Just when Bitcoin looked like it was cooling off, a mysterious whale stepped in with a jaw-dropping $23.7 million bet—banking on BTC hitting $200,000 by December.

But that’s not all. As the crypto market trembles under sudden price drops and whale movements, many traders are abandoning this cryptocurrency. What’s going on behind the scenes?

Are we heading for a short-term crash—or is a bitcoin $200000 prediction secretly loading? Let’s break down.

A whale has placed a massive $23.7 million options bet on Deribit, targeting a $200000 coins price by December 2025. The strategy used is known as a bull call spread—buying $140,000 calls while selling $200,000 calls.

This means the whale is highly confident it could explode upwards but also wants to hedge the upside risk.

This information came from Coin Bureau latest post on X, where the team highlighted the massive trade. This bitcoin whale trade immediately caught the attention of analysts and traders alike.

At the time of writing this, the coin is at the price of $116,348, down 1.51% from 24 hours ago. Trading volume is up 30% from yesterday at $96.43 billion, indicating healthy market movement despite prices being lower.

The mixed signals—rising volume during a price drop—are fueling debate across the market. What’s adding to the mystery is that while one whale is betting big on a bullish reversal, others are preparing for a correction.

It may be aiming for $200K long term, but today’s dip below $117000 has many traders nervous. So what’s causing this sudden drop? There are two primary reasons behind the bitcoins price crash today:

1. Too Much Whale Movement in the Market

$23.7M Deribit Options Bet: Though bullish, it implies major btc options volatility incoming.

14,273 BTC (~$1.67B) Moved to Exchanges: Lookonchain and Galaxy Digital tracked a 14-year-old address transferring large holdings—often a pre-sell indicator.

AguilaTrades Flips To Ethereum: The top trader exited The Crypto King longs and entered a massive 17.5k ETH long with 25x leverage. This shake-up reflects shifting sentiment and speculative plays around ETH dominance.

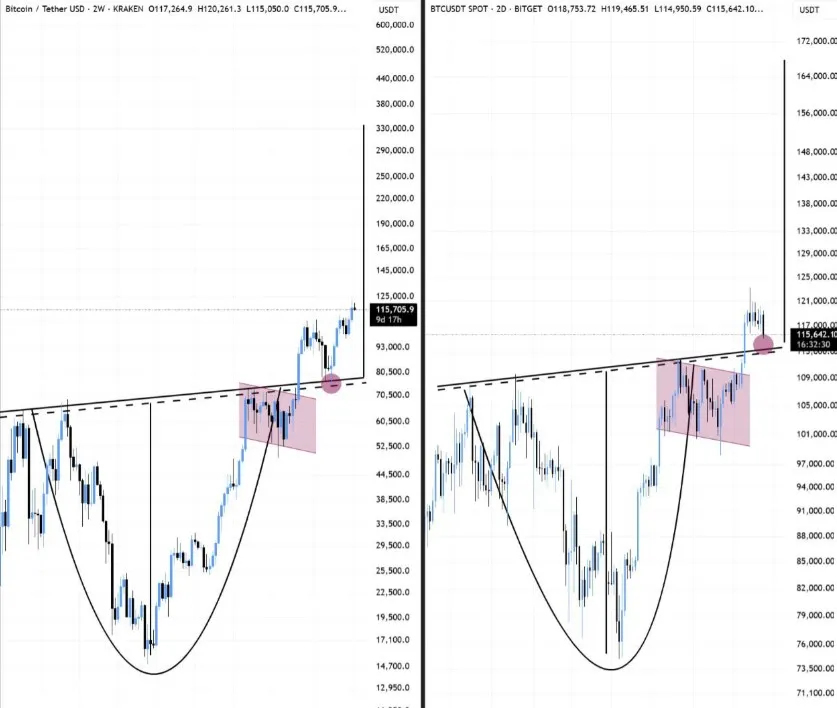

2. Technical Indicators Flashing Bearish Signals

RSI Dropped from 67 to 55: Weakening buyer pressure signals potential correction ahead.

MACD Bearish Crossover: A key btc technical analysis today sign, showing decreasing upward momentum and early correction stages.

Together, these factors are creating short-term chaos in the market. But is this a signal to panic—or a setup for the next move higher?

Despite the bearish indicators, analysts remain optimistic on the long-term trajectory. Crypto analyst BitBull believes The Crypto King may soon retest the $111K–$112K range, a key untested zone since the last breakout. If this zone holds, it could become the launchpad toward the btc $200k december target.

The current combination of whale positioning, ETF inflows, and reduced miner rewards could create the perfect storm. This makes the bitcoin price prediction 2025 not just hype—but a statistically backed possibility.

All eyes are on the next The Crypto King move. While btc crash reason discussions grow louder, some are seeing opportunity. Technicals point to a short-term pullback, but fundamentals suggest a breakout may be brewing.

Whether The coin crashes to $111000 or blasts off to $200000, one thing is clear—whales are preparing for a big shift. The deribit btc options bet, along with major the bitcoin whales news, hints at growing tension between short-term fear and long-term belief.

The question now isn’t if something big is coming—it’s which direction it explodes in. Let’s see who gets it right—the bearish chart or the bitcoin $200K prediction believer.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

good