Ethereum Institutional Investment is increasing as Bit Digital raises $162.9 million to purchase more token. In keeping with the trend of publicly traded companies amassing $ETH for their treasuries, Bit Digital raises $162.9M to purchase ETHTokens. The company issued 86.25 million shares in total, and after subtracting fees and expected offering expenditures, net proceeds came to $162.9 million. Bit Digital confirmed that it will purchase ETHtokens with the funds.

Since 2022, Bit Digital, which is listed on the Nasdaq with the symbol BTBT, has been developing its Investment strategy. Today, the business operates one of the biggest publicly traded token staking systems. Its platform has yield tools for L1 coin staking, custody services, and validator infrastructure.

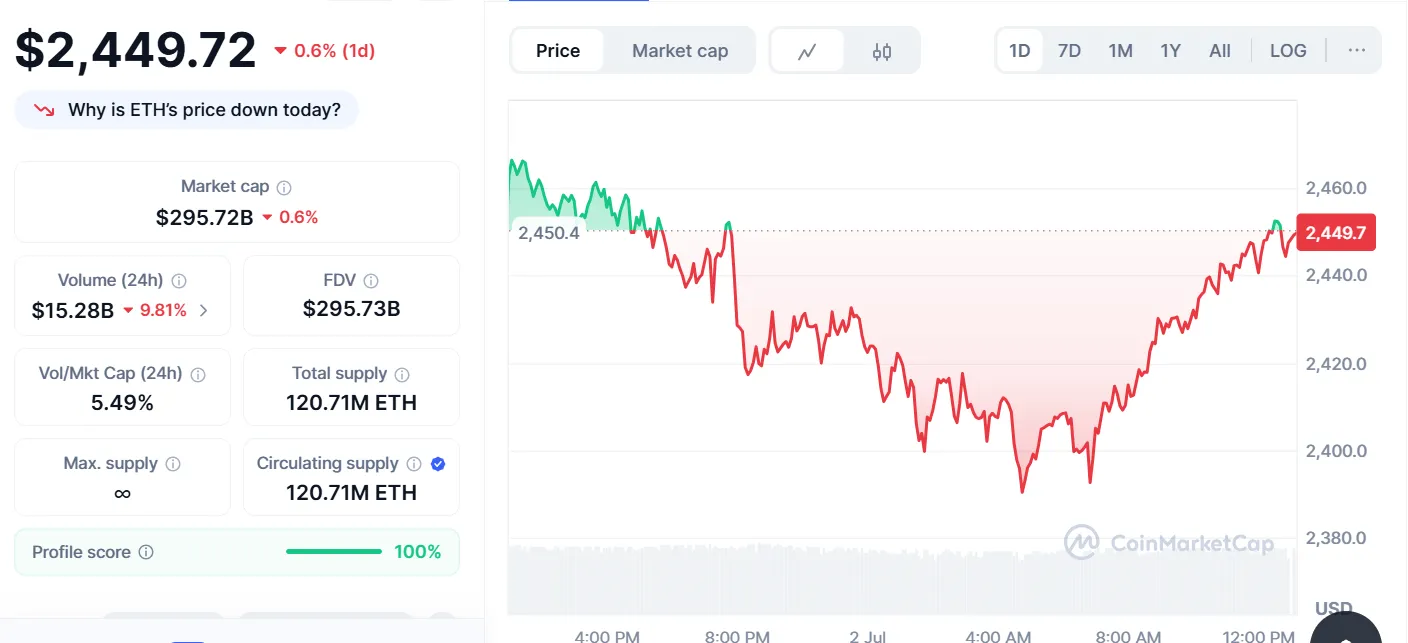

Source Coinmarketcap

The token price today is $2,445.03 USD with a 24-hour trading volume of $16,212,942,499 USD with a downfall of 0.85%. During a larger selloff in the cryptocurrency market, Ether's price fell. Over the last day, the whole market capitalization fell 4.1%, mostly due to a resurgence of political unrest in the United States. 501 ETH (about $1.22 million) was sold by a Genesis ICO participant on July 2, continuing a multi-year profit-taking trend that has taken 14,895 ETH out of circulation since 2021. This comes after Grayscale approved a $11 billion ETH on July 1. This approval initially raised sentiment, but because of coin's 33.87% 60-day rise prior to the event, it caused "sell-the-news" behavior.

