The Bitcoin price crash has once again shaken the crypto market. Right now, it’s trading at around $104,041, which means it’s down 1.48% in the last 24 hours. Trading volume has also fallen by over 6%, showing that fewer people are buying or selling today.

Source: TradingView

So, what’s going on? Why Bitcoin is falling today, and can it stay above the important $103,000 support? Or are we heading toward a bigger crash—maybe even down to $100,000 or $97,000?

As someone who follows the crypto market daily and writes about it, I’ve seen this largest cryptocurrency go through many such ups and downs. But this time, global economic fears are adding to the pressure.

If we look at the BTC/USDT chart on TradingView, we can see that it is sitting just above an important level-$103,000. This is a valuable support area:

If the price stays above this level, it could bounce back up to $106,000 or more.

But if it breaks below $103,000, the next stop might be $100K, and in the worst case, even $97000.

This fall happened after the token failed to rise above the $108,000–$110,000 resistance, which shows that buyers are currently weak.

This kind of price analysis helps us understand where the market may go next.

A big trader known as AguilaTrades lost more than $15.4 million in less than 10 days by betting on this cryptocurrency. He had a profit of $5.8 million last week but didn’t sell it then. Now he’s in heavy losses.

Source: X

According to data from Lookonchain, he recently took a $2.95M loss while closing his BTC long positions. This shows that even big players are struggling—and their actions often affect the whole market, especially when it comes to $BTC.

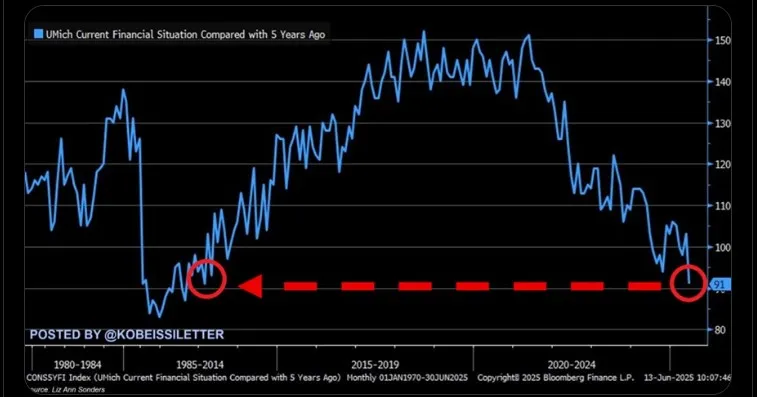

A report from The Kobeissi Letter explains part of the reason behind the current Bitcoin price crash.

U.S. consumers say their financial situation is worse now than 5 years ago.

The score that measures financial confidence dropped to 91 points in June—the lowest in 12 years.

Many Americans feel poorer now than even during the 2008 financial crisis.

Source: The Kobeissi Letter

This fear is hitting all financial markets, not just crypto. People are avoiding risky assets, aslo with inflation, high interest rates, Iran-Israel war, and an uncertain job market affecting personal finances, leading to why the latest Bitcoin news shows such sharp selling.

So overall, U.S. consumer sentiment data is the reason behind Bitcoin price crash today.

So, what could happen next? Here are the two possible outcomes:

If BTC support at $103K stays strong, we may see a recovery to $106,000 soon.

But if it breaks, the coin could fall to $100,000, and maybe even test $97,000 again.

The current market is quiet, and the volume is low. That means traders are unsure about what’s coming next. Until we see some strong buying, Bitcoin remains under pressure.

This Bitcoin crash explained here is clearly not just about the charts. It is a function of global fears — especially fears around the U.S. economy. Large traders are selling, and small investors are not necessarily rushing in to buy.

However, crypto is a volatile market place, and you need to manage risk, whether you are trading or investing. And, watch the BTC $103K support level for future action!

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.