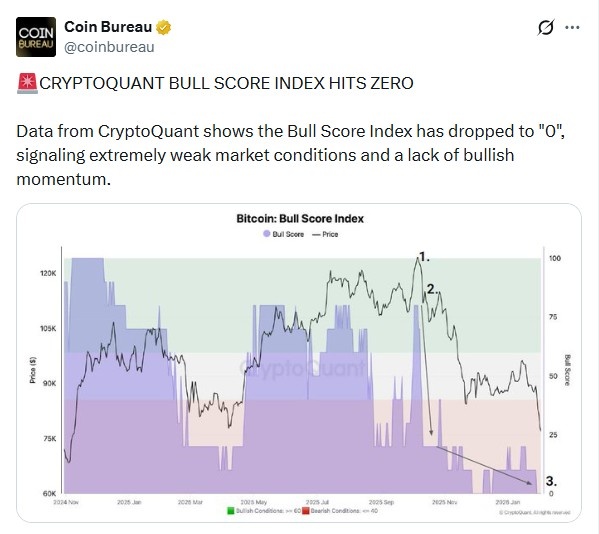

In a recent update, analytics platform CryptoQuant reported that Bitcoin Bull Score Drops to Zero out of a possible 10 points as of Thursday. According to the firm, this marks the first time the indicator has reached this level since January 2022, ending a long stretch of stronger readings that lasted nearly four years. The announcement has sparked discussion among traders who closely watch on-chain signals for hints about market direction.

Source: X official

CryptoQuant noted that such a low reading usually reflects fragile sentiment and slowing capital inflows, suggesting that current conditions favor caution rather than aggressive buying.

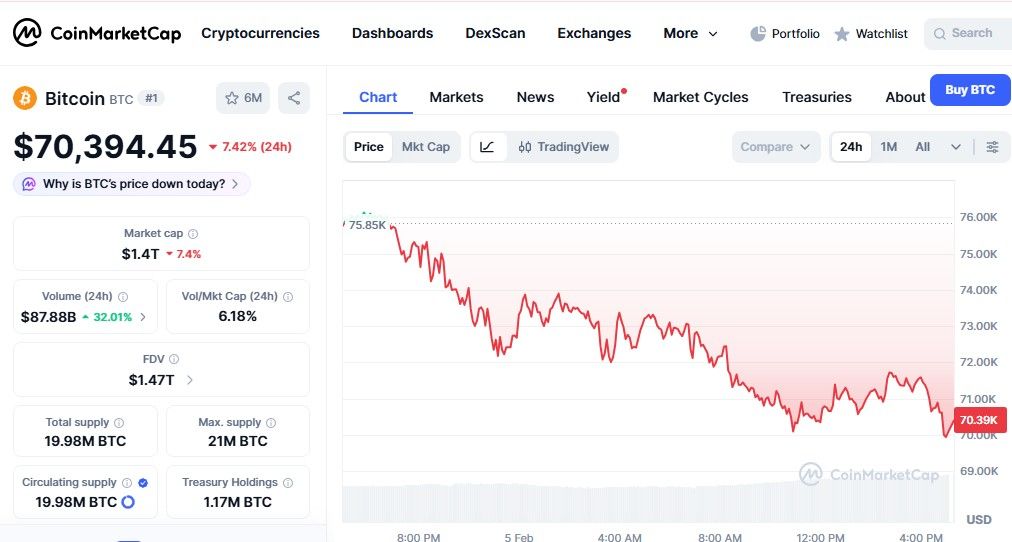

Current Bitcoin data shows: The current price of BTC is $70,394.45 and the current market cap is $1.4T.

Source: CoinMarketCap official

The Bull Score is an on-chain composite indicator that measures the overall health of the crypto market by analyzing multiple blockchain data points.

It combines 10 separate on-chain components, including profitability metrics, liquidity conditions, and investor behavior.

Analysts use it to judge whether the environment leans toward expansion or contraction.

Typically, the score is viewed as a bearish signal when it falls below 40 and a bullish signal when it rises above 60. A reading of zero therefore points to extremely weak momentum and limited confidence among participants.

CryptoQuant highlighted that all ten components are now below trend, showing broad softness rather than a single weak metric.

One of the biggest drivers is the sharp drop in the MVRV (Market Value to Realized Value) ratio, along with reduced stablecoin liquidity across the Bitcoin network.

When MVRV declines, it often means investor profitability is shrinking.

It may indicate undervaluation or a possible buyer re-entry zone depending on broader conditions.

A falling ratio suggests that market value is approaching — or even dipping under — the average purchase price of holders. In simpler terms, many participants are sitting on smaller unrealized gains or temporary losses, which tends to reduce enthusiasm for fresh capital deployment.

Lower stablecoin supply can also signal limited buying power waiting on the sidelines, further explaining the muted outlook.

From a broader perspective, several forces could be influencing this reading:

Profit-taking after earlier rallies may have drained short-term momentum.

Macro uncertainty, including interest rate expectations and global liquidity shifts, often makes investors more defensive.

Large players sometimes pause accumulation during unclear phases, leading to quieter on-chain activity.

Despite the gloomy signal, extreme lows have historically appeared near transitional periods rather than permanent downturns. For recovery, analysts typically look for improving liquidity, rising profitability metrics, and renewed demand from long-term holders.

If capital begins flowing back into crypto markets and profitability improves, the score could gradually lift in the coming months.

While indicators provide insight, they are not guarantees. Periods like this often encourage a balanced approach.

Long-term participants sometimes view weak sentiment as a chance to study value zones.

Short-term traders may prefer patience until stronger confirmation appears.

Avoid emotional decisions and focus on research, risk management, and portfolio balance rather than reacting to a single metric.

YMYL Description: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto markets involve risk and volatility.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.