Kiyosaki’s August Warning: Is the Bitcoin Curse Back?

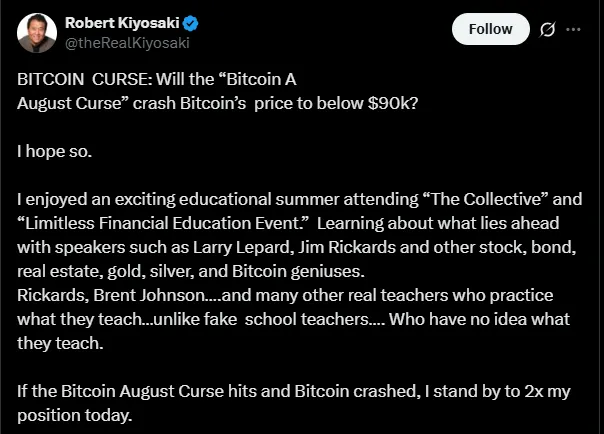

Investor and author Robert Kiyosaki is sounding the alarm again. In a recent post, he warned of what he calls "Bitcoin August Curse,” suggesting the concerns that BTC could drop below $90,000. But despite the warning tone, Kiyosaki says he is ready to double down on his holdings.

Source: X

But why is he still sure about the purchase despite his own Bitcoin August Curse statement? Well the concerns he raises is not for BTC itself but the authorities that are influencing the matter like the Fed, Treasury, and White House.

Kiyosaki’s “Bitcoin August Curse” comment landed when markets were hit with a great disruption. Last week’s U.S. employment report showed only 73,000 jobs added in July, far below than the expected 104,000 joinings. On top of that, May and June jobs were cut by 258,000.

The Report triggered panic. U.S. stocks lost more than $1 trillion in value in just one day. BTC dropped sharply from $118,000 to $114,000, while ethereum slipped under $3,350 on July 24, 2025. Following the news, about $729 million in crypto was liquidated in a day.

The jobs data hit hard, but politics made things worse. Right after the report, Trump fired the BLS chief, accusing her of faking numbers. He also criticizes the Fed and tells Powell to quit. Then the Fed governor suddenly resigned, opening the door for Trump to shift Fed policy.

This all puts weight on Kiyosaki’s mention “They are the problem.” And of course, it matters a lot for the crypto market which is fragile to the traditional systems.

In the past years, heightened geopolitical tensions or economic stress often pushed investors towards BTC. And in the most recent when the golden asset achieved a milestone of $120k, the predictions of its to achieve $1 million were supported by more than 20 experts including Robert Kiyosaki, Eric Trump, and Josh Fraser.

But this time, the flow went the other way. Is the situation hinting towards Bitcoin no longer seen as a hedge in times of stress, or is the current volatility just too high for any speculative asset to benefit?

August has a rough history for the coin. Over the past 12 years, it has posted losses in most of them, earning the title “Bitcoin August Curse.” With shaky economic data, political mess, Fed drama, and military posturing all happening at once.

Still, not everyone’s selling. ARK Invest added millions in Coinbase shares and crypto-linked stocks despite the downturn. Big wallets continue to show accumulation signs, even though small investors are backing off.

Whether “Bitcoin August Curse” is going to prove itself or not, but the volatility is certain in the market following the chaos by the biggest economy.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.