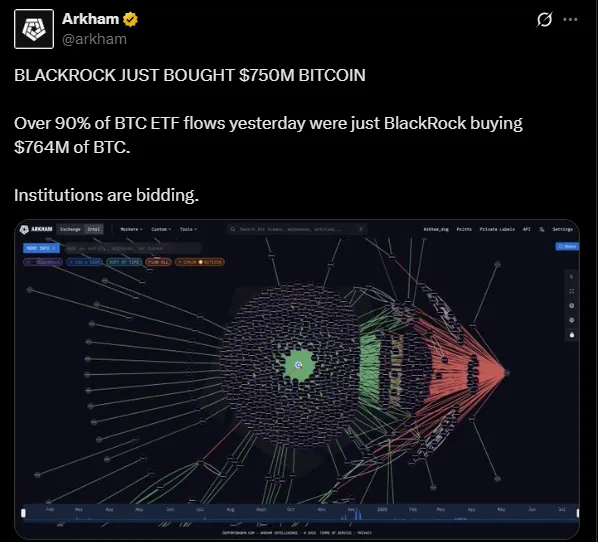

BlackRock Buys Additional $750 Million in Bitcoin

In the latest news, BlackRock Bitcoin purchase surged to $750 million, just a day after accumulating $416 million worth of BTC, indicating a strong commitment towards the currency, despite market turmoil. This raises BlackRock Bitcoin holdings to more than $86.2 billion (727,359.3 BTC under its IBIT as of July 17, 2025), 3.6% of supply in circulation, positioning as a dominant player in the crypto space.

Source: X

Company is making a strong statement with its two-pronged strategy, underlining long-term belief in Golden asset as a dependable store of value based on structural shifts in the market.

Meanwhile, BlackRock Bitcoin ETF saw a whopping $764 million in inflows in a week, showcasing its contribution to virtual asset growth. As of July 17, the total ETF inflow was $522.60M in which IBIT solely represented over 90% of all BTC ETF activity with a hold of $497.30M. This influx underscores increasing Institutional belief.

Source: Sosovalue

In the first half of July, 2025, BlackRock Bitcoin on-chain portfolio grew from $79.55 billion to more than $91 billion, an increase of +$12 billion. The firm’s aggressive amassing strategy shows its intent to leverage on foreseen long-term returns.

The largest Asset manager is not limited to the Golden asset, but it is also exploring other Digital stores of value. The treasury reserves of the company holds 2.143M ETH of $7.81B value as per current price, along with this surging groundbreaker reserves accumulates IMAGE (~784.2K) MOG (~ $784.2k), SPX (~ $153.12k), and more shows diversified holdings making it a bit giant of more than $94B market cap.

Source: Arkham

By combining direct asset gathering with groundbreaking ETF inflows, the firm is signaling long-term certainty in future. This framework not only empowers its own position but also paves the way for broader institutional adoption. Along with it other major players, such as MicroStrategy (holding 601,550 BTC), MARA (around 50,000 BTC), and Metaplanet (with 16,352 BTC), have also made significant investments in B-coin and leads.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.