Wall Street just saw something no one expected so soon. A $1.15 billion initial public offering did not go through banks or wires—it settled fully in digital coins. The company behind this bold step is Bullish (NYSE: BLSH).

By using blockchain money instead of cash, Bullish IPO Stablecoin has linked the process with a new on-chain economy. This moment is being called the start of a different chapter for finance.

On August 14, 2025, this company became the first firm in the United States to complete an IPO with settlement in tokens like USDC, EURC, PYUSD, RLUSD, and USDG. Instead of dollars in a bank, digital equivalents powered the deal.

This is being called the first stablecoin IPO USA, a move that could transform how capital markets raise funds. It is not just Bullish IPO news today—it is a sign of how stocks and blockchain are starting to merge.

How did this actually happen?

Solana handled most of the minting, showing its ability to move money at high speed.

Jefferies, acting as billing and delivery agent, managed conversion and flow of funds.

Coinbase became the pubic offering custodian, holding the raised amount in USDC and EURC.

Coinbase exchange confirmed this in its X post: “Stablecoins are just better. Faster, cheaper, and more global, proven yet again by this crypto exchange company.”

This simple statement explains why traditional rails may soon be challenged. This cooperation brought together multiple players—Paxos, Ripple, Societe Generale-FORGE, and others—making the Bullish NYSE BLSH listing a global digital finance milestone.

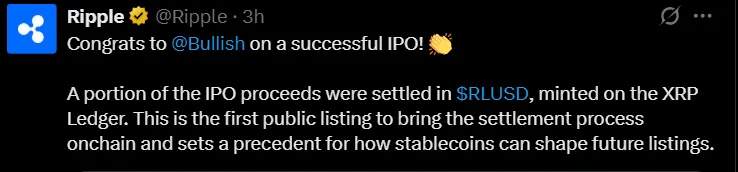

Ripple also celebrated the event. A part of the proceeds was paid in Ripple RLUSD IPO settlement, its token launched on the XRP Ledger.

Ripple’s official X post called this a historic step for capital markets. By showing that company’s RLUSD pegged currency, USDC, and EURC could all be used in one deal, the market saw a multi-chain future in action.

Stable assets are no longer tied to one network—Solana stablecoin settlement and XRP Ledger tokens both played a role. This adds weight to the top analysts' belief that more issuers will soon launch their own trusted coins for such events.

The Bullish IPO Stablecoin moment is bigger than one listing. It proves that digital assets can handle billion-dollar operations.

Why is this powerful?

Speed: Unlike wires, coins settle instantly.

Lower fees: Transactions cost less than old banking methods.

Global use: Investors from multiple regions can join without cross-border pain.

Crypto Exhcange Comapny CFO David Bonanno explained:

“We view stablecoins as one of the most transformative and widespread use cases for digital assets.”

For many, this was more than Bullish stock news . It was proof that Wall Street blockchain intial public offering events are no longer a dream. If others follow, the next decade of public listings could look very different.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.