Amid this uncertainty, a growing list of companies are buying this L1 token as a strategic reserve asset results in Ethereum Institutional Investment surge. SharpLink Gaming acquired an additional 9,468 ETH, worth $22.8 million, between June 23 and June 27, strengthening its position as the world's largest publicly traded holder of token. The company is embedding it at the center of its balance sheet as part of a broader push to align with the digital economy. BitMine disclosed a $250 million private placement to fund an Ethereum institutional investment treasury strategy, with major backers such as Pantera, Founders Fund, Galaxy Digital, Kraken, and DCG. Tom Lee Says Ethereum Could Be The Next Bitcoin

Even if ETH price action is still under pressure, these developments collectively show a larger change in institutions perspectives toward it's role in treasury management. Bitcoin's dominance pressure, delayed ETF tailwinds, and early holders' profit-taking all contributed to decline. The new crypto ETF regulations from the SEC may make future approvals easier.

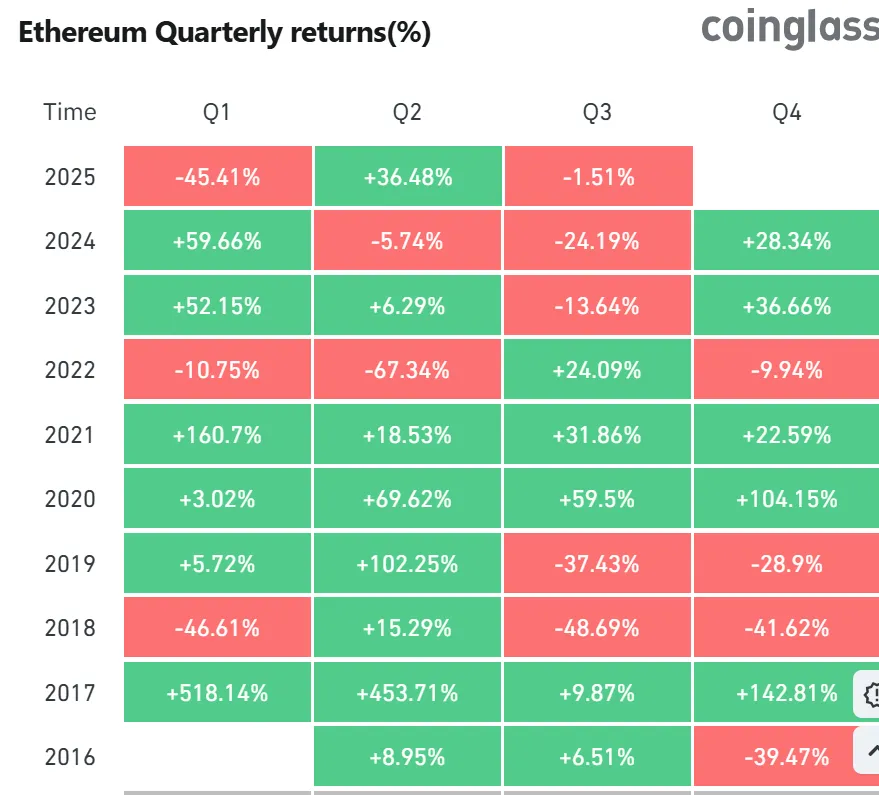

Source Coinglass

With a strong 36.48% gain at the end of the second quarter of 2025, demonstrated a notable rebound from earlier market swings. This performance demonstrates Ether's tenacity and rising investor trust as it remains a top platform for smart contracts and decentralized apps. Market players are closely watching to see if token can continue its upward trend as the third quarter gets underway. In the upcoming months, It's performance will be greatly influenced by a number of factors, including network upgrades, legislative changes, and general market trends.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.

3 months ago

Good Sharing