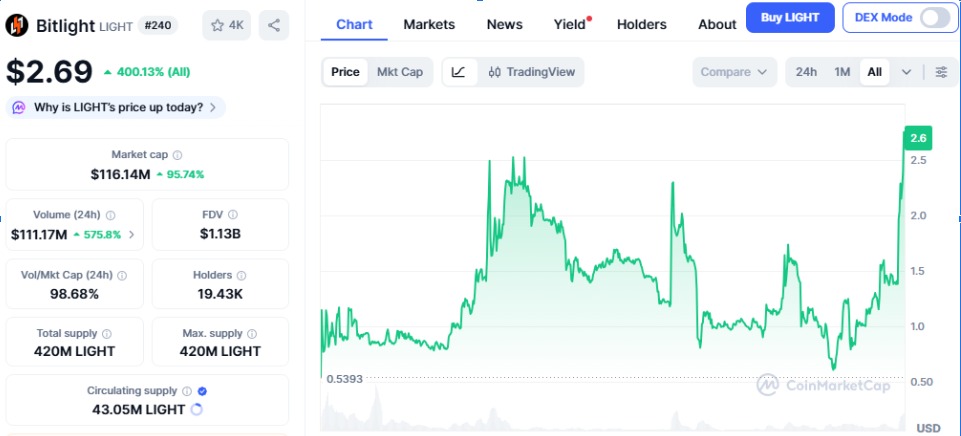

The price of the light increased by 400% as Bitlight Labs strengthened the Bitcoin DeFi narrative. Is there going to be a new price high for LIGHT based on this hot momentum? Check the full price prediction.

The ongoing development of the Lightning Network and RGB has raised the question whether BitLight can take the leading role in the Bitcoin DeFi market. Light has not only drawn attention to itself through its impressive volume upticks, but has also secured a spot in the limelight with its trading on leading exchanges and corroborated technical breakout.

Bitlight Labs is creating the main infrastructure for Bitcoin and the Lightning Network while at the same time taking part in RGB, a protocol designed to facilitate the creation of stablecoins and smart contracts on Bitcoin.

As Bitcoin-native DeFi attracts attention, projects like Light not only share the benefits of technological relevance but also get the support of speculative momentum.

Light's market liquidity has been remarkably enhanced by new listings on KuCoin, Bitget, and WEEX. The new listings activated a quick rise in trading activity, which resulted in a huge increase in volume from the previous day of almost 567% to around $110 million.

A sudden increase in trading volume, in most cases, is a signal of very high investor activity, and increased confidence—all factors contributing to the persistence of the bullish trend.

The overall Bitcoin Layer-2 narrative was given more weight when RGB and Lightning Network integration disclosures reflected in the updated whitepaper. These changes opened up the speculation about Bitcoin-native DeFi ecosystems again, thus transferring some funds towards the infrastructure-token market like Light, which benefited the most.

According to CoinMarketCap , currently it is trading around $2.69, reflecting a 400% price increase in just a day. The movement clearly indicates a change in market sentiment supported by an increase in volume and a strong technical structure.

The aggressive price increase was so strong and fast that it surely indicated aggressive buying and not just a low liquidity spike.

On the daily chart, the token has broken out of a bullish flag pattern, a continuation formation that usually leads to massive price increases, thus supporting the breakout. A decisive daily candle close above resistance now acts as a trigger for a potential 180–200% continuation rally, but only if the price stays above the breakout zone.

What is more, the volume is increasing together with the breakout which confirms real buying interest rather than speculative exhaustion.

The daily chart from Bitlight Labs indicates the breaking of the price from a long-term descending channel that limited the upside for weeks. After consolidating around the demand zone of $0.80-$1.00, increased sharply and reclaimed major trendlines, thus pushing the price towards $2.57 with the highs being close to the critical resistance level of $2.85.

This change in the market structure suggests that the reversal has taken place and not just a short-term bounce.

The momentum indicators are showing the same bullish scenario:

The RSI is at the level of 70, meaning that the bullish momentum is there but the overbought condition is not extreme yet.

The MACD has switched to a bullish signal, and the increasing histogram bars are indicating the speed of the trend getting stronger.

All these indicators are pointing out that Light still has a way to go before the momentum dies down.

The channel resistance may serve now as strong support if it manages to stay above the breakout zone. Subsequently, the upside targets are as follows:

Short-term: $2.85–$3.20

Mid-term continuation: $4.50–$5.00 (if volume and narrative remain strong)

On the contrary, holding above the key support may lead to temporary consolidation before the next higher move.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.