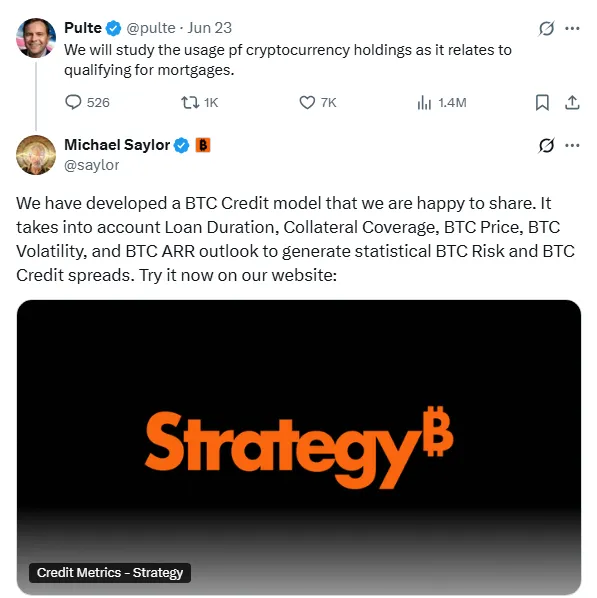

The idea of using Bitcoin to buy a home might have once seemed like a fantasy. But now, two influential voices- entrepreneur Bill Pulte and Bitcoin Champion Micheal Saylor are suggesting it could soon become reality.

Micheal Saylor introduced a Credit model which is basically a backed, in response to Bill Plute’s interest in using crypto holdings for mortgage or loan eligibility.

BTC price, volatility and more to assess credit risk by this model factors in loan duration. Now live on strategy.com, this tool basically aims to bridge traditional lending with the digital asset world.

Pulte acknowledged the effort and promised to review it- making a potential step toward crypto - integrated mortgages.

Source: Twitter

Responding to Plute, Micheal Saylor revealed that his team has already developed a comprehensive Credit Model.

This tool analyzes several variables, including:

Loan Duration

Collateral Coverage

Bitcoin’s Market Price and Volatility

Projected BTC returns (ARR)

According to Micheal, these data points come together to estimate both risk and potential credit spreads- essentially building a new way to measure creditworthiness using BTC as the backbone.

Source: X

Right now, most people holding Bitcoin can’t use it for things like loans unless they convert it into cash.

But if models like Saylor’s become accepted, Bitcoin could be used as collateral- letting holders access funds without selling their assets.

This means they could keep their long-term investment while still fulfilling real-life goals i.e. buying a home.

None of this can move forward without clear5 regulatory support. For banks and lenders to adopt crypto-backed models will be essential.

But conversations like this in between Micheal and Pulte could help influence how these future rules are shaped.

This dialogue between Bill Pulte and Micheal isn’t just a casual exchange- it’s a glimpse into the future of finance. If crypto assets like Bitcoin begin to influence mortgage approvals, it include:

The windows for crypto holders are open to access traditional loans.

Redefine how creditworthiness is measured.

Bridge the gap between Decentralized Finance (DeFi) and traditional banking.

As institutions slowly warm up to digital assets, modes like Micheal's could become the foundation for a new era in lending- where Bitcoin isn’t just an investment, but real financial leverages.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.