As the FED Rate Cut Meeting wraps up today, whale Bobe2 has made a massive $2.4 million bet that the it won’t cut interest rates. His bold move on Polymarket is turning heads in the financial world and has everyone wondering—does he know something others don’t? Will the Federal reserve confirm Bobe2’s bold call—or surprise the market?

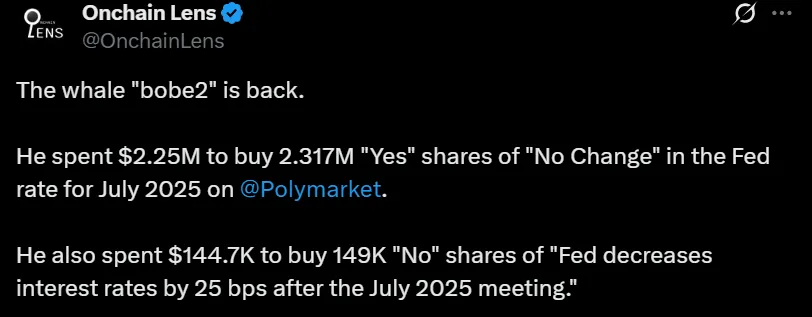

Source: Onchain Lens X Account

Market whale has placed over $2.4 million in bets that the U.S. will not cut interest costs in its meeting scheduled today.

Using the Polymarket no fed rate cut July prediction platform, he bought 2.317 million “Yes” shares on “No Change” in rates at 97¢ per share, amounting to $2.25M.

He also purchased nearly 149K “No” shares on a 25 bps rate cut prediction, spending an additional $144.7K.

