Bitcoin Price Prediction takes a serious turn when the price does not just fall but loses trust.

Bitcoin has done what many big traders were afraid of—it broke a support level that had been holding for months.

For bulls, this was the last line of hope.

This move was not just technical. When liquidity dries up, confidence drops with it.

Today’s BTC bloodbath feels more like a warning than a normal dip. The kind that usually shows up when the market is already weak inside.

If we look at past cycles, similar moments came before deeper pain.

Slow price action, a clean breakdown, then silence. BTC seems to be standing at that point again.

Now the question is simple and uncomfortable—is the 72% crash scenario back in the Bitcoin price prediction?

Because when BTC lets go of strong support, it often keeps moving until weak hands are fully pushed out and balance returns.

This BTC drop is not driven by fear alone. It is coming from big money stepping out.

As per the on-chain data shared by CryptoNobler, whales and institutions are selling aggressively ahead of major macro events.

One whale wallet, bc1pyd, sold 5,076 BTC worth $384 million, booking a $118 million loss. That kind of move is about cutting risk, not panic.

At the same time, BlackRock reportedly sold heavily around 15,258 BTC, and others followed fast.

Binance sold 9,367 BTC

Coinbase sold 9,489 BTC

Wintermute sold 8,765 BTC

In just minutes, over $3.5 billion worth of coins flooded the market. Even the Royal Government of Bhutan sold another 184 BTC.

When liquidity disappears this fast, price does not wait.

This selling pressure explains why BTC is breaking support instead of bouncing.

As per data shared by AshCrypto, Michael Saylor’s strategy is now facing nearly $2 billion in unrealized losses.

This is not forced selling, but it does highlight how long this drawdown has stretched.

When even the most conviction-driven holders start absorbing deep paper losses, the mood quietly changes. Confidence does not break loudly; it fades.

On the TradingView daily chart, price is moving inside a falling channel and has broken below its 2025 low, holding under that level.

This keeps sellers firmly in control.

Based on the channel structure, the next downside level comes near $66,980. If price tries to move up, $74,647 is likely to act as strong resistance.

The 9 and 21 EMA bearish crossover is adding downside pressure.

Until a bullish crossover appears, short-term bounces are often treated by the market as sell-on-rise moves, not as signs of a trend reversal.

