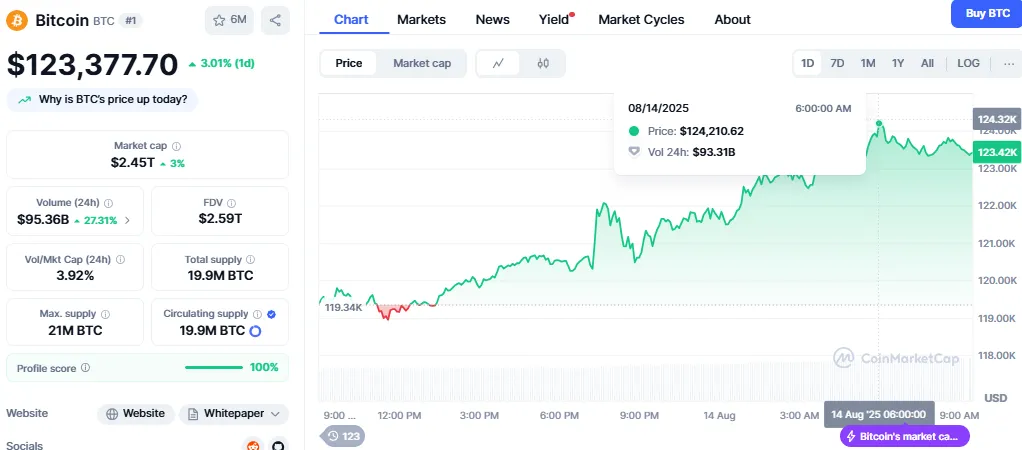

On August 14, Bitcoin hit a new all time high of $124,457.12, marking a major milestone in the crypto market. This is just 0.85% lower than the current price, with BTC now trading at $123,380.75. In the last 24 hours, BTC recorded an intraday surge of 3.04%, with a market cap of $2.45 trillion and a trading volume of $96.28 billion, according to CoinMarketCap.

Source: CoinMarketCap

Bitcoin price charts show an unusual strength with rapid acceleration in price movement from a maximum of 119,550 to $124,457.12 in a single day early this month, countering a month of consolidation between 119,000 and 122,000. Many traders are now pondering over the big question: Why is crypto going up today?

One of the obvious reasons for the replication of new ATH is recent CPI numbers. According to Ali Martinez, BTC had strong support at $118,163 and $116,934, and breaking above these levels helped push the price towards $124,457.12. Historically, if Bitcoin dumps before CPI or PPI data, it usually rallies after the release.

Source: X

The July CPI data released on August 12 indicated inflation at 2.7%, softer than an expected 2.8%, while core inflation went unexpectedly high to 3.1% as against 2.9% and highest since February 2025. This combination of softer headline inflation and hard-core inflation has fueled bullish sentiments in price news.

Another named factor would be the continuous accumulation of BTC by big players. MicroStrategy recently increased its holdings to 628,946 BTC, valued at $77.53 billion. Meanwhile, El Salvador, which has been buying 1 coin daily since November 18, 2022, now holds 1,000, bought for $57.29M — currently worth $124M, a 115% profit.

From here, Will it Soar to a New High, Plunge Again, or Trigger a Short Squeeze?. Let’s find out.

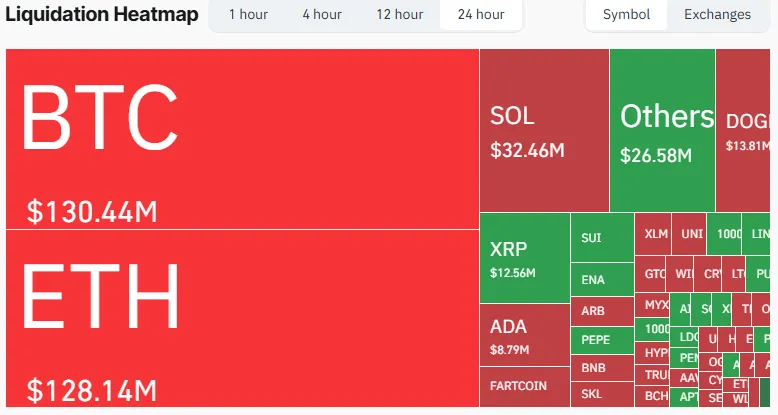

Data from Coinglass shows that in the past 24 hours, $417.51M was liquidated from the crypto market — $280.64M from shorts and $137.07M from longs. The largest single liquidation was on Bybit for BTCUSD worth $10M.

Source: CoinGlass

BTC led the liquidations at $130.44 Million, followed by Ethereum at $128.14M and Solana at $32.46M. Analyst Ali Martinez reported that miners sold over 2,000 BTC in just three days, suggesting more liquidations could be on the way. If it hits $125,000, an estimated $6 billion in Bitcoin shorts could be wiped out — adding fuel to the bullish crypto rally.

From a technical perspective, the news remains positive. The weekly chart shows higher highs and higher lows since late 2023. At the moment it is at $123,380.75, with the RSI at 68.62, thus bullish but not yet overbought.

Source: TradingView

Both $118K and $110K serve as key supports, with an additional one at $100K; meanwhile, $125,000 and the psychological level of $130,000 both pose multiple resistances. Closing above $125,000 allows BTC an ascent between one-to-three weeks to $130K. The break above $130K opens $138K–$142K, and even $150,000, as suggested by few Bitcoin price prediction models.

On the contrary, a weekly close below $110,000 may indicate a pullback towards $100,000, thereby delaying any Bitcoin new ATH prediction. However, a weekly close below $110,000 could signal a pullback toward $100K, delaying any new ATH prediction.

With all-time high turns, the effect of bullish macroeconomic data, institutional buying, and diminishing short liquidations work. As to whether BTC hits $130,000 or goes into a correction, it now depends upon its hold on the key supports and ability to break above $125,000 with strong volume. When asking Will it crash today or rally further, traders should watch these levels closely.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.