Binance has announced a major restructuring of its primary emergency reserve. According to Binance’s official statement, The Binance SAFU fund bitcoin conversion will see the exchange transition its $1 billion Secure Asset Fund for Users entirely into Bitcoin (BTC) over the coming period. The Exchange confirmed the strategic shift through official channels, positioning the decision as a long-term endorsement of Bitcoin’s role as a foundational asset in the digital economy.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The Secure Asset Fund for Users (SAFU), launched back in 2018, originally aimed to protect traders from extreme scenarios like security breaches. Historically, keeping this reserve in stablecoins provided a predictable dollar peg. However, market observers note that 2026 has brought a shift in how major platforms view risk. By moving to a Binance SAFU fund BTC model, the exchange is essentially exiting the traditional banking-linked stablecoin system and leaning into the "native" store of value that defines the crypto world.

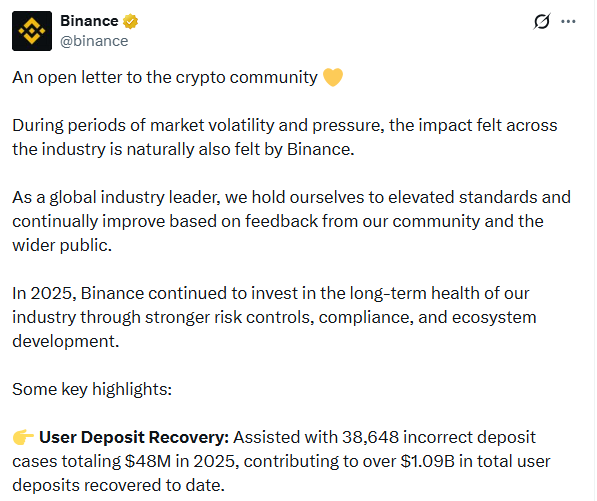

This transition didn't happen in a vacuum. It follows a massive year for user protection on the platform. In 2025, the exchange successfully helped over 5.4 million users identify potential scams, preventing roughly $6.7 billion in losses. Additionally, about $48 million in "incorrect deposits" were recovered for customers. The move to a Binance SAFU insurance pool bitcoin reserve is the next logical step in a roadmap focused on independence from legacy financial risks.

The biggest question most users have is about volatility. If BTC's price drops, does the insurance Reserve vanish? The short answer is no. To maintain the Exchange SAFU fund bitcoin utility, a dynamic rebalancing system is now in place:

The Threshold: If market fluctuations cause the reserve’s value to dip below $800 million, the exchange triggers an automatic replenishment.

The Top-Up: The Exchange will inject additional BTC to restore the reserve's total value to the $1 billion mark.

The Result: This ensures that while the assets are in BTC, the actual "protective power" remains at the promised $1 billion level.

Industry analysts suggest this move could spark a "domino effect" among other major global platforms. Throughout 2025, a clear trend emerged where institutional players began rotating out of passive stablecoins and into "hard" assets. By backing its most critical safety net with Bitcoin, The platform isn't just following a trend, it's validating a new standard for treasury management. The built-in replenishment clause is particularly clever; it respects the reality of price swings while maintaining the fiduciary duty of an insurance fund. Moving forward, the Binance SAFU fund BTC structure will likely be studied by regulators as a case study in decentralized risk management.

This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets involve significant risk. Readers should conduct independent research and consult qualified professionals before making any financial decisions.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.