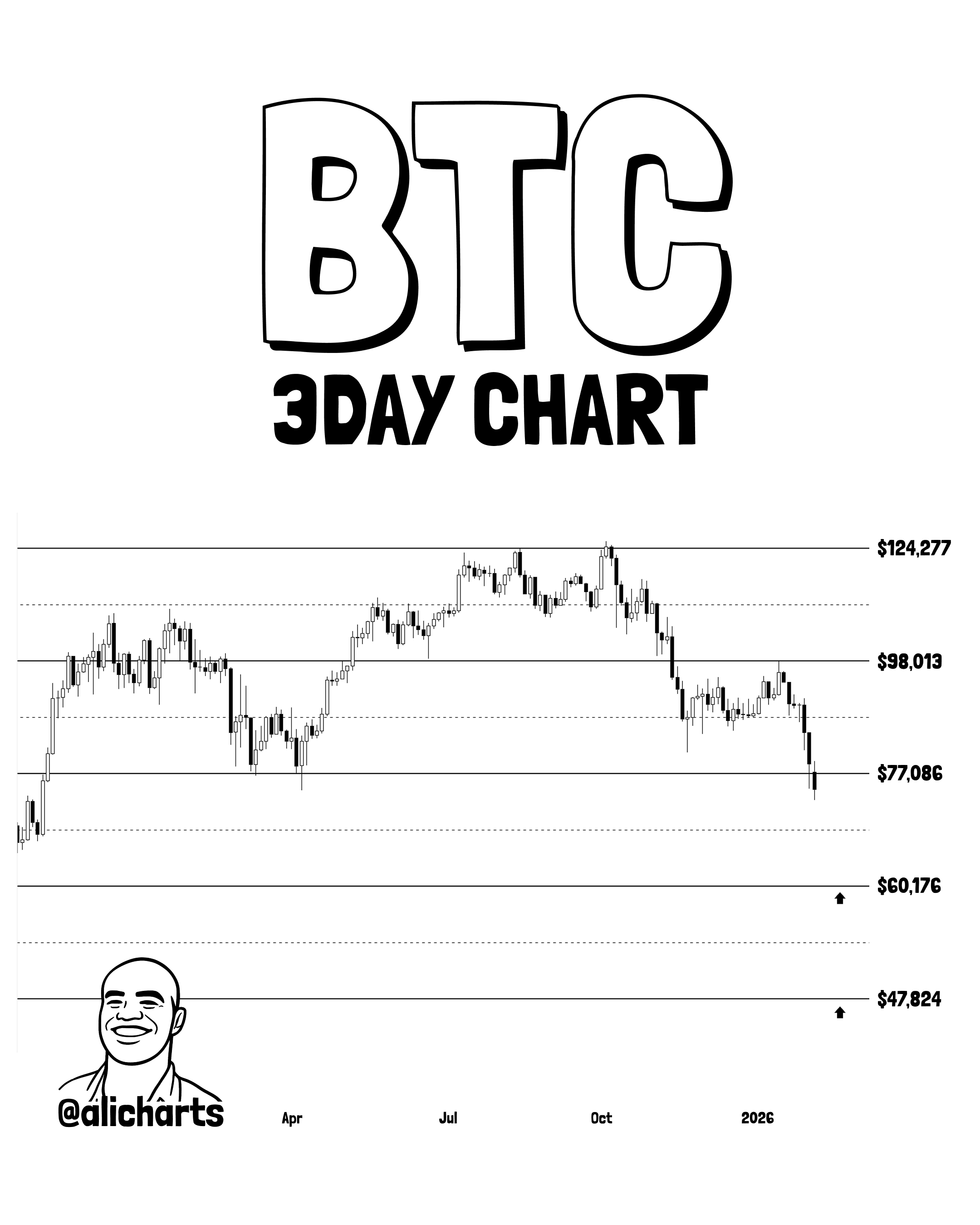

As per crypto analyst Ali Martinez, the 3-day chart shows increased downside risk below $77,086.

With the price trading around $71,000, the next key levels to watch come near $60,176, followed by $47,824.

These zones mark historical areas where price previously slowed down or found temporary stability.

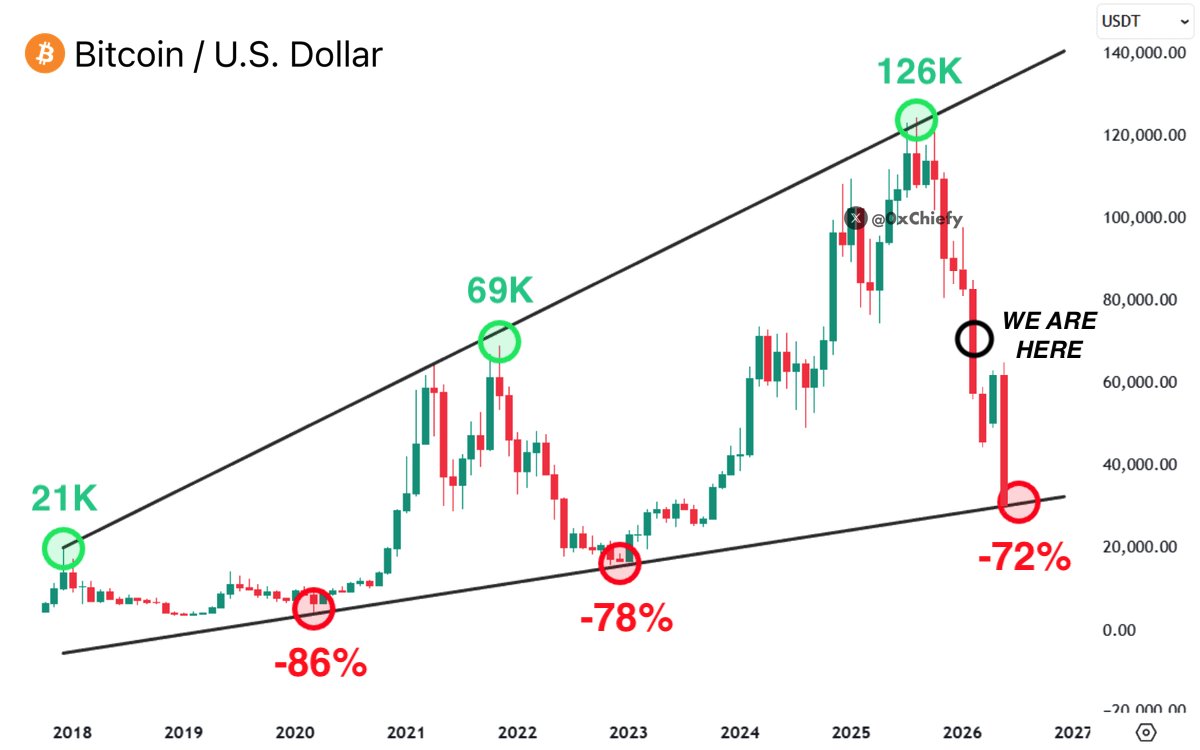

According to crypto analyst 0xChiefy, BTC may still be only halfway through a bull trap phase.

The chart compares previous market cycles where Bitcoin corrected between 78% and 86% before reaching a final bottom.

If the same pattern remains in play, downside risk could extend further, with projections pointing toward the $35,000 level around February.

From this perspective, the broader bear phase may not have fully started yet, and recent bounces could still be part of a larger distribution phase rather than a recovery.

Analysts see the current Bitcoin price prediction phase as a risk-off environment, not panic.

Heavy whale selling, institutional exits, and long-term holders sitting on large unrealized losses suggest confidence is thinning rather than breaking.

With key supports broken and historical cycle patterns still active, BTC Price Prediction remains exposed to further downside until liquidity and structure improve.

However, these views are based on current market conditions and historical patterns, not certainties, as crypto markets can change quickly.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.