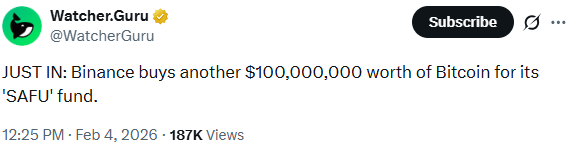

The Binance SAFU Fund Bitcoin reserves reached a major goal today, February 4, 2026. The exchange is taking a two-part approach to keep your money safe. First, they are building huge cash reserves. Second, they are working hard to fix user mistakes. Recently, the exchange bought about 1,350 Bitcoin. This deal is worth over $102 million. All of this Bitcoin went into the Secure Asset Fund for Users, also known as SAFU.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

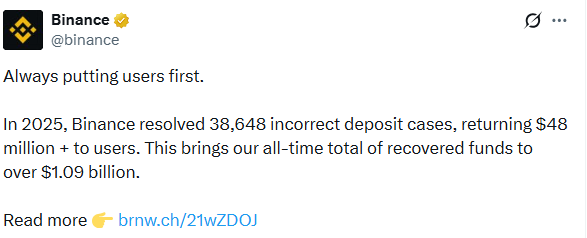

This news comes right after a big report from last year. The report shows that Binance returned $48M to people who made deposit errors. In a market that moves fast and changes often, User Protection stays a top priority. The SAFU Fund is now worth more than $1 billion. By moving from stablecoins to Bitcoin, the exchange is showing real trust in the future of crypto. This move makes the safety net a growing treasury rather than just a pile of cash.

Managing money is only half the story. The User Protection team also helps users directly. In 2025, the team solved 38,648 cases where users sent money to the wrong place. These efforts helped return over $48 million to their rightful owners. This brings the total amount recovered over time to more than $1.09 billion. This kind of help is rare in the crypto world. Usually, if you make a mistake with a crypto address, the money is gone forever. Binance is changing that rule.

The SAFU fund started in 2018. It is like an insurance policy for users. It gets its money from 10% of all trading fees. The new $100 million in Bitcoin is part of a plan to move the fund into "hard assets." If the fund's value ever drops below $800 million because of price changes, Binance will add more money to bring it back to $1 billion. This gives investors peace of mind, especially during big market crashes.

Source: X(Watcher.Guru)

Source: X(Watcher.Guru)

The 2025 report also shows how User Protection fights crime. The platform stopped nearly $6.69 billion in potential scams. They did this by spotting risks for over 5.4 million users. Binance also worked with police around the world. Together, they took away $131 million from criminals. These steps make the crypto world a much safer place for everyone.

The move to back insurance funds with Bitcoin suggests a new "digital gold" standard. In the future, every big exchange will likely need a fund like this to survive. We expect other platforms to copy this Bitcoin-heavy strategy soon. As User Protection grows, the focus will stay on keeping individuals safe while keeping the market moving. The industry is moving toward a more professional model that puts the user first.

Your Money Your Life (YMYL) Disclaimer: Investing in crypto is risky. Funds like SAFU are meant for emergencies and do not protect against normal market price drops. Always talk to a financial expert before investing.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.