A shifting economic outlook, new regulatory updates, and heavy Bitcoin movements dominated crypto news for today as investors monitored the changing landscape across the digital asset market.

Coin Bureau shared remarks from White House adviser Kevin Hassett, who suggested the Federal Reserve may cut interest rates as soon as next week. This update became central to today’s crypto news because rate adjustments often guide liquidity trends that traders watch closely.

His comments arrived during ongoing discussions about easing financial conditions, which placed more attention on how the central bank may adjust its approach in the near term. Another development surfaced when Coin Bureau reported that the CFTC completed a new framework aimed at helping the United States regain leadership in the global crypto sector.

This update remained part of today’s crypto news, as regulatory clarity continues to influence how institutions navigate digital assets. The plan suggested that further steps may follow as the agency advances its approach.

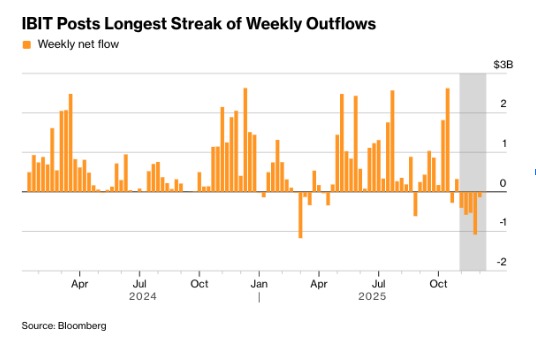

A growing wave of outflows from BlackRock’s iShares BTC Trust has prompted closer analysis as investors search for clues in shifting institutional trends. BlackRock’s iShares BTC Trust saw its longest weekly period of outflows since launching the trust in January 2024. In total, over $2.7 billion left the fund.

There continues to be significant interest in the current developments in terms of inflows and outflows from institutional funds, and many traders are closely observing these outflow patterns in an attempt to discern potential trends among institutions based on their flows.

The current outflows reported by the iShares BTC Trust occurred during a week where there have been significant changes in economic conditions as well as general bearish sentiment among markets.

Source X

In addition, Whale Alert reported on another major transaction involving the transfer of 1,999 BTC worth over $182 million from Binance to an unknown wallet. As a result of the considerable amount of Bitcoin being transferred, traders had a great deal of interest in the transaction, as it is suspected that this transaction represents a movement made by a large market participant, and has certainly helped fuel the Bitcoin market’s continued monitoring of large transfers.

SpaceX reportedly transferred $ 100 million/ 1083 BTC to possibly Coinbase Prime for custody, as reported by a well-known crypto analyst, Lookonchain, and it continued the trend of large bitcoin transactions that they have been making lately.

At the same time, analyst 0xNobler reported that there was over $ 125 billion added to the financial system in the last week. This information also prompted discussions regarding the liquidity in the market, as well as what is being done by Central Banks and institutions regarding policies about their respective currencies.

All of this information put together has created a picture of the big trends regarding major bitcoin transactions through policy, institutional flow, and large-scale transactions that occurred during this week in the crypto world.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.