BTC recently touched a new all-time high of $123,091.61, but failed to hold that level. As of now, Bitcoin price today is around $116,712 after falling 4.66% in the last 24 hours. The asset's market cap stands at $2.32 trillion, with a trading volume of $147.38 billion.

Source: CoinMarketCap

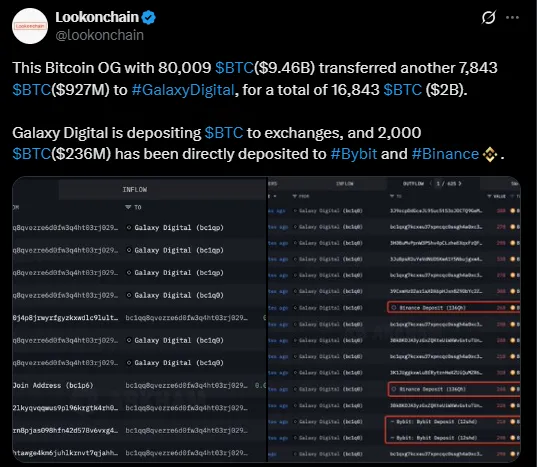

On July 14, a dormant whale holding 80,009 BTC ($9.68B) transferred another 7,843 ($927M) to Galaxy Digital, for a total of 16,843 ($2B), according to Lookonchain.

Source: X

After seeing the bitcoin OG WITH 80,009 ($9.46B) start selling near the top, the whale Ox960B closed his long position and flipped short on it. Currently, he is now sitting on an unrealized profit of nearly $228K. This selling pressure came right after Bitcoin touched a new high. He moved and flipped from long to short, gaining $228,000 in unrealized profit.

Source: X

In contrast, the Bhutan government also kept selling and has so far sold 11,411 BTC. This new Bhutan news presents yet another dissenting view from sovereign investors.

On the other hand, MicroStrategy doubled down. The company bought 4,225 coins worth $472.5M at $111,827 each. As of July 14, MicroStrategy Bitcoin holdings stood at 601,550 coins, bought at ~$42.87B. MicroStrategy holdings gain for 2025 is 20.2% YTD.

Such advances highlight one reality — BTC is now integral to national and institutional policy. For profit or for risk management, it is included.

Even institutional assets acknowledged investing 1% of assets into BTC during the State of Crypto Summit hosted by Coinbase. With an estimated $31 trillion of United States institutional capital alone, even a 1% of assets translated into over $300 billion investments going into top digital asset. Include global assets, and the number increases to $1 trillion.

Source: X

This shift is largely thanks to the U.S. government’s change in stance, heavily influenced by Coinbase CEO Brian Armstrong's efforts to fight SEC regulation. Institutional investors now see BTC as "too big to ignore."

However, Economist Peter Schiff disagrees. He argues that the new ATH in dollars doesn’t mean much since the same hasn’t happened in euros or Swiss francs. He believes this is more U.S.-driven speculation, not global adoption. In his view, it's becoming a pyramid of speculation, not a revolution.

Source: X

Still, technical analysts and traders aren’t ignoring the numbers. Trader Steve Grasso predicts Bitcoin could easily hit $250K–$350K.

This aligns with Bitwise CEO Hunter Horsley, who said "Buying pressure from ETFs could send prices flying", and expects BTC to hit $200K.

So, will it reach $200,000 in 2025 or even more? Many believe the next big leg up will be led by ETF inflows, institutional FOMO, and limited supply.

It is clearly experiencing selling pressure at the moment with the current price dipping back to $116,712. The severe rejection at the $120,000 mark implies formation of a short-term top. Technically, this could translate into a phase of correction unless it rallies quickly and consolidates above $118,500.

Source: TradingView

The key support is at $112,000, recent resistance. If that is broken, the next downside targets are $108,000 and $104,000. On the other side, a close above $120,000 will cause the breakout to $125,000 or even $130,000 over the coming weeks.

Nonetheless, long upper daily wick and bearish divergence in RSI point towards short-term fatigue. With elevated profit-taking at the ATH region and macro ambiguity, It may retest $108K–$112K prior to continuing its bull run. Traders should wait until a close above $119K or below $112K for the next significant move.

The latest rally to its high of all time has signaled two things for certain—giant participants are entering the race, and the future is optimistic and cautious. With institutions pouring in and professionals pricing aggressively, the question of "Will Bitcoin rebound again?" has become "How much will BTC go up next?"

Disclaimer: This is for informational purposes only. There is a high degree of market risk in investing in cryptocurrency. Do your own research before investing.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.