The price of Bitcoin has been hovering around major support and resistance areas, but what’s driving the cryptocurrency’s future? Whale action may help form a new support level, but the uncertain environment of regulations and bearish technical analysis leaves the future of BTC open.

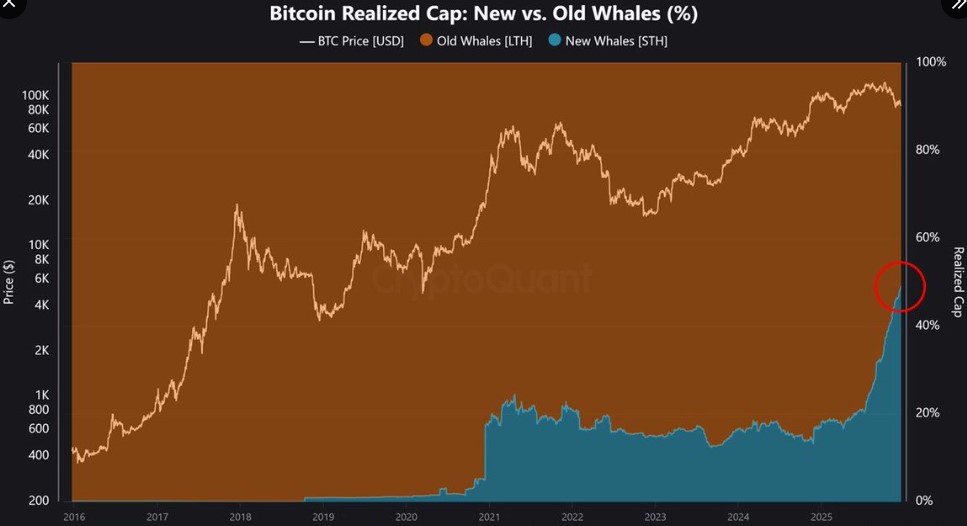

New whale buyers acquired by BTC have actually become a major influencing factor behind the current Bitcoin price ($88,191), contributing nearly 50% of the coin’s realized market capitalization. The data shows that there has been a vast increase in new whale buyers.

Source: Coin Bureau

This new group of institutional and well-funded investors is creating a buzz about the potential for the continuation of the rise of the coin. But can this demand propel BTC through the impending technical roadblocks?

Although there is increasing institutional participation, many big investment banks are reducing their target prices for the crypto. Citi has reduced its 12-month forecast for the crypto to $143,000 from $181,000, while Standard Chartered has reduced its 2026 target by 50 percent to $150,000 from $300,000. Even Cathie Wood's Ark Invest has reduced its 2030 forecast for the crypto to $1.2 million from $1.5 million.

This dramatic drop in the targets of Bitcoin's price suggests a greater fear among key financial institutions.

Notably, however, amidst all these changes, another firm making predictions about the price of Bitcoin is Tom Lee and his Fundstrat group, which is pegging the price of Bitcoin at $60K-$65K in the short-term future. The projection made by Lee seems quite optimistic compared to the views of other analysts.

CryptoQuant has raised red flags, indicating that BTC can be entering the bear market stage. The company indicates that prices can drop to a low of $70K within the next 3-6 months, with the possibility of going even lower to $56K during the second half of 2026.

Although some market analysts regard the current price action as only a phase of consolidation, there are warnings of the approach of a bear market.

The MACD and RSI both indicate that there is bearish momentum in cryptocurrencies, and the failure to move through key levels of resistance in BTC valuation may lead to further downside in the short term.

Bitcoin’s price prediction is largely impacted by two significant events, namely the actions of whales and the latest developments in the regulation scene. The U.S. is heading towards more defined regulation in the cryptocurrency space, with the CFTC being charged with the regulation of Bitcoin under the Crypto Market Structure Bill. On the flip side, the enforcement stance of the SEC may soften.

Despite the ongoing uncertainties, new whales are actively accumulating Bitcoins, contributing to an increase in the asset's realized cap. However, rising exchange deposits suggest that profit-taking is also on the horizon, which could apply downward pressure on prices in the near term.

On a technical analysis front, critical support for the coin stands at $84.5K with a massive amount of over $35 billion at play at this level. A break below this critical support can cause a sudden drop to lower levels of $63K. For now, the course of BTC will depend upon whether it can sustain levels at these critical points or experience additional downward pressure from technical as well as macroeconomic settings.

Disclaimer: This is for informational purposes only and not financial or investment advice. Crypto markets are volatile, do your own research before investing.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.