Highlights:

The Aave DAO Proposal to reclaim the brand asset control didn't pass the vote

Community division was high, with more than 55% of the voters voting against the proposal and 41% voting abstinence.

The token price fell by almost 18%, which represents the concern in the market.

The voting process of the ARFC proposal of Aave DAO crypto, named: $AAVE Token Alignment - Phase 1: Ownership has officially ended and was not successful.

The proposal sought to hand over the brand-related assets, including domains, naming rights, and social media accounts, to third parties, like Labs.

The plan was not popular enough in the community despite the fact that there were good arguments for decentralization and long-term governance.

Source: Official website

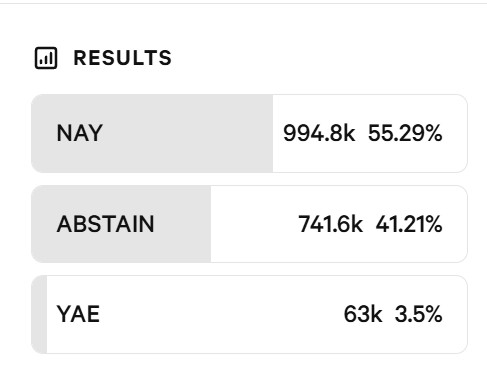

The voting Results show the number of token holders:

Against (NAY): There were 994,800 votes, which constituted 55.29%.

Abstain: Around 741,600 votes, or 41.21%

In Favor (YAE): A mere 63,000 votes, which is 3.5%.

The large number of abstinence emphasized indecisiveness and uncertainty among the community instead of the popularization of either side.

Source: Official

The proposal aimed to provide the DAO and AAVE token owners with the entire ownership and control over:

The Aave brand and naming rights.

Key domains like aave.com

Social media accounts on websites like X, Discord, and Instagram.

Developer systems such as GitHub and npm.

It even suggested the establishment of a legal framework that is controlled by a DAO to safeguard these assets and prevent their misuse by individuals.

The purpose was based on the principles of decentralization. The author claimed that the introduction of third parties to dispose of core brand assets weakens the authority of the DAO and introduces an unequal balance of power.

It was already feared that the branded assets were being privately monetized and made product decisions without adequate DAO control, which would become a risky governance structure over time.

This Plan was highly opposed because of:

Fears of legal and operational risks.

Concerns about the abrupt changeover of the brand would damage the stability.

There was criticism that the vote was rushed in time of the holiday.

Threats of unspecified but severe governance risks by influential members of the community.

All these made a lot of voters vote against or not vote instead of voting in favor of the plan.

The AAVE Token price fell almost 18% indicating a lack of confidence and disappointment in the market. The brand assets are still under the ownership of Labs, and the governance compatibility and the authority of the DAO are still being discussed.

Source: MEXC Official

The AAVE crypto market has now recovered, and the present token price indicates 2.23% growth, with the price being $153.67 noted in the last 24 hours.

Source: CMC

The event highlights a broader issue in DeFi: striking a balance between the principles of decentralized governance and their practical application in a centralized manner. The conflicts between the DAOs and the core contributors are increasingly becoming common as the protocol matures enough, and these conflicts push the boundaries of decentralized decision-making.

The collapsed DAO governance highlights the difficulty of the DAOs in trying to regain control of the established ones. Although it is one of the values, the vote indicated that the majority of token holders value stability and caution.

The argument of governance, ownership, and accountability is not going away soon- and its result may have an impact on the future of DAO-driven protocols in DeFi.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.