Soon on MEXC

TEA ($TEA) will be listed on the MEXC exchange, and it has already been announced that it will trade before the market. Although the day of listing and the trading pair are not disclosed, the next MEXC (SPOT) listing is likely to raise the visibility, accessibility, and early price discovery of the TEA token. It is recommended that users watch official MEXC announcements to get confirmed launch information.

$TEA Tokenomics & Roadmap

TEA consists of 100 billion tokens at a governance-balanced structure with a limited inflation rate of 2% per year. The allocations are 28% in incentives and airdrops, 21.8% in ecosystem and governance, 18.6% in protocol development, and the remaining in supporters, liquidity, and reserve sales. At mainnet, a supply unlock of approximately 20% occurs.

Source: Website

The roadmap of TEA is centered on the launch of the mainnet, decentralized governance through teaDAO, growth of the OSS ecosystem, security through staking, and sustainable emission of tokens. Basic contributors and investors have a 12-month cliff, which enhances long-term dedication and protocol consistency.

4. Acurast ($ACU) Listing Coming Soon on MEXC

Acurast ($ACU) will be listed on the MEXC exchange, and pre-market trading has already been announced in the ACU/USDT pair. The next crypto listing will provide international traders with a first-mover advantage on the token as it aids in price discovery before full spot trading. The liquidity of MEXC, its global presence, and Web3 listings in their early stages make the exchange's launch a significant milestone for the project.

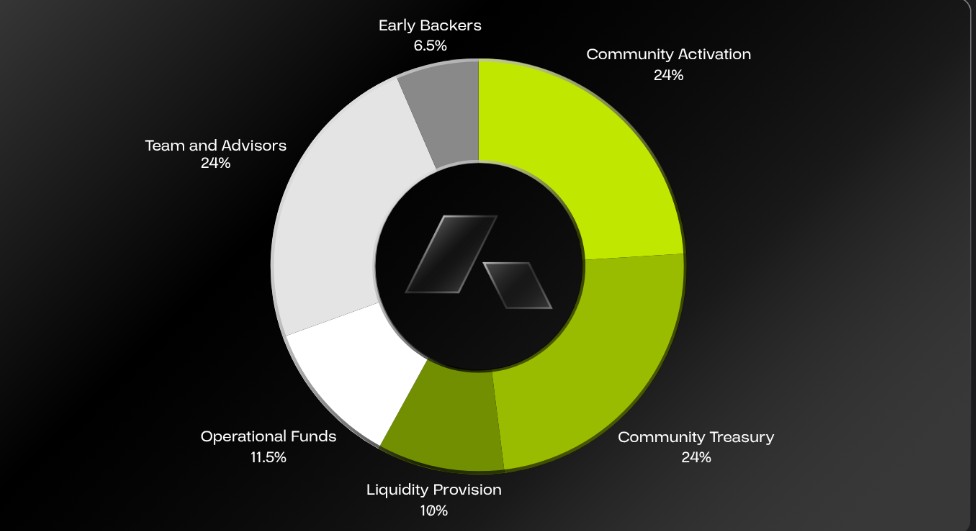

$ACU Tokenomics & Roadmap

The initial supply of Acurast is fixed at 1 billion ACU tokens, and the inflation rate is 5% per annum. Almost three-quarters of the tokens are used in the development of communities and ecosystems. The initial supporters are only guaranteed 6.5%, which isa fair launch. The rewards of inflation are allocated to staking, treasury, compute providers, and validators, which help to promote long-term decentralization, security, and sustainable network expansion.

Source: Website

The roadmap of Acurast is aimed at the development of a secure compute base, the rise of developer and dApp usage, and the expansion of infrastructure. Subsequent stages focus on governance activation, greater node engagement, and enterprise-scale cases of decentralized compute.

5. MaxFi ($MAX) Listing – Coming Soon on BitMart

The MaxFi (MAX) will be listed on the BitMart Exchange to trade on the spot, increasing its availability to the worldwide population. Although the official listing date and trading pairs have not announced, BitMart has already confirmed the future release. It is recommended that traders keep an eye on the official channels of BitMart to be informed about the deposits, the trading, and the withdrawals.

MAX Tokenomics & Roadmap

MAX has a total supply of 300 million fixed tokens, which will be staked to generate rewards, reserves, insurance, and operational requirements. The protocol has an automated buyback-and-burn system known as ComputeBurn that uses a fraction of platform profits to repurchase and burn tokens, decreasing supply and enabling a long-term sustainable cycle of value.

The MaxFi roadmap is dedicated to the expansion of the ecosystem, the listing of exchanges on both centralized and decentralized platforms, the development of staking functionality, the optimization of the protocol, and the expansion of its distribution. The subsequent stages will enhance the utility, liquidity, and sustainability in the long-run by constantly improving the product.

Among these future listings, MEZO and Acurast are the ones that can attract the attention of fundamental-oriented investors. MEZO has the advantage of the Bitcoin-native finance utility and structured vesting, which minimizes early sell pressure. Acurast provides a good real-life example of decentralized computing using community devices and equitable token allocation.

Rainbow targets users who want consumer-facing adoption, whereas TEA and MaxFi are targeted at long-term believers in governance-based and deflationary ecosystems. Selection is based on risk-taking and investment period.

These future crypto listings feature a variety of opportunities in Bitcoin finance, wallets, open-source governance, decentralized computing, and DeFi. Although exchange listings increase awareness, investors must consider tokenomics, roadmaps, and utility before making an investment choice.

Disclosure: This is not a financial recommendation. Do your own research (DYOR) before investing. There is no financial loss on CoinGabbar. Cryptocurrencies are extremely unpredictable and can bring you to bankruptcy.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.