Once again, Pudgy Penguins created history. Pudgy Penguins join the realm of institutional finance with the CBOE's historic filing to list the Canary PENGU ETF (19b-4).

Canary Capital's Exchange Traded Fund filing focuses on PENGU tokens and Pudgy Penguin NFTs, aiming to allocate 80%-95% of its assets to PENGU and 5%-15% to NFTs. Smaller portions of SOL and ETH will be held to cover transaction fees and NFT purchases, but not for investment exposure. PENGU is deployed on the