The US job data today has raised serious alarm bells. July’s work report didn’t just disappoint, it sent shockwaves through markets, showing massive downward revisions that erased 258,000 posts from previous data.

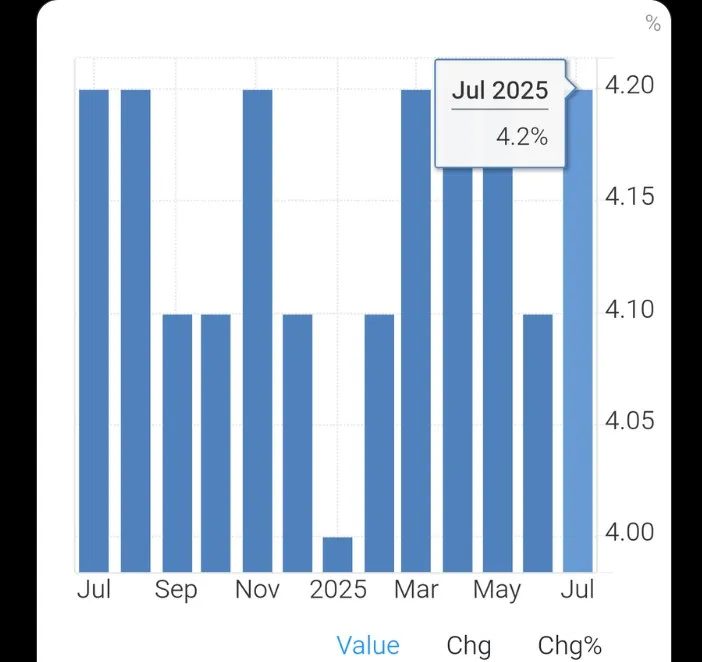

With unemployment rising and occupation growth sharply missing expectations, many are questioning whether the U.S. is heading into a recession, and if the Fed will lower rates in September to counter the slide.

Let’s break down what the numbers reveal — and why they matter now more than ever.

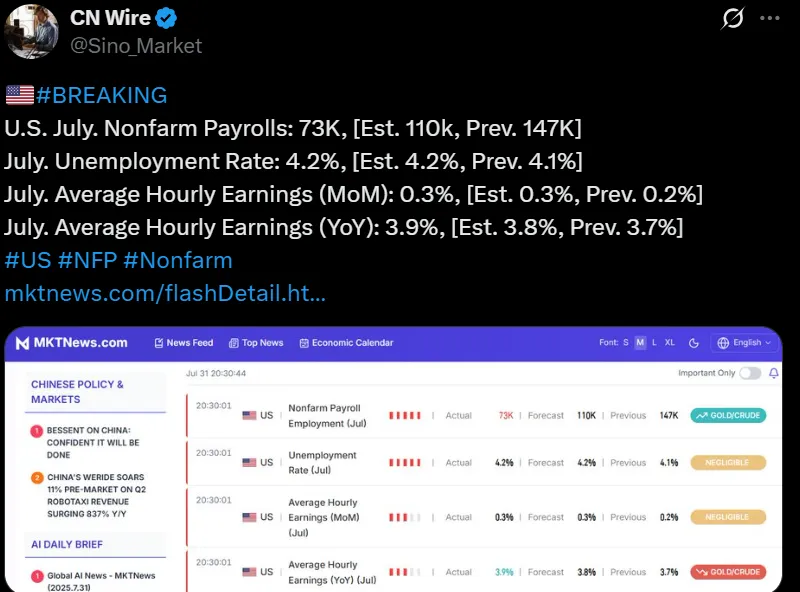

According to the US jobs data today, the economy added only 73,000 nonfarm payrolls in July, compared to an estimate of 110,000. Worse, past months were revised heavily:

June: From 147K → 14K Now

May: From 120K → 19K

Source: CN Wire X Account

That's 258K posts vanished—more than the population of Scottsdale, Arizona in a single revision. For a supposedly “strong” labor market, this is a brutal wake-up call.

This isn’t just a slowdown, it could be a sign that the US recession probability is rising.

“There are two scenarios:

The US labor market is entering a recession

Something is seriously wrong with the detials”

Just a day before this report, the Federal Reserve claimed the labor market remained “strong.” But the numbers from the latest US job data news today tell a very different story.

The unemployment rate climbed from 4.1% to 4.2%, matching forecasts, but signaling weakness. More people are out of work, and the trend may continue if posts creation remains low.

For employement seekers, this means: More competition, harder work hunts, and rising uncertainty. It’s not just numbers, it’s your paycheck, your future. But wage growth is still rising: will it fuel more inflation?

Despite weak job creation, wages continued rising:

Monthly: +0.3%

Yearly: +3.9% (above expectations)

If inflation stays sticky, it may delay any meaningful rate cuts, despite softening job numbers. Still, according to the US job data today, this wage growth is one of the few bright spots.

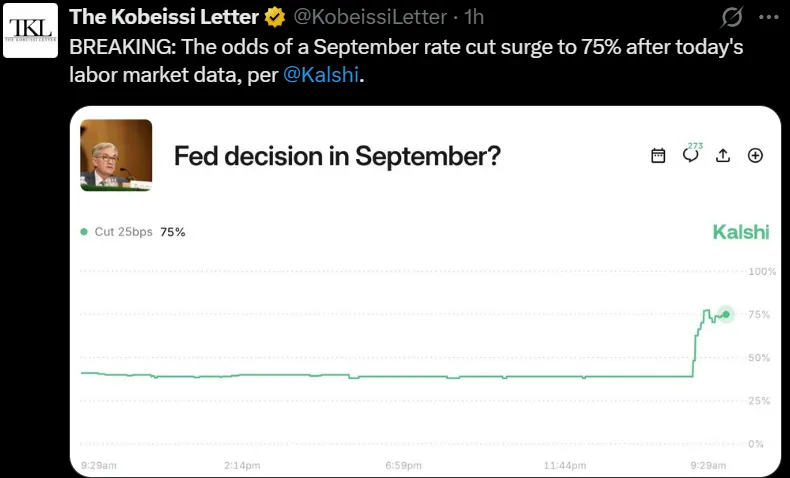

Wall Street now sees a growing chance of a Fed rate cut in September. The weakening labor market, combined with rising unemployment, could push the central bank to act.

Source: The Kobeissi Letter

But the situation is tricky:

Lower rates can help jobs and the economy

Higher wages and lingering inflation may force the Fed to stay cautious

Investors are closely watching to see will Fed lower rates in September, especially after such a weak showing in the nonfarm payrolls 73K update.

Here’s what this means for your money:

Crypto reaction to US jobs data : Currently facing a crash, but likely bullish according to analysts prediction for Ethereum, bitcoin, and other altcoins like Cardano.

Gold & Equities: May see a boost from lower interest rate expectations.

Interest rate cut news could dominate headlines, causing short-term volatility.

Whether it's a true slowdown or a details reporting issue, the US job data today paints a worrying picture. The Fed now stands at a crossroads. Do they act fast and cut rates or wait and risk a deeper downturn?

Whatever they choose, one thing is clear: The American labor market is no longer as strong as it once seemed.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.