Ethereum Price Prediction 2026 chart showing bearish flag patternPrice Prediction 2026 is back in focus as ETH prints a sudden 6% green candle on trader screens.

With Bitcoin stabilizing near $78,500 and ETH recovering $2,300, attention is slowly shifting toward certain altcoins, including Hyperliquid.

On the surface, the market looks calmer, but the mood underneath still feels tense.

The Crypto Fear & Greed Index remains in the fear zone, showing that confidence has not fully returned.

Traders are watching this bounce with caution rather than excitement.

A few green candles are not enough to erase the pressure built over the past weeks.

That leaves one key question on trader screens: Is Today’s ETH Surge a Bull Trap?

With uncertainty still hanging over the market, Ethereum sudden strength feels less like relief and more like a test of trader patience.

The Dark Side of Ethereum’s Recovery: 2 Red Flags Behind Today’s Surge

The 6% surge looks impressive on the chart, but two key signals show that the market may not be out of danger yet.

1. Heavy ETF Outflows and Institutional Exit

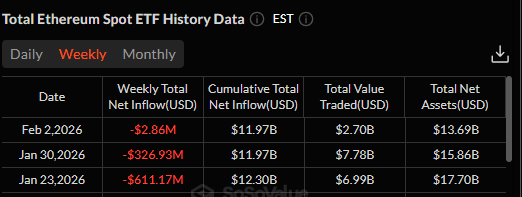

According to recent data from SoSoValue, institutional selling pressure in US spot Ethereum ETFs has not fully stopped.

On January 23, 2026, US spot Ethereum ETFs recorded an outflow of $611.17 million.

This was followed by another $326.93 million outflow on January 30, 2026.

Even in early February, pressure continued, with $2.86 million in net outflows on February 2, 2026.

Such large and repeated outflows suggest that big investors are still cautious.

When institutions reduce exposure, it usually reflects concern about short-term price stability.

2. Vitalik Buterin Recent Transfers and Market Signal

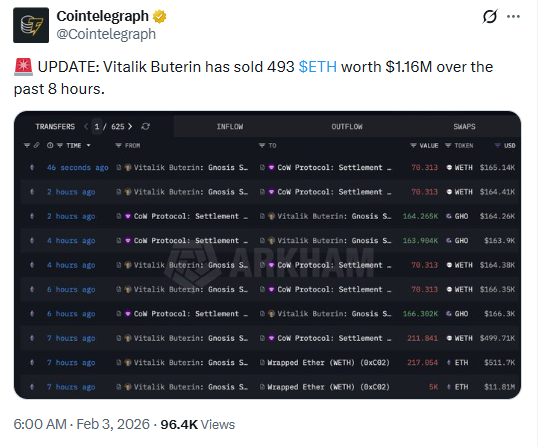

Ethereum co-founder Vitalik Buterin has added to market caution with his recent on-chain activity.

According to a recent report shared by Cointelegraph, Vitalik sold 493 ETH worth around $1.16 million over the past few hours.

In addition, wallet movements linked to him suggest that up to 5,000 ETH could be prepared for further selling.

When a project founder moves or sells tokens, retail investors often read it as a warning sign.

It does not always mean a bearish outlook, but it does raise short-term uncertainty.

