One of U.S. largest banks is now formally recommending Bitcoin exposure – a move that signals how far crypto has entered Wall Street. In January 2026, Bank of America officially allowed its capital advisors to recommend Bitcoin and crypto investments of up to 4% of client portfolios.

Source: Watcher Guru

This advancement marks a clear shift from a cautious approach to active participation in digital assets. For investors, this means cryptocurrencies exposure is now being framed as a controlled portfolio tool, not speculation.

Under the new policy, more than 15,000 advisors across Merrill Lynch, Bank of America Private Bank, and Merrill Edge can now proactively suggest cryptocurrencies exposure to their customers. Earlier, cryptocurrency advice was there, but advisors were only allowed to discuss it if the client asked first.

Currently, with new cryptocurrency policy reforms in the banking giant, users will be recommended a 1% to 4% allocation of their portfolio to crypto. The investment is going to be mainly through U.S. spot Bitcoin ETFs, making access safer and simpler for investors.

The bank highlighted Bitcoin’s strong performance over the time. Although the digital asset faced major drops in 2025, it even reached around $76,500 in April, 2025. But the coin shows significant progress in the year-to-date performance, while also warning that cryptocurrencies remain volatile.

Source: CoinMarketCap

According to the bank’s investment team, small and controlled exposure can help balance risk, similar to other alternative assets like commodities or private equity.

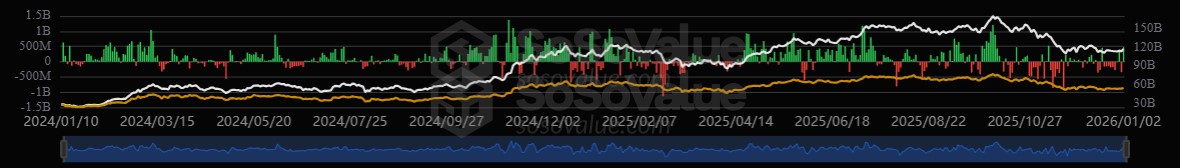

Additionally, the decision follows massive success in the U.S. Bitcoin ETF market. Since their approval in 2024, the ETFs have attracted over $57 billion in inflows, signaling strong demand.

Source: SoSo Value

Bank of America now covers major ETFs, including:

BlackRock’s IBIT

Fidelity’s FBTC

Bitwise’s BITB

Grayscale’s Bitcoin Mini Trust

These regulated products make it easier for traditional investors to gain BTC exposure without directly holding digital assets.

However, the U.S. banking giant sees BTC as a diversified portfolio, not a replacement for traditional assets.

Bank of America is not alone in this advancement. Other well known names in the financial sector have already issued similar guidance, understanding BTC’s increasing value:

Morgan Stanley: 2–4% cryptocurrency allocation

BlackRock: 1–2%

Fidelity: 2–5%, especially for younger investors

This broader trend shows how crypto is being treated as a legitimate investment class, not just speculation. However, at the same time, banks still stress caution. Digital asset exposure is meant to be limited and diversified, not an all-in bet.

For now, with supportive U.S. regulations, strong ETF inflows, and backing from major banks, 2026 is shaping up as a turning point for crypto adoption. Bitcoin is increasingly viewed as a strategic asset rather than a fringe investment.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.