Bitcoin Spot ETFs have collectively surpassed Satoshi Nakamoto BTC holdings, marking a significant milestone in the cryptocurrency market. As of December 6, U.S. spot bitcoin ETFs now hold a combined 1,104,534 BTC, edging past Satoshi's 1.1 million BTC stash. This achievement was shared by Eric Balchunas, a Senior ETF analyst at Bloomberg, on X (formerly Twitter).

Source: X

Source: X

The rise of Bitcoin Spot ETFs has been remarkable, with BlackRock's iShares Bitcoin Trust leading the pack, holding 521,375 BTC. According to Balchunas, U.S. Spot ETFs have become the largest BTC holders globally within less than a year of their launch. This development has sparked discussions about the centralization of BTC holdings.

Critics, including Jonas Schnelli, argue that such centralization contradicts Bitcoin's decentralized ethos. Despite this, the numbers tell a compelling story:

BlackRock iShares Bitcoin Trust: 521,375 BTC

Fidelity ETF (FBTC): Significant daily net inflows of $120 million

Total US Spot ETFs: 1,104,534 BTC

Satoshi Nakamoto: 1,100,000 BTC

Binance: 633,103 BTC

MicroStrategy: 402,100 BTC

US Government: 198,109 BTC

Chinese Government: 194,000 BTC

Bitfinex: 184,027 BTC

Kraken: 158,959 BTC

Block One: 164,000 BTC

Robinhood: 142,361 BTC

Collectively, these major players hold over 4,281,193 BTC out of the 21 million maximum supply, with 19.79 million currently in circulation.

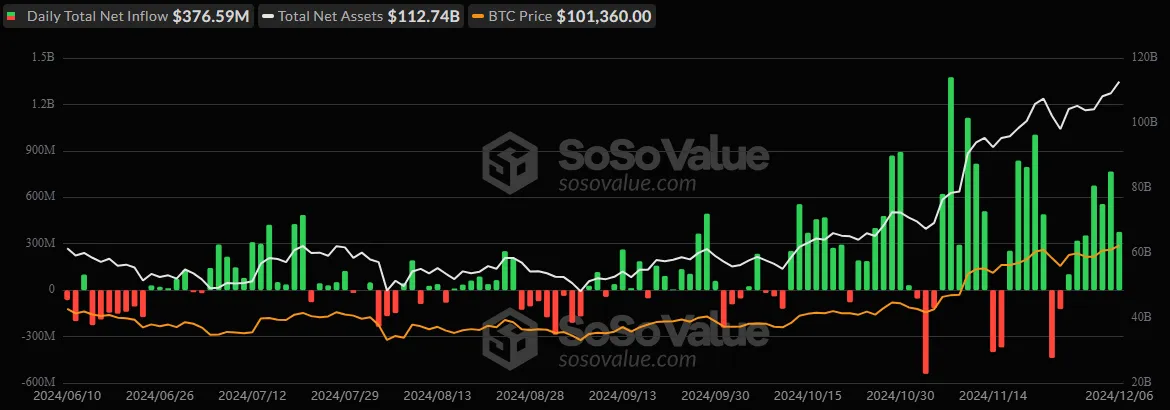

On December 6, Bitcoin Spot ETFs experienced a total net inflow of $377 million, marking seven consecutive days of net inflows. Notably, BlackRock ETF IBIT saw a daily net inflow of $257 million.

Source: SoSoValue

Source: SoSoValue

At the time of writing, Bitcoin was trading at $99,481.67, reflecting an intraday surge of 1.55%. The market cap stood at $1.97 trillion, with a 24-hour volume of $84.02 billion.

This surge in Bitcoin price and the substantial inflows into Bitcoin ETFs highlight the growing interest and confidence in Bitcoin Spot ETFs among investors. As these ETFs continue to attract significant investments, their role in the cryptocurrency market is poised to become even more influential.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.