The Ethereum price has been struggling frequently, falling sharply amid broader crypto market weakness. Yet, Tom Lee’s crypto investment firm – Bitmine Inc., is still buying Ethereum, sending a strong signal of long-term conviction despite the fact that it is facing about $5-6 billion in unrealized losses from the asset.

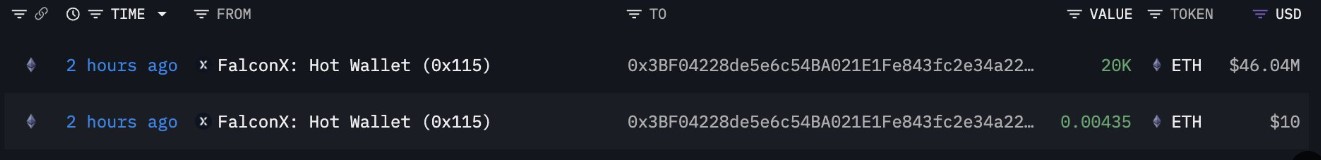

According to Arkham Intelligence, Bitmine recently purchased 20,000 ETH worth roughly $46 million through FalconX. The funds were sent to a fresh wallet that follows Bitmine’s established buying pattern.

With this purchase, the firm retained its position as the largest Ethereum holding institution. As of today, it eventually controls 3.55% of Ethereum’s total supply, or roughly 4.285 million ETH. A large portion of these holdings is already staked, generating yield while waiting for long-term price recovery.

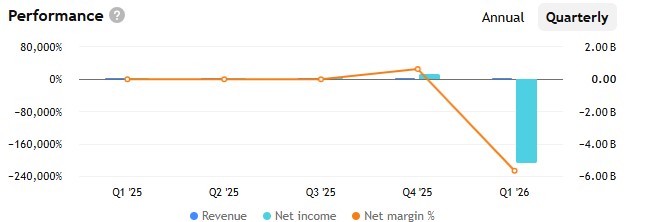

Bitmine bought ETH at an average price of around $3,650–$3,883 per coin. With current prices near $2,200, the firm is now facing $6–$6.6 billion in unrealized losses. These losses are “on paper,” but they highlight how severe the downturn has been.

Source: Trading View

These losses were once into the green area when the token hit an ATH in 2025 before falling sharply during the October 2025 crash, and is still staggering to rebound.

Source: $BMNR Stock

At the same time, the Immersion Technologies’ stocks, BMNR, are also facing downturns. On Feb 3, the stock closed at $22.35, down 1.97% (-$0.45), and fell further to $21.98 after hours (-1.66%, -$0.37), reflecting pressure linked to its ETH exposure. In long-term scenarios, the conditions is more tensed:

1 Month: -20.07%

6 Months: -46.42%

Year-To-Date: -20.18%

In response to this, CEO Tom Lee said the criticism misunderstands the Ethereum treasury model, noting that Bitmine is built to track ETH’s price over marketplace cycles, not avoid short-term swings. He added that unrealized losses during sharp market drops are normal and expected, not a flaw in the strategy.

The token is currently trading at $2,278, down 2% in 24-hour trading, extending its 23.31% weekly drop, as broader market weakness combined with specific negative catalysts weighed on prices. The asset lost more than 50% of its value from the 2025 peak era.

Source: CoinMarketCap

The weakness in the Ethereum price is largely driven by market conditions, not network failure. Key pressures include Market-wide deleveraging, Extreme fear sentiment, Bearish technical structure, and now headlines around Bitmine’s ETH-related losses giving fuels.

Despite price volatility, its fundamentals remain strong. The network consists:

More than $11.431 billion in real-world assets tokenization on the network,

ETH-ETFs market record $13.39 billion total net assets value,

Platform-based stablecoins market cap at $160 billion,

DEX activities capture $18.489B (+56.39%) in weekly data.

Developer activity, transaction growth, and upcoming upgrades continue to reinforce Ether’s role as the leading smart contract platform, supporting its long-term demand.

Ether in 2026 is clearly facing pressures, at least for now, but its long-term framework remains strong. Falling values have tested investors' confidence, yet large holders like Bitmine, BlackRock, SharpLink are backing it continuously.

For 2026, Ethereum remains a high-risk but high-conviction asset. Volatility is likely to continue, but if market conditions improve, Ether’s strong fundamentals, institutional interest, and expanding real-world use cases could support a meaningful recovery.

Disclaimer: The article is based on current market data and information from public tracking platforms. It does not constitute any claims or financial advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.