Fundamental Global Inc. has filed shelf registration with US Securities and Exchange Commission to build a Ethereum Treasury through a self offering of $5 Billion.

Source: Sec Gov Website

The Nasdaq listed company Fundamental Global filed a S-3 registration with SEC to raise a massive amount of $5B . The majority of proceeds will be used to accumulate Ethereum with the rest allocated for business operations. However the company has not committed the exact amount or timings.

The form S-3 filing gives the investment firm flexibility to issue various securities including common stocks, preferred shares, warrant and in dept. This will lead to broad expansion of firms towards the crypto market keeping its roots strong in holding cryptocurrency. In accordance with the terms of the market offering agreement, we may offer and sell shares up to $4,000,000,000 of our common stock from time to time through ThinkEquity,” the filing stated.

In order to allow for flexibility in terms of size, pricing, and terms based on market circumstances, it intends to issue the shares in phases. Through an at-the-market (ATM) sales arrangement with ThinkEquity, Fundamental Global expects to raise $4 billion from the whole offering, according to the filing.

Source: X

Fundamental Global recently announced to launch its Ethereum Treasury with successfully raised $200M in private placement. CEO Kyle Cerminara reposted the post and shared that “the company aims to acquire a 10% stake in the Ethereum network”. It also announced plans to rebrand FG Nexus Inc., changing its NASDAQ ticker FGNX to FGNXP.

The company can sell shares gradually to purchase ETH for its reserve, based on market conditions. There is no doubt that Crypto currency treasury trend is attracting the public listed companies for their growth expansion. The firm joins the holding ETH trend with many other Ethereum-focused companies like SharpLink Gaming, BitMine and Bit Digital.

Fundamental Global Shares surged after the news came out to above 40. The Nasdaq listed firm closed its share at 36.17 with 1.44% of decline yesterday.

Source: Yahoo Finance

Over the night the share price rose slightly with approx 3%. The share price was majorly affected with the Fundamental Global S-3 filing news, the share went up above 40 yesterday for a while. This is a very good example that crypto markets directly affect the shares of companies.

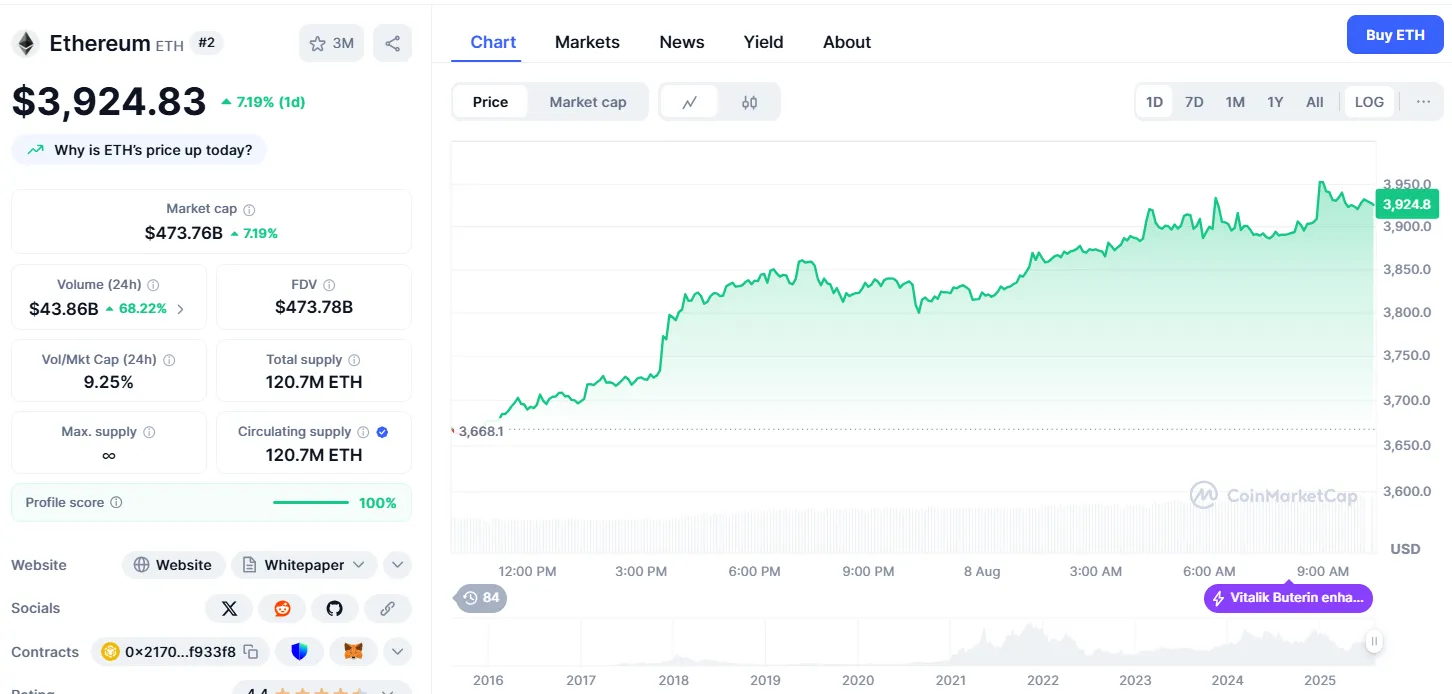

Ethereum is trading at $3,924 nearing its $4k target as predicted by analysts with total market capital of $473B. The token saw a 7.19% hike in the last 24 hours.

Source: CoinMarketCap

Fundamental Global news of filing shelf registration to raise $5B for its ETH treasury is the main reason for the surge. Day by day corporate treasury accumulation is increasingly replicating Bitcoin’s corporate reserve playbook.

Institutes are mirroring MicroStrategy's Bitcoin strategy for long term growth. Nowadays big companies are moving towards crypto reserve to avoid the fluctuations of the stock market. Vitalik Buterin’s recent comment on Ethereum reserves is now proving correct. Now lets see who is next in line for their ETH reserve.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.