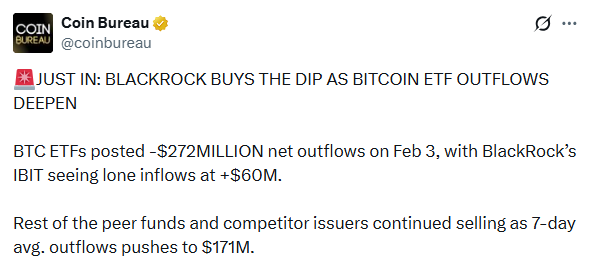

The crypto market saw a Massive split in how people invested on February 3, 2026. Most funds were losing money. However, a huge BlackRock Bitcoin ETF inflow of $60 million went into the IBIT fund. This was very different from the rest of the market. Overall, Bitcoin spot ETFs saw $272 million leave the industry on that same day. This shows that while many investors were scared, the world’s largest money manager was busy buying more.

Source: X(formerly Twitter)

Experts say this BlackRock BTC ETF inflow happened because big institutions like to buy when prices are low. While smaller investors sold their BTC, BlackRock took the chance to grow its holdings. The total market has seen an average of $171 million leave every day for the last week. In this sea of red, BlackRock’s IBIT was the only fund that grew. This suggests that large banks and big firms still trust BTC for the long term.

Bitcoin prices recently dropped to around $74,000. Many people called this a "fire sale". The ETF inflow of $60 million shows that big players think this is a good price to buy. Jack Kong, the head of Nano Labs, says this kind of buying changes the market. It shows that "smart capital" is not afraid of short-term price drops. Instead, they are looking at where the price will be in the coming years.

The iShares Bitcoin Trust (IBIT) is now a giant in the crypto world. By early 2026, it held over 800,000 BTC. That is nearly 4% of all the Bitcoin that will ever exist. This latest ETF inflow is part of a bigger plan.

Even when other funds like Fidelity or Grayscale lose money, BlackRock stays strong. Most ETF buyers are currently "underwater", meaning their Bitcoin is worth less than what they paid. But the firm's clients seem happy to wait for the next Massive jump.

Why did $272 million leave other funds? Many traders were closing "arbitrage" deals. These are quick trades used to make small profits from price gaps. When these gaps close, the Capital leaves the market. But the institutional inflows is different. It comes from people who want to hold BTC for a long time. They aren't trying to make a quick buck. They are building a "digital gold" reserve for the future.

The market is moving into a new phase. We are seeing BTC move from small sites to big, regulated funds. In the first half of 2026, the institutional inflows will be a key signal to watch. When the firm buys, it often sets a "floor" for the price. This means the price might not drop much lower. While retail investors are still nervous, big institutions are making BTC a core part of their plans. We expect more big firms to join the firm soon, which could push prices back up toward $130,000.

Your Money Your Life (YMYL) Disclaimer: Bitcoin is a risky investment. You can lose all your money. Prices can change very fast. Please talk to a professional advisor before you invest. Only use money that you can afford to lose.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.