The modern financial landscape, one issue, quietly threatens the wealth of a billion debasement. Central banks and governments are continuing to print money in massive amounts. They slowly erode the value of each unit in circulation. This inflationary trend strips away from the purchasing power of ordinary people, making it harder to save, invest or plan for the future.

Bitcoin currency debasement offers a bold solution. Unlike traditional money, Bitcoin currency debasement has a fixed supply of 21 million coins. No central bank or politician can print more. Its scarcity is coded, never promised. This design ensures that Bitcoin currency debasement not only resists inflation– it helps dismantle the very system that creates it.

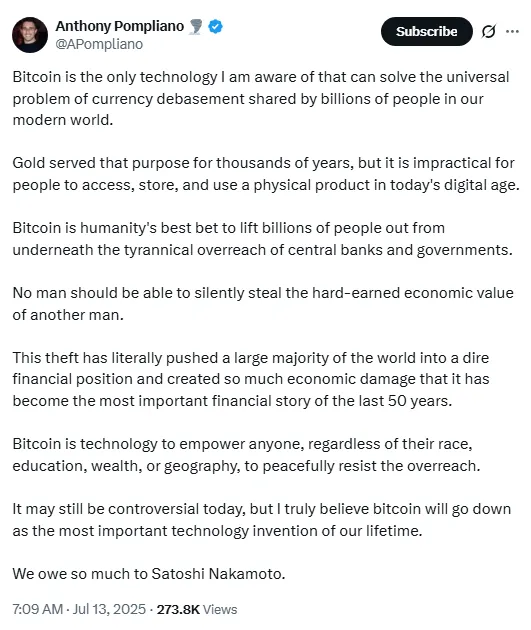

Source: X

Gold has long been considered a hedge against inflation. For centuries it held its place as the ultimate store of value. But in today’s digitized world, gold has its limits. It’s heavy, expensive to store and hard to move across borders. In short, it no longer fits the needs of a mobile, digital economy.

Source: TradingView

Gold recently saw a strong upward move, rising from around $3,320 to $3,358. After peaking, it entered a consolidation phase with reduced volatility. The current price action suggests indecision, as the market waits for a clearer breakout or reversal.

Source: TradingView

BTC currency debasement market cap recently surged sharply, crossing $2.44 trillion before slightly pushing back to $2.43 trillion. This strong bullish breakout reflects renewed momentum, though the small red candle indicates mild selling pressure as the market cools off.

For decades, the central bank has controlled over the transactions and have the unchecked power to print money, and this has led to a silent kind of theft– one that gradually despite your savings. No individuals should have their economic value diminished without consent. Yet that’s exactly what inflation and rare.

BTC challenges this kind of system through peaceful defiance. It gives people an alternative– a decentralized not controlled by any authority. Its narrative is more than a financial solution: it’s a clear stand against systemic manipulation and centralized control.

In countries plagued by hyperinflation, government corruption or banking restrictions.Bitcoin currency debasement has become a financial lifeline. It offers access to global markets with the ability to save without interference and protection from collapsing national currencies.

All you need is a smartphone and internet access. Bitcoin currency debasement does not ask for your credit score or any kind of financial history. It always provides equal access to a global economy, that’s the real power behind– restoring economic freedom to the people who need it most.

As the population grows day by day, or we say as per the reports over 1.9 billion people worldwide remain unbanked or we say they have no chance of having their access to the financial services like credit, savings or a mode of secure payments.

Living in other countries with corrupt or unstable banking systems.

When Satoshi Nakamoto released Bitcoin currency debasementwhitepaper in January, 2009 via an email, a very few people imagined how it would be the future of reshaping global finance.

But nowadays, Bitcoin currency debasement has been more important than just being a code– it is becoming a new way of revolution. It represents a break from the old, inflation-prone systems and a shaft towards monetary inflation.

The rise of Bitcoin currency debasement is proof that people are waking up. They are no longer accepting the silent theft. Thanks to Satoshi’s vision, we now have a choice– and have a chance to take back control.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.