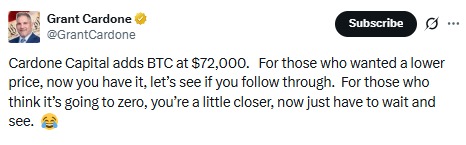

At a time when the crypto market is under pressure, Cardone Capital buys Bitcoin instead of stepping back. Investor Grant Cardone confirmed that his firm added more BTC at around $72,000, making a bold move while fear spreads across the market.

Cardone directly addressed people waiting for lower prices, saying that if they wanted a discount, this might be it. He also joked about those predicting BTC would crash to zero, suggesting that such claims still seem far away.

Source: X (formerly Twitter)

His message was clear: some investors panic during drops, while others see opportunity.

When Cardone Capital BTC purchase comes during a downturn, it usually means the buyer is focused on long-term value rather than short-term price swings. Cardone even shared a simple example: if only 35% of the world’s estimated 60 million millionaires bought one BTC, supply would shrink quickly.

However, not everyone agreed with his logic.

Several market participants responded that this crypto asset's pricing is no longer based only on scarcity. Today, derivatives such as ETFs, futures, and options create what some call “paper Bitcoin,” allowing large exposure without buying the actual asset.

In other words, leverage now plays a bigger role in price movement than it did years ago.

Strategy, owned by Michael Saylor, is reportedly sitting on about $3.8 billion in unrealized losses on its BTC holdings after the recent drop.

While these losses are not locked in unless assets are sold, they highlight how quickly the market mood has changed. Saylor has long promoted a buy-and-hold approach, but sharp declines still test investor confidence.

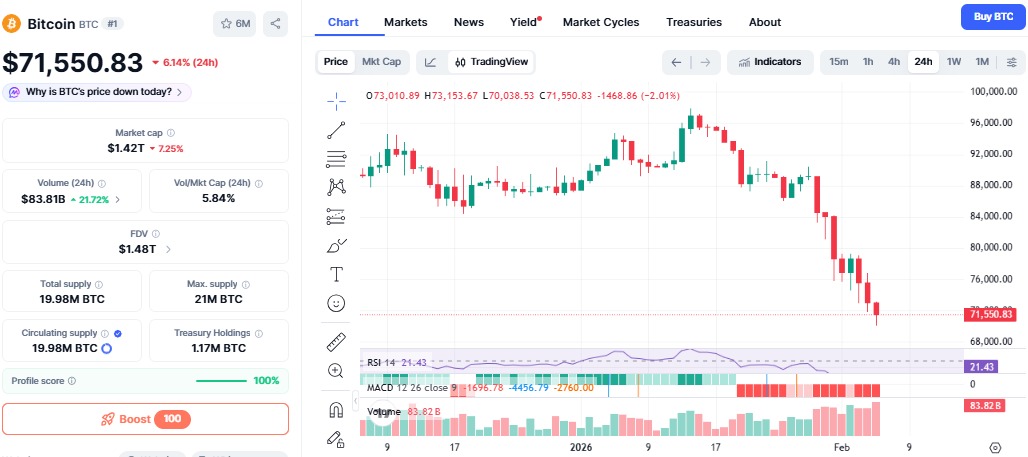

It is trading near $71,550, down roughly 6.14% in the last 24 hours and almost 20% over the past week as per the CoinMarketCap. The fall has been fast enough to shake both retail and professional investors.

Source: CoinMarketCap

What Is Driving the Bitcoin Price Crash?

Heavy Institutional Selling:

Spot Bitcoin ETFs recorded about $1.2 billion in outflows last week. Data also shows a deeply negative Coinbase Premium Gap, often seen as a sign that large investors are selling.

Global Risk-Off Mood:

Weak earnings from major tech companies triggered a broader selloff in financial markets. When uncertainty rises, investors usually reduce exposure to riskier assets like crypto.

Large Holder Movements:

On-chain data shows the Royal Government of Bhutan moved more than 184 BTC to exchanges and trading firms. Even if not immediately sold, such transfers often create fear of added supply.

The broader crypto space is feeling the heat. Leveraged liquidations are approaching $800 million in just 24 hours, and the total crypto market has lost nearly $900 billion in value within weeks.

These numbers explain why the fact that Cardone Capital buys Bitcoin is drawing attention because it goes against the current cautious trend.

Short-Term Outlook for BTC

Technically, the cryptocurrency remains under pressure, and sentiment is sitting in extreme fear territory.

If BTC cannot climb back above the $72K–$73K range, traders may start watching the $65K level as the next support. Still, markets rarely move in straight lines, and sharp drops sometimes lead to temporary rebounds.

Market downturns often reveal how investors truly think. Some rush to exit, while others quietly accumulate.

As Cardone Capital buys Bitcoin, it reflects a belief that the long-term story may still be intact despite the current storm. Whether this turns out to be perfect timing or an early entry will only become clear with time.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency markets are highly volatile and can result in significant losses. Readers should conduct their own research and consult a qualified financial advisor before making any investment decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.