Bitcoin price predictions continue to stir discussion, as XRP lawyer John Deaton projects a significant surge in the coming year. He believes that the crypto will trade between 180,000 and 250,000 as institutional and macroeconomic headwinds continue to swell.

Deaton believes that the MicroStrategy stock may reach above $500 in this rally, as the crypto value increases its asset base. The stock has been experiencing pressure due to concerns about equity dilution and declining mNAV, with the current price standing at $358.

https://x.com/JohnEDeaton1/status/1959678951053271072

Although recent critics of Michael Saylor have accused the company of a change in policy, Q2 earnings of $10 billion support the long-term Bitcoin policy of the firm. Analysts state that a major BTC rally would give investors confidence in MicroStrategy and its high-risk strategy.

On the other hand, Deaton is cautious of a sharp correction after the rally, and he predicts a 30-40% decline in the Bitcoin price. Such a fall can have a severe impact on MicroStrategy, and rumours of liquidation can cause further volatility of the stock.

Tokyo-listed Metaplanet added 103 BTC, bringing its total to 18,991 BTC. The company has already invested $1.95 billion since April 2024 with the average price of the top crypto being $102,712.

Its listing in the FTSE Japan Index increases passive fund interest in Bitcoin in its stock. Metaplanet sold 4.9 million new shares to acquire more BTC, increasing the number of shares to 722 million.

Analysts feel that this strategy will route institutional capital into crypto indirectly with its acquisition of 210,000 BTC, Metaplanet is conducting an aggressive buy up that will help price and market stabilization in the long term.

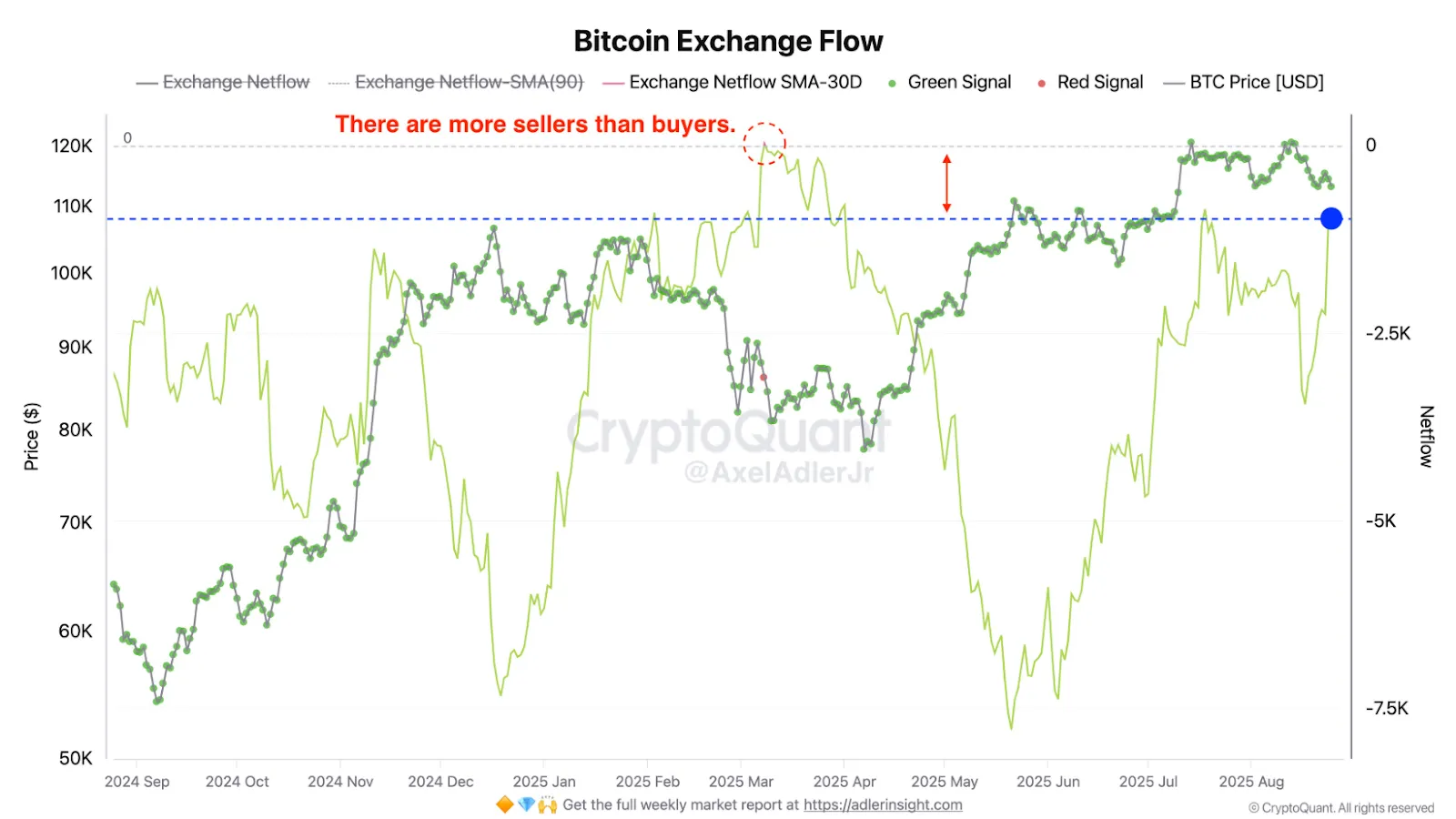

Analyst Axel Adler Jr points to increasing selling pressure on exchanges as big holders dump without risk management tools such as TWAP. He cautions that netflows are approaching a point where sellers may overtake buyers and create downside risk.

Exchange Flow : Source : CryptoQuant

CEX netflows are in positive territory as Bitcoin price hovers around $110,000. Adler cites less corporate interest, as recent interest has been focused on Ethereum instead of the top crypto by market cap.

In contrast, analyst Merlijn The Trader flags a “Double Top” near $112,000, calling it a last stand for bulls. If this support breaks, a cascade of liquidations could follow, flushing weak hands and offering accumulation opportunities for stronger players.

BTC Double Tops : Source : X

He also notes that September historically brings fake rallies and drawdowns, while October marks recovery phases. Investors who endure the volatility could benefit in the following rebound.

Despite short-term concerns, the broader outlook remains positive, according to long-term analyst AO. He draws parallels between the current market and the 2020 cycle, where Bitcoin broke resistance before a large rally.

Price Forecast : Source : X

AO’s fractal analysis shows a similar accumulation zone forming now, suggesting the crypto price could enter a full bull run. His target sits near $320,000, supported by structural breakouts and historic repetition of market behavior.

This long-term view aligns with Deaton’s bullish prediction and continued institutional interest from firms like Metaplanet. Together, these factors suggest the crypto may still be in the early stages of its next major uptrend.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.