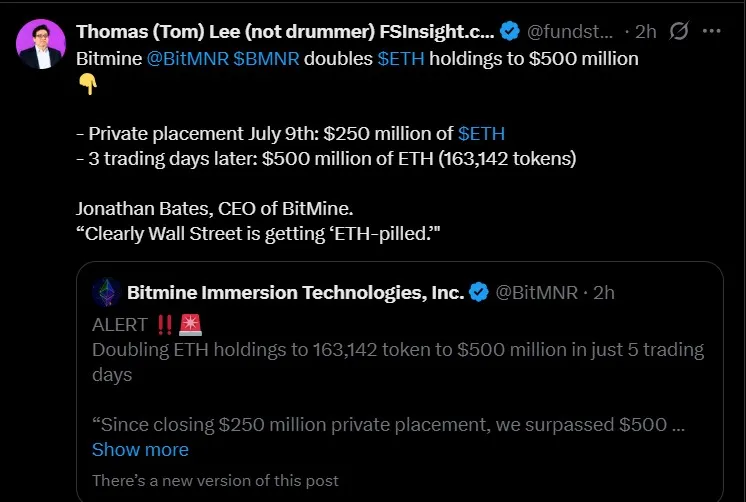

Las Vegas, July 14, 2025—Publicly listed BitMine Immersion Technologies (NYSE: BMNR) has officially announced its massive bitmine ethereum purchase of 163,142 coins, now worth over $500 million, making it one of the top ETH holders in 2025.

According to Bloomberg data, the average price paid per token was $3,072.67, and the buying spree was completed within days of a $250 million private placement on July 9th.

Source: Whale Insider X Account

This major move comes amid rising institutional interest in this cryptocurrency, helping explain why Ethereum is going up today.

The appointment of Tom Lee founder of Fundstrat, adds serious weight to the company’s crypto thesis. Lee said:

“This purchase is not just a bet — it’s a long-term commitment to network. Lee’s comments echo the bullish sentiment across today's news, where analysts have begun projecting the next big leg up — with an price target of $5K.

CEO Jonathan Bates emphasized a multi-pronged approach:

Capital markets transactions

Volatility-based purchases

Yield from staking coins

“We’re witnessing a unique market shift. The latest bitmine 500 million eth holding catapults the company into an elite club of Ethereum whale news, joining the SharpLink and the its own Foundation.

It's recent rally is being fueled by aggressive institutional purchases, reduced supply from staking, and increasing Layer-2 activity. According to whale tracking reports, the holdings have reduced circulating liquidity triggering a supply squeeze.

This growing whale accumulation explains the price surge that’s capturing headlines, with some predicting a breakout that could push coin to $5000 before the year ends.

At the time of writing, it is trading around $3,031.37, reflecting an increase of 2%. Many Crypto analysts now believe that this currency is on a trajectory to hit:

Short-term: $3,800–$4,200 (within Q3 2025)

Mid-term: $4,800–$5,000 (by Q4 2025)

Long-term: Potential $6,500+ if ETF inflows continue

The eth price prediction 2025 is heavily influenced by how many treasuries follow company's lead.

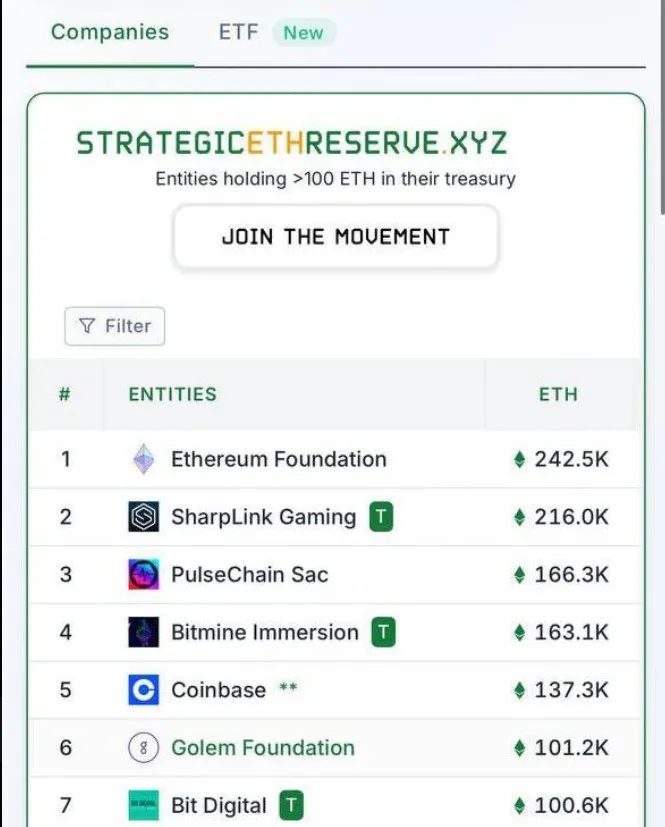

The company topped up its mega bitmine ethereum purchase, it has now reached the #4 positions among the other holders globally.

Speculation is mounting whether the firm will soon be knocking on SharpLink's door for the #2 spot - this should add further pressure to its supply and strengthen the bullish narrative.

The bitmine ethereum purchase isn't just a headline — it's a turning point in how corporations view digital assets. The currency is no longer just a smart contract platform — it’s becoming a core financial asset for Wall Street.

Tom Lee’s comparison of this token's treasuries to Bitcoin's 'sovereign put' shows that traditional finance is now converging on ETH. With continued bullish momentum, next target to $5000 looks more like a milestone than a fantasy.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.