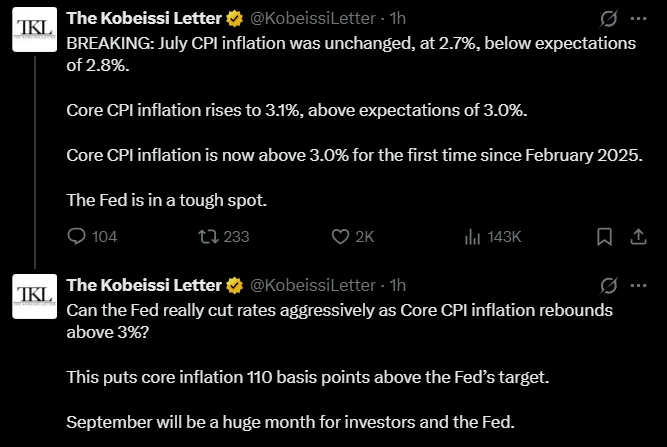

The latest July CPI inflation data has sparked fresh debate on Wall Street. While Consumer price index stayed at 2.7%, below the 2.8% forecast, Core inflation unexpectedly rose to 3.1%, the highest since February 2025.

This mix of cooler overall prices but hotter underlying cost increase is putting the September rate cut odds 90% narrative into sharp focus.

The Federal Reserve is now caught between a slowing labor market and a sticky core high price trend, making the coming month one of the most critical times for the market in years.

According to the US CPI result released today, headline cost increase came in flat at 2.7% year-over-year, matching June’s number and staying below estimates.

Source: The Kobeissi Letter X Account

However, US core CPI news was hotter, coming in at 3.1%, exceeding the 3.0% consensus. This marks the first time in six months that core price growth has breached the 3% level.

It excludes food and energy prices, making it a key metric for the Federal reserve's policy path. At 3.1%, it now sits 110 basis points above the Fed’s 2% target.

The latest CPI data news today sends mixed signals. On one hand, price increase is steady, giving the Federal reserve some cover to ease rates. On the other hand, the rise in core price index data suggests inflationary pressures remain embedded.

For Fed Chair Jerome Powell, the challenge is balancing the economic slowdown narrative with the political and market push for rate cuts. As a senior crypto market analyst at CoinGabbar, “This is a classic policy trap—cut too fast, and you risk re-igniting inflation; wait too long, and you risk a deeper slowdown.”

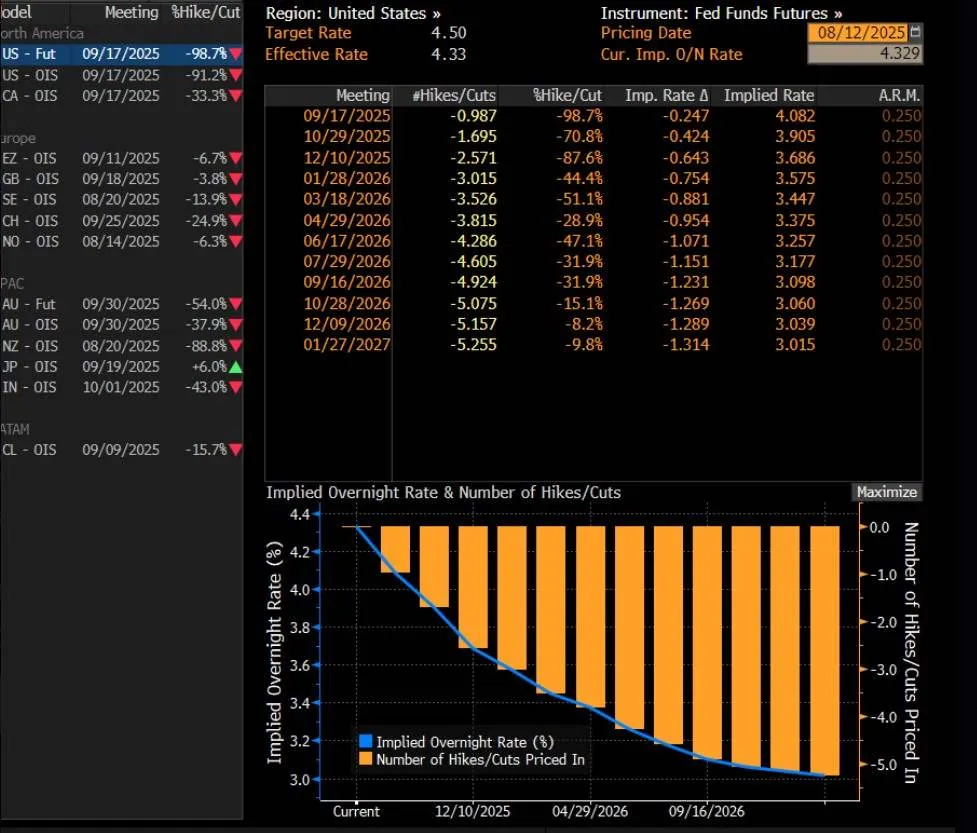

Market reaction was swift. CME FedWatch now shows a 90% probability of a 25 basis point September Fed rate cut, while Polymarket prediction odds jumped from 73% to 81% after the consumer price index release.

Source: Ben Calusinski

The surge in September rate cut odds 90% is being driven by expectations that the Fed will prioritize employment stability over a temporary inflation uptick.

But, not everyone is convinced the Fed should be cutting. Peter Schiff, global strategist and chairman of SchiffGold, argued that the 3.1% data actually understates the real cost of living. “Even taken at face value, these numbers show the need for higher, not lower, interest rates,” Schiff said on X (formerly Twitter).

His view adds weight to the argument that official data might be masking deeper inflationary risks.

In crypto markets, this core CPI data vs. FED rate cut September is creating a volatile setup. Policy easing generally weaken the dollar and boost risk assets, which is why Bitcoin and other cryptocurrencies often rally ahead of such policy moves.

Traders are betting heavily on a policy easing, with some projecting this could push Bitcoin toward the $144K–$147K zone before a sharp correction.

However, if US inflation data crypto impact plays out, then a sharp post-Fed rally could be followed by an equally sharp correction.

For now, all eyes are on September, as both traditional and crypto investors position themselves for a potential Fed pivot.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.