The world's largest cryptocurrency has failed to hold the major $90,000 support level as the recent rebound lost momentum and investors shifted toward a risk-off stance. The BTC price is now down nearly 32% from its yearly high, raising fresh concerns about where the market is headed—especially as risky technical patterns emerge ahead of the Bank of Japan’s (BoJ) policy decision.

The daily chart tells us that Bitcoin went back up from the low of the previous month which was at $80,524 and reached up to $94,640 where it was met with strong resistance. This rejection changed the course of events, and the selling pressure came back quickly.

Notably, the recent market downturn wasn’t driven by retail panic selling. Rather, data indicates that large institutions sold a considerable amount of Bitcoin.

Companies like Wintermute, Coinbase, BitMEX, Binance, Bitwise, and Bitfinex were named as the source which caused the selling of BTC through the heavy sell pressure distributed over multiple exchanges.

This coordinated outflow suggests deliberate positioning by whales and centralized entities rather than organic fear-driven selling.

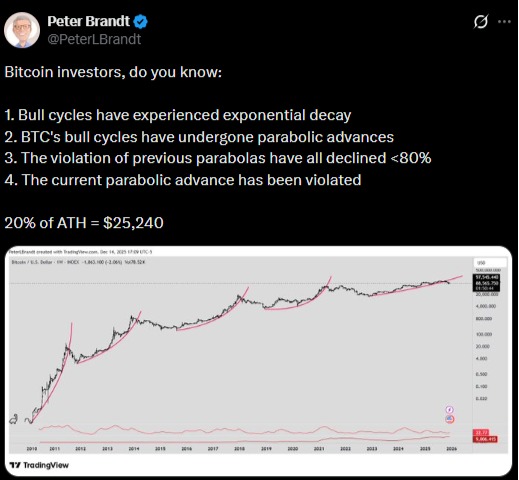

History has taught a very important lesson to the Bitcoin investors. Every bull cycle has pushed prices higher in a sharp, almost parabolic move—but each cycle has also produced smaller returns than the previous one.

More importantly, whenever Bitcoin has broken below its parabolic trend in the past, the resulting correction has been severe, often exceeding an 80% drawdown from the peak.

At this moment, Bitcoin seems to have yet again crossed the line of its current parabolic movement. If history were to repeat to any extent, then it wouldn't be totally impossible for us to see a move to just 20% of the all-time high—approximately $25,240.

The question of the moment is really whether the ultimate upside is still appropriate to be considered if the long-term scenarios of Bitcoin are already strong?

Source: X

There is also the Bank of Japan’s interest-rate decision on Friday that adds to the uncertainty surrounding the market. The central bank is almost in unanimity for the 25 basis points hike in borrowing costs. Such a scenario could result in a stronger yen, which in turn, could put more pressure on risk assets including cryptocurrencies.

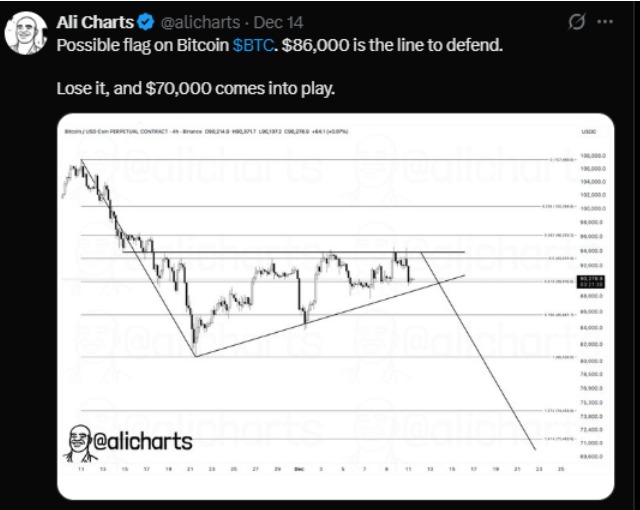

BTC is currently hovering near a critical support zone around $86,000. Although this level has held so far, continued selling could push prices lower. A decisive break below this zone may open the door for a decline toward the $80,000–$75,000 range.

According to analyst Ali, The chart shows a possible flag formation, which typically indicates a continuation of the preceding trend—in this case, bearish.

Traders are going to keep a sharp eye on the $86,000 line considering it is a crucial point of defense, as losing this level might quicken the downward trend, possibly dragging BTC to the next significant support areas around $75,000 and $70,000.

The technical analysis reveals that BTC price has been rejected at a descending trendline that coincides with a major Fibonacci retracement level of 61.8%. As of now, BTC is under all the major moving averages of 20-day, 50-day, 100-day, and 200-day and this is a sign that the overall trend is still weak.

Bearishness is also observed in the momentum indicators. The RSI is at 44.42, which is below the neutral 50 line, indicating that there is slight selling pressure on the market. At the same time, the MACD lines are nearing each other, and a bearish crossover might occur which would add to the risk of experiencing a downward trend.

In the light of these signals, it can be said that Bitcoin may have a hard time for a while, and the scenario of a traditional Santa Claus rally is ruled out for this year.

If the selling pressure continues to rise, the next critical support area to observe is $80,524, where the November low is situated. If the price goes below this support then it would mean that the bears have taken control and the price could even go down to the $75,000 support level.

Source: Coinmarketcap

Conversely, in case Bitcoin goes above the falling trendline and stays above the $94,000 resistance, there will be a return of the bullish momentum. In that case, the decreased selling pressure would lift BTC up to the psychologically important $100,000 milestone.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.