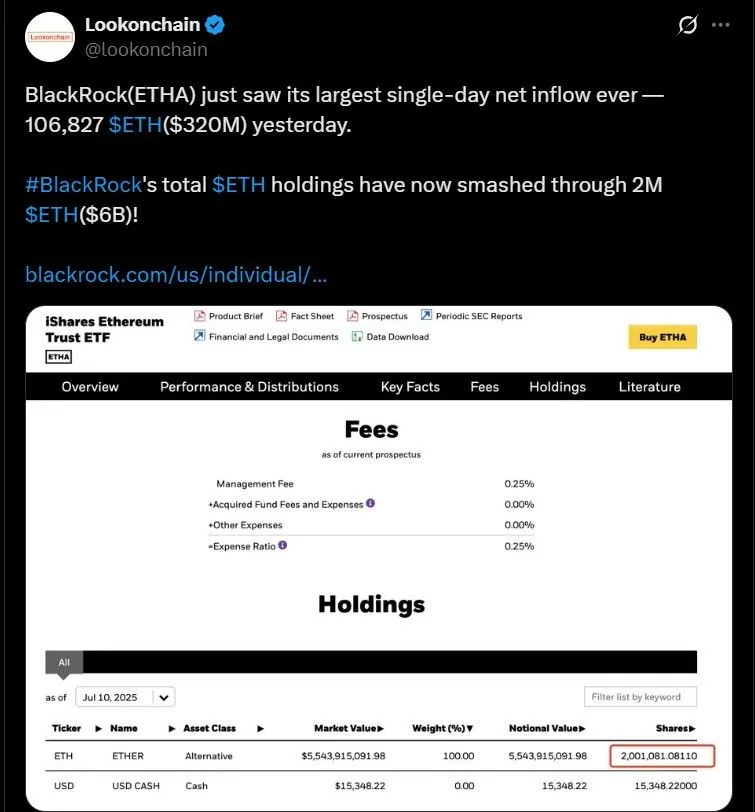

BlackRock didn’t just make headlines today — they made history. BlackRock’s Ethereum ETF, known as ETHA, recorded a jaw-dropping single-day net inflow of 106,827 coins, on July 10, worth around $320 million according to Lookonchain data.

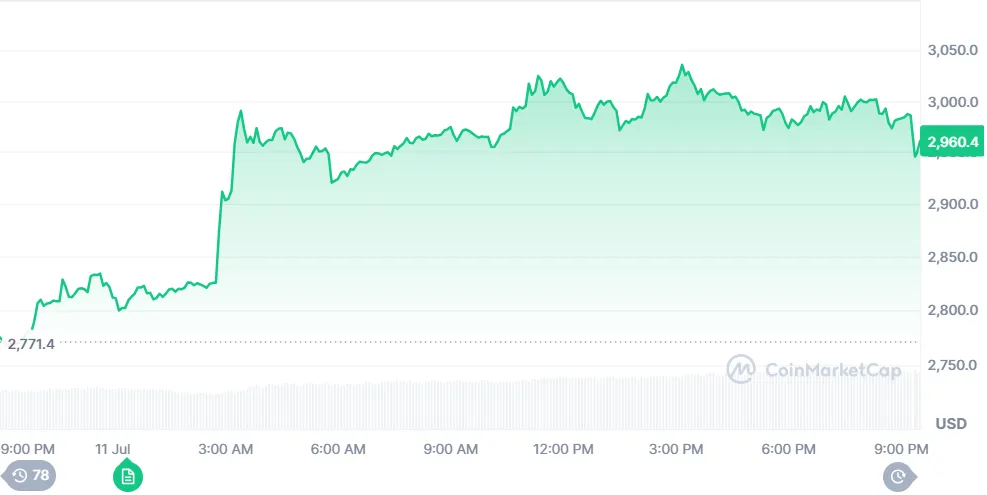

This is the biggest ETH buy day we’ve ever seen from any institutional player. The inflow came at a critical time, as the token was already showing signs of strength near the $2,800 mark. And just like that it has roared to nearly $3,000 within hours of the inflow.

With this latest move, BlackRock total Ethereum holdings have officially crossed 2 million coins, valued at more than $6 billion.

Wall Street’s most powerful institution now holds more tokens than most exchanges—and this isn’t a fluke. This is strategic, long-term, and deliberate.

The company clearly sees what many retail investors have missed: This token isn’t just digital money — it’s digital infrastructure. From powering DeFi to NFTs and Layer-2 ecosystems, it is at the center of everything Web3.

At the time of writing, it is standing around $2,982.08, reflecting a increase of 7.6% jump, backed by a 48% spike in trading volume. The market cap now stands at $359.98 billion, with over $44 billion in 24-hour volume as per CoinMarketCap.

So, where do the prices go from here?

All eyes are now on the $3,050 resistance zone. If it can break and hold above that level, we could see a clean move toward $4 and beyond. But if it fails? A pullback to $2,360 is possible before the next leg up.

The firm isn’t gambling, they’re simply positioning. This move is part of a bigger institutional shift toward this cryptocurrency. With ETFs gaining traction globally, Layer-2 chains like Arbitrum and Optimism booming, and ETH 2.0 quietly locking up millions in staking, the coin is now evolving into a must-have asset. This is Ethereum institutional investment at full throttle. And let’s be clear: when BlackRock buys ETH, it’s not a trade — it’s a statement.

Short Term: It needs to hold above $2,950 and break $3,050. If that happens, $3,300 is next.

Mid Term (2–3 months): Targeting $3,800 as ETF interest builds and L2 adoption grows.

Long Term (End of 2025): With this high prcie surge and global liquidity cycles aligning, it could push to $5,000–$6,500.

This BlackRock Ethereum inflow isn’t just a record — it’s a roadmap. With 2 million coins in their vault, the firm is betting big on the future of digital assets like this. The rest of the market? It’s starting to wake up. The breakout is brewing. $3,050 is the key. After that, don’t be surprised if $4,000 comes quicker than anyone expects.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

2 months ago

good