What triggered such a sudden crash in the Bitlight price after a huge rally?

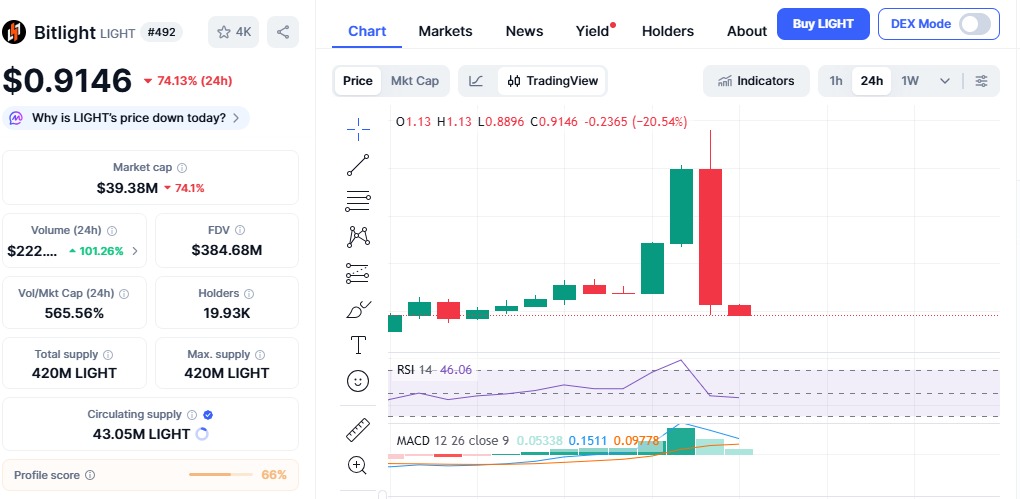

This is the question that all market participants are asking as the LIGHT token dropped by over 74% within 24 hours, falling below $1 after topping $4.75 at the start of the week.

This Bitlight price crash came as a surprise to the overall market, particularly since Bitcoin and Ethereum markets stayed stable. Although the overall market cap of the crypto market saw an increase of 0.7 percent, LIGHT saw a significantly worse performance.

As per the CoinMarketCap, it is currently trading near $0.91, based on market information. The token broke through multiple major support levels in a short period of time.

With the nearly 400% three-day increase, the sales momentum gained pace rapidly. As soon as the market value dropped below $1.48, the liquidations began, pushing the drop even further.

Source: CMC

RSI is close to the value of 45 and showing no oversold bounce yet

The MACD turned negative, indicating bearish momentum.

Price was not able to hold the support zones post 400% Bitlight rally

If it cannot maintain above $0.56, there may be another fall.

Information from the blockchain tracking data further supports the observations.

According to the Lookonchain data, 5 wallets transferred 8.84 million LIGHT tokens worth $8.2 million to Bitget in just 7 hours.

Source: Lookonchain

More troubling, however, was the observation by Onchainschool.pro that a wallet affiliated with team funds transferred $6.4 million in LIGHT to Bitget only six hours prior to the flash crash, although this was preceded by a transfer of $2.4 million two days ago to the same exchange.

Large money inflows can increase selling pressure, especially when market liquidity is low.

During this period, LIGHT liquidations hit a 24-hour figure of $16.17 million, second only to Bitcoin and Ethereum.

This explains that leveraged investors were highly positioned on the long side. As the prices went downward, the forced sales created a ripple effect, causing an acceleration of the price crash.

Low supply is one of the reasons for the price crash. Only 10% of a total of 420 million has been released.

Low-float tokens tend to be very active in both directions. When early buyers decided to take profits after the rally, there was not enough demand to absorb the selling pressure.

In the short term, the risk is high.

Bearish scenario: The price might fall below $0.56, resulting in further drops.

Stabilization zone: $0.53–$0.60

Recovery attempt: It’s only possible if the price manages to recover $1.20 with strong

Long term, Project's Bitcoin DeFi and Lightning Network remains a promising story. But trust and transparency are going to be very important factors in the case of the Bitlight.

The price crash serves as a reminder that it is not wise to risk much in rapid price movements. Influx of exchange money, leverage, and small order books all added up to extremely high volatility levels, and traders must remain cautious in such situations.

Disclaimer: This article is for information purposes only and not a financial advice, crypto can be highly volatile, always do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.