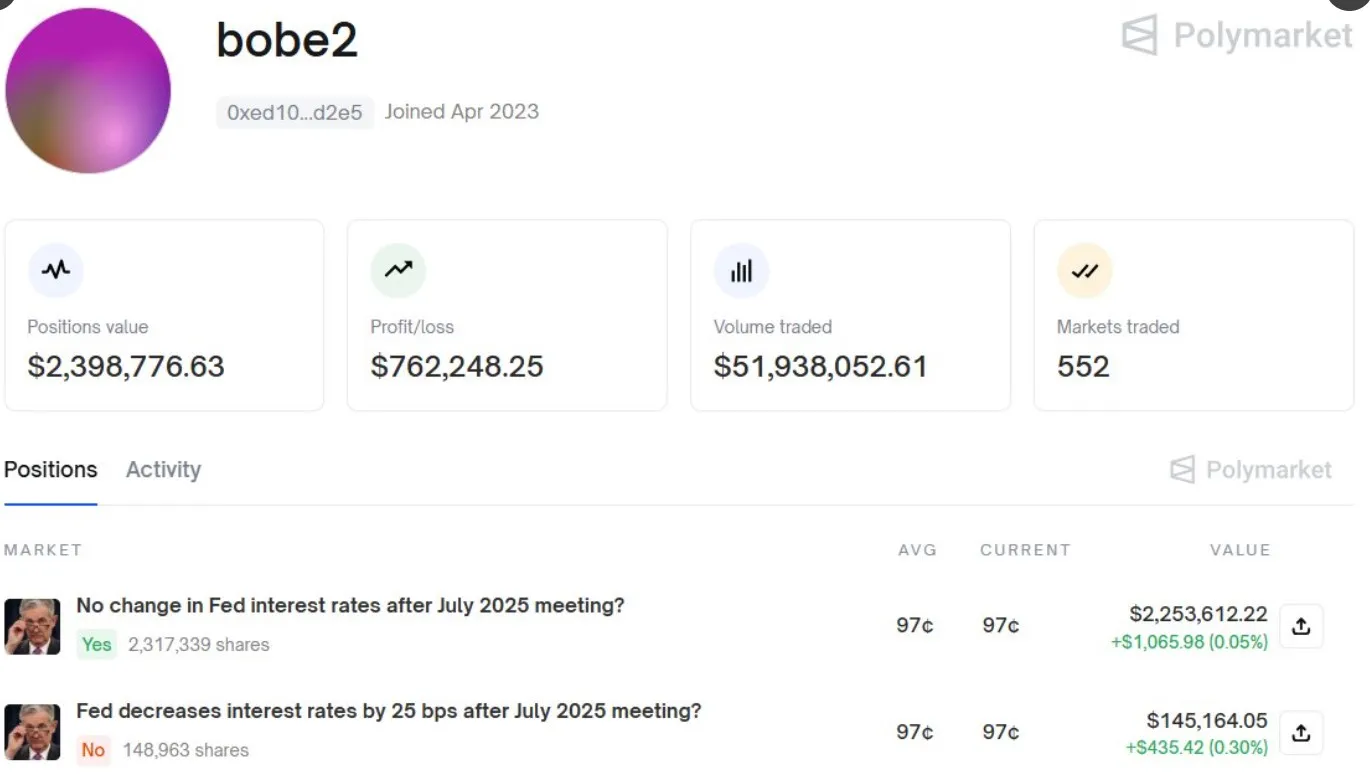

Source: PolyMarket

The whale’s strategy indicates strong conviction that there will be no change in monetary policy tonight, regardless of growing political chatter and economic pressure.

Kalshi, another prediction market following the FED Rate Cut Meeting, is backing Bobe2’s view. Right now, 95% of traders on the platform believe that they will keep rates steady in tonight’s decision.

Economic indicators further support this bet:

Inflation remains sticky, with core PCE still above target.

Unemployment is steady, not triggering urgent easing.

While political voices like Donald Trump hint at a Jerome Powell exit or shift, smart money is signaling steady rates over speculation.

The two-day meeting concludes today, July 30, with markets awaiting clear guidance. While many expect the federal reserve to hold rates steady, investors are closely watching the policy statement and Powell’s speech for clues about a September or November rate reduction. This week’s gathering could set the tone for the rest of 2025 movements.

If he is right and the they holds rates:

Short-term volatility may ease in the crypto market , as currently it is down around 1%, standing at $3.86T.

Stocks and crypto could rebound like Bitcoin, especially after last week’s pullback.

Confidence in Polymarket forecasting tools may strengthen.

However, if the White House unexpectedly slash rates today:

Bobe2’s $2.4M bet may collapse in value.

Risk-on assets may soar, led by small caps and high-beta tokens.

A surprise deduction could raise fresh worries about inflation in the bond market. No matter what happens, the outcome of this rate cut meeting will impact everything from stocks and crypto to commodities, making it one of the most closely followed Fed meeting decisions of 2025.

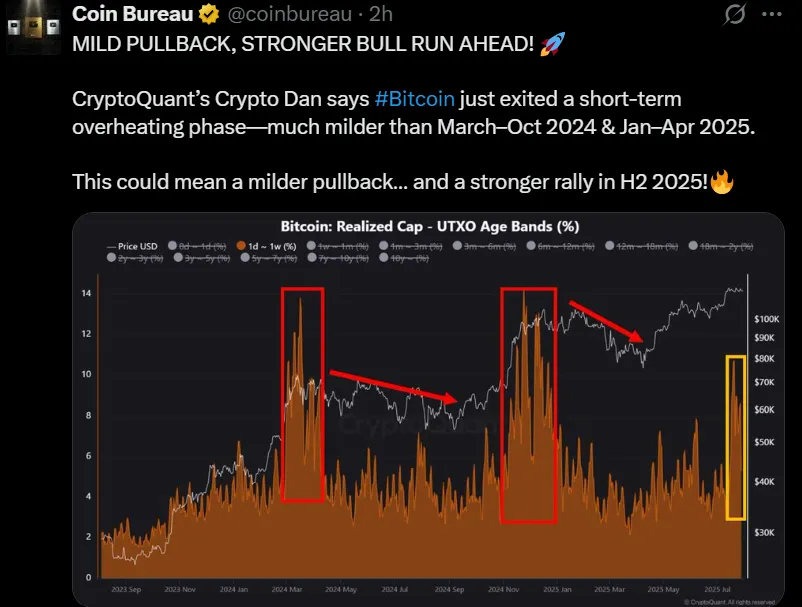

With crypto market cap now at $3.86T and daily volume dropping over 10%, broader sentiment is cautious. Yet voices like CryptoQuant’s Dan believe Bitcoin’s current phase is a mild cool-down, not a crash.

If Bobe2’s Polymarket prediction for the July 2025 FED Rate Cut Meeting is right, it could show just how accurate these prediction markets can be—and that he made a smart move at the right time.

But if it does something unexpected, like cutting rates, then this whale might lose millions. Right now, everyone’s waiting to see whether Jerome Powell sticks to the script or surprises the markets.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.