ETH Price Action Signals Downside Risk

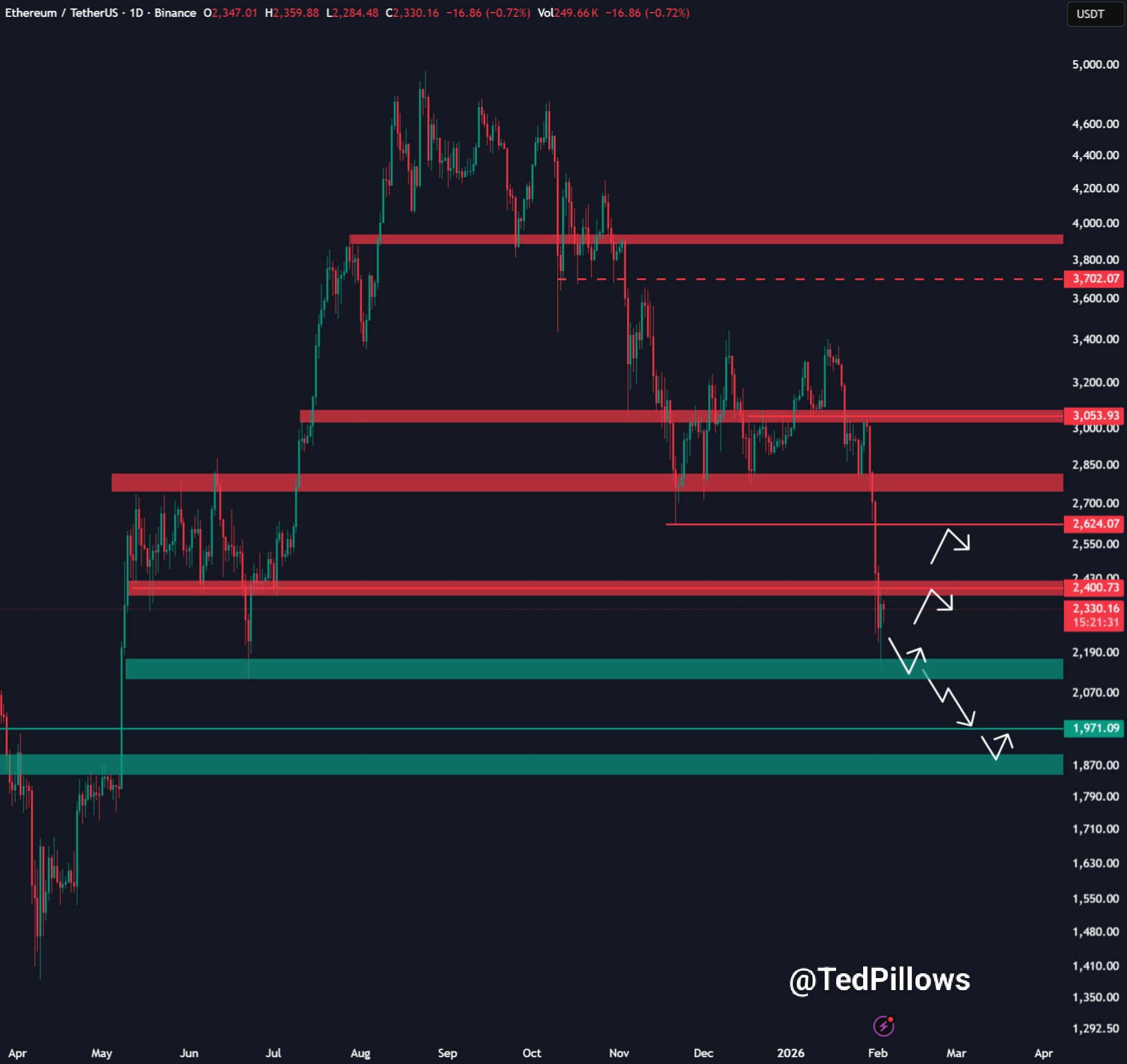

On the TradingView 1-hour chart, ETH formed a bearish flag pattern.

The price first dropped sharply, creating a strong downward move.

After that, it started moving up slowly inside a narrow rising channel, which usually signals a pause rather than a true reversal.

This bounce from the $2,160 level looks weak because volume is not expanding and price is still trading below the 50 EMA.

That shows buyers are not in full control yet.

Currently ETH has already broken below the lower side of the flag structure, opening the door for another downside move.

The $2,268 area is now the first support to watch, followed by the $2,160 zone.

According to Ted Pillows, Ethereum is still struggling near the $2,350 area, as selling by large holders is limiting any bounce.

Recent activity shows that some big wallets are reducing exposure, which is keeping momentum weak.

Price has already lost several mid-range supports and is now trading in a fragile zone.

From a structural point of view, $2,400 has become the key barrier. Until price can reclaim this level, recovery attempts remain shaky.

If buyers defend current levels, a short-term move toward $2,400 and $2,620 is possible.

However, continued selling could push altcoin back toward the $2,000 zone, turning the recent bounce into a continuation move rather than a recovery.

For now, this range is acting as a decision point for Ethereum.

The current move fits into a cautious Ethereum Price Prediction 2026 outlook rather than a clear bullish reversal.

ETH is rising mainly on short-term relief and market positioning, while deeper signals still point to hesitation.

ETF outflows, founder-linked transfers, and weak technical structure suggest that confidence has not fully returned.

From a broader perspective, Ethereum is trying to stabilize, but it has not yet reclaimed strong trend levels.

If institutional flows remain negative and key supports continue to be tested, upside momentum may struggle to be sustained.

For 2026, ETH still carries long-term relevance due to its network dominance, but near-term behavior shows that the market is not ready to price in a full recovery yet.

Until demand strengthens and key resistance zones are reclaimed, this rally looks more like a reaction move than the start of a new trend.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.