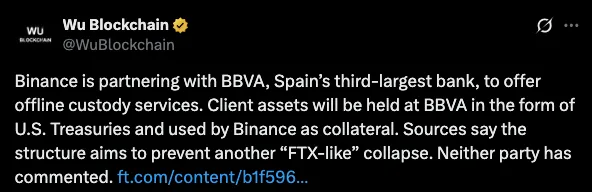

The largest cryptocurrency exchange in the whole world, Binance, has taken the first steps in a strategic partnership with BBVA, one of the largest banks in Spain, in order to provide custody services without interference.

In this step, the firm seeks to minimise the underlying risks associated with maintaining client funds on exchanges. The mechanism is that it will hold the user assets in U.S. Treasuries managed by BBVA, which will act as collateral of the crypto trading activities.

Individuals close to the situation confirmed that BBVA has managed to start operating as an autonomously regulated custodian to some of the exchange users. A spokesman at both institutions has refused comment. The collaboration is regarded as an initiative to counter the growing need for transparency after the industry collapsed in the past.

BBVA moving towards entering cryptocurrency custody is one of the trends of mainstream financial institutions entering this business. More transparent international industry rules, like the EU MiCA program, have spurred already existing banks to consider collaborating with digital asset companies. It is indicative of a growing up market as banks attempt to satisfy the demands of the increasing demand in secure crypto provisions by retail and institutional customers.

Insiders believe that BBVA's role can rebuild trust since it will serve as an intermediary in maintaining assets. Customers will gain the advantage of seeing that their funds are safe with government-guaranteed securities instead of being stored in the exchange's internal systems. This will be a cause of relief following the post-FTX era, when insufficiently run funds left too many investors at risk.

BBVA recently introduced Bitcoin and Ethereum on its mobile application. The bank has also recommended that its individual customers invest up to 7 percent of their investments in cryptocurrencies. These moves point to its long-term potential interest in making digital assets part of mainstream financial products.

With its case of regulatory violations in 2023 costing an approximate $4.3 billion fine, Binance has focused on restoring trust by reinforcing its governance. It used to enable its clients to hire third-party custodians such as Sygnum and FlowBank. The new initiative with CSBS is the latest development of the exchange's risk management approach.

The structure enables clients to entrust their wealth in U.S. Treasuries at BBVA. These act as margin on the exchange and separate the trading and custody of monies. The model resembles the risk-mitigation strategies employed in conventional finance to mitigate counterparty risk.

The experts in the industry assume that the model reduces significantly the risks of another massive failure. It also gives its clients confidence in more satisfactorily trading environments. As the crypto markets of the whole world develop, the importance of safe storage and compliance-oriented storage practices continues to grow.

The new custody system by Binance fits into an existing trend in the industry to be more accountable and decentralize duties. Crypto exchanges are being nudged toward exchange, custodian, lender activities. This assists in safeguarding investors since it limits the possible conflict of interest and weaknesses of the entire system.

As the feeling changes to regulated cooperation, many more exchanges will do so. Such collaborations would set the precedent for how digital asset security will be tackled in the future.

In the event that the strategy was successfully implemented, it might also encourage the future cooperation between the traditional banking industry and crypto businesses in the future to further integrate the two financial industries.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.