Bitcoin price saw a sharp rise earlier this week, peaking just above $126K, but has since fallen to around $116K. This marks a notable drop of approximately 7-8% over the past week. The steepest decline occurred between August 15th and 16th, causing some concern among investors.

Despite the correction, we may be witnessing a window of stabilization according to recent data and a short-lived rebound put forward in prices of the cryptocurrency.

Meanwhile, a significant move was observed in the crypto industry by Ark 21Shares. The firm sold some holdings, precisely 559.85 Bitcoin, eliciting a value of around $64.4 million. The sale is a means by which the company managed its portfolio and made adjustments according to market fluctuations.

Therefore, due to price declines of late, one might anticipate an element of caution behind such a decision, nevertheless, it lends further credence to the increasing institutional trend in the cryptocurrency market. Ark 21Shares could be positioning itself for some opportunities that should come up in the near future, probably taking advantage of current levels.

The action taken by Ark 21Shares is worthy of note, as it gives credence to the institutional participation in crypto. Given the volatility, firms like Ark adjust amid the volatility to control risks and gain profits.

On the retail side, some data from CryptoQuant support a disturbing trend. Short-term holders (STHs) have started selling Bitcoin at a loss once again, a situation last witnessed during the start of 2025. The STH-SOPR (Spent Output Profit Ratio) has fallen below 1, which would imply that these investors are locking in losses at this price retraction. It constitutes a behavioral shift since short-term holders had been predominantly undertaking profitable disposals as the market marched towards six figures.

Historically, there are two possible directions such losses-realization events take for the market. The first one acts as a dampener in momentum, while speculators just lock in their profits. The second is only temporary and acts as a "reset," which disposes of weak hands for a stronger rally ahead. Since Bitcoin has been locked near strong resistance, this loss-selling can be an important market health indicator.

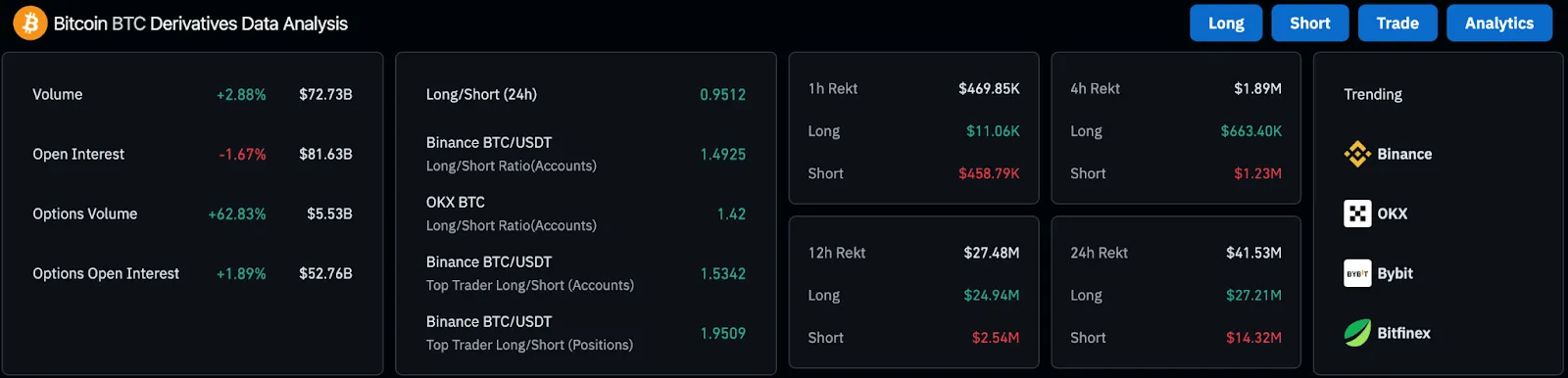

Noteworthy activity was also witnessed in the Bitcoin derivatives this week. The derivative market traded at $72.73 billion, a 2.88% increase, suggesting an increase in Turnover. Open Interest contracted negatively by 1.67% to $81.63 billion, indicating lessening in contracts in force from prior levels.

Source: Coinglass

Particularly in options, the volume saw some serious second-month growth. It rose by 62.83% to $5.53 billion. This increase implicates more traders taking part in hedging or speculative endeavors. Options open interest has also increased by 1.89% to $52.76 billion, indicating a rising interest in options contracts reflecting expected volatility or price movement.

Long-long/short appears to be more or less balanced at 0.9512 in the last 24 hrs. On the contrary, it has been long favored in recent days in exchanges like Binance and OKX respectively with long/short ratios above 1.4.

However, it seems shorts are coming under pressure lately with short liquidations being $458.79K in comparison to long liquidations of hardly $11.06K. In the continuing days of prevailing short liquidations, it could show a change in market sentiment as shorts are increasingly under pressure with the stabilization of Bitcoin price.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.