Bitcoin's response to the latest US CPI data release caught the attention of many people in the crypto world. The bitcoin CPI data release impact was easy to see — the price of the crypto king went up quickly to $110,000, then came down a little and stayed around $109,749.26.

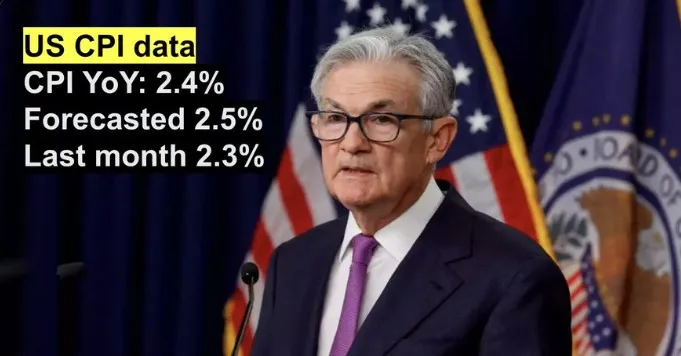

This showed that many investors were feeling positive. This price move happened after the May 2025 inflation statistics came in at 2.4% for the year, which was a bit lower than what experts expected — 2.5%.

Source: X

As inflation slowed, BTC gained momentum, despite volatility. Many are now asking: is it affected by the cost escalation? The answer, as seen today, is a resounding yes.

The core Consumer Price Index data, which leaves out food and energy, rose by 2.8%, also under market expectations. Month-over-month, both headline and core index increased just 0.1%, lower than projected.

This kind of economic data is closely watched by investors. Lower price pressure means a less aggressive Federal Reserve rate, which could benefit this currency as a hedge. No wonder we saw a crypto CPI data today reaction with Bitcoin price jump over $110K briefly — a move that could trigger the short squeeze potential if bulls hold strong.

Even though inflation is slowing, rate cut odds are now down to 0%, according to The Kobeissi Letter. This signals that the Fed might remain cautious due to Trump tariff strategy and sticky core inflation.

Source: Kobeissi Letter X Account

Nevertheless, this has not stopped the industry optimism. The Consumer price index reaction analysis suggests its allure is strong in uncertain macro conditions. This is not simply rates - it is trust in fiat over digital stores of value.

It is increasingly seen as digital gold, offering protection against currency devaluation. That’s why after the inflation report today was missed to the downside, this currency gained favor again.

Crypto expert James Wynn cautioned against short-term trades. He advised investors to zoom out and focus on longer-term trends.

Source: James Wynn

The bitcoin CPI data release impact clearly showed how closely markets watch macro numbers like cost escalation. With May 2025 statistics underperforming forecasts, this coin jumped, showing its strength as an alternative asset.

Although rate cut hopes are off the table for now, if the token continues to thrive. Traders, investors, and even newcomers should now understand how Consumer price index and rising prices tie into cryptocurrency price swings. If your are wondering, $BTC is affected by price increase, today's market action says it all.

Stay updated for the next US inflation report release in June 2025, as it could once again shift the industry landscape.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.