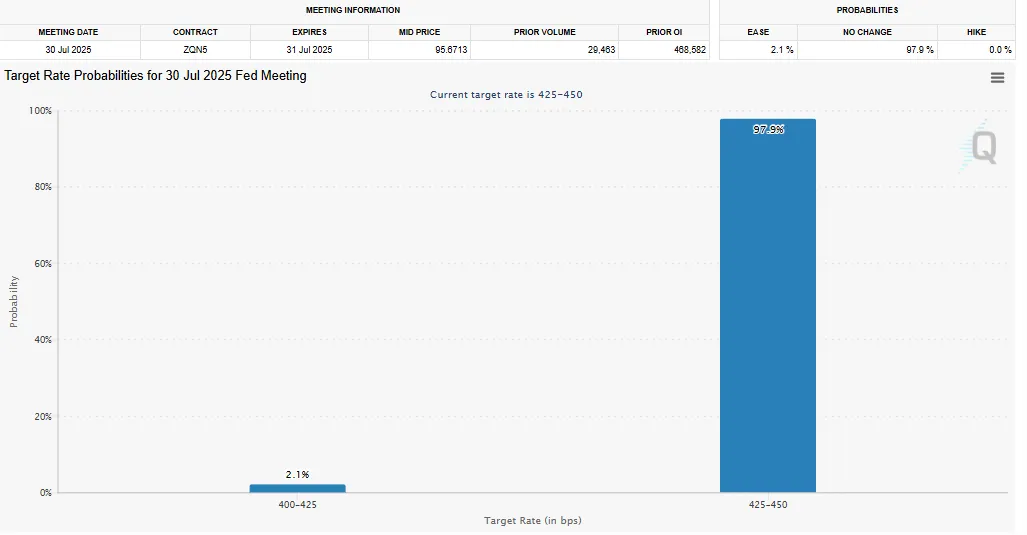

98% Chance Rates Stay Unchanged, Markets Brace for Upcoming Verdict

In a critical update, the Federal Reserve is strongly expected to keep interest rates steady at the July 30 FOMC meeting, with CME FedWatch placing chances Fed rate cut at just 2%. This move comes despite elevated pressure from President Donald Trump to reserve rates in the face of cooling inflation and global tariff uncertainty.

Source: FedWatch Tool

Trump’s aggressive push to cut borrowing costs, aimed at accelerating the economy ahead of the 2026 election, has put Fed chair Jerome Powell in the political fire line. However, Powell remains firm. Market analysts from Nomura note that “data has remained robust,” especially around GDP and labor market, giving the central bank little reason to act prematurely.

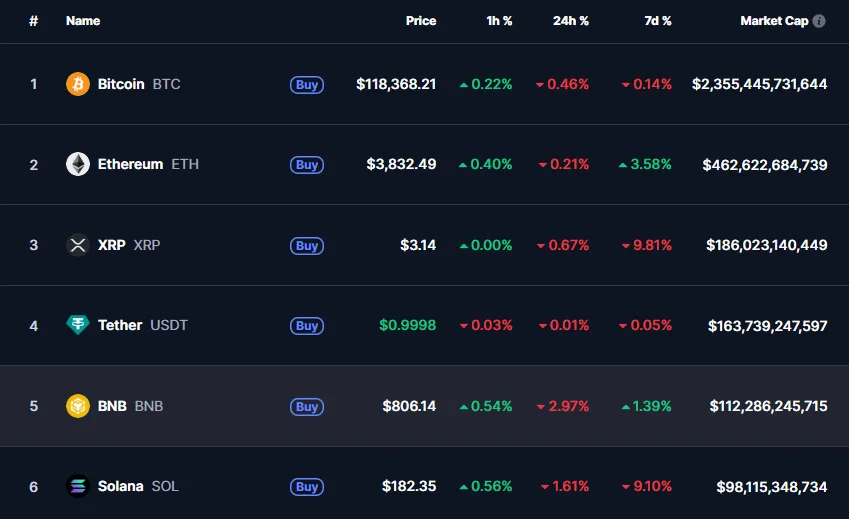

Ahead of the Fed rate cut decision, the cryptocurrency market is showing signs of short term caution. As of Wednesday morning, Bitcoin is trading at $118,368, down 0.46% over the past 24 hours. Meanwhile, Ethereum, although up 3.58% over the past week, has dipped 0.21% around the clock to $3,832.49, signaling short term hesitation.

Source: CoinMarketCap

This modest downturn is not indicative of panic but rather a cautious refinement, an increasingly common pattern as crypto matures with a broader economy.

Crypto markets are extremely sensitive to the orhanisation's policy. When interest rates are high, big investors don’t prefer investing in risky assets like crypto, highlighting the reason why institutions are staying out for now. But if the Fed rate cut happened, it might give spark to new money to flow into digital assets, pushing prices up across the market.

But Powell is signalling caution, particularly with resurgence inflation due to Trump’s tariff expansion.

The Central Instution's tough perspective sounds like its previous approach of 2022-23, COVID aftermyth. It was slow to raise interest charge, and that didn’t stop inflation. As a result, stock and crypto markets became very inconsistent. Bitcoin even dropped below $20,000 in mid 2022. Although it gains heights again in 2023.

With ETH ETFs approved and corporate treasuries holding significant BTC reserves, the next move could redefine capital flows in Web3 finance.

A Fed rate cut is unlikely, at least for now, but markets put the probability at 64% that it may occur in September, particularly if the economy begins to weaken. Experts predict GDP growth in the second quarter to decline to 1.8%, from 2.8% a year ago.

Jerome Powell's move today may be a turning point for financial policy and crypto's ripple effects. For the time being, digital markets hold steady, but with fiscal and trade uncertainty looming in the shadows, the central reserve's next actions will be what decides the moods of both Wall Street and Web3 in the third quarter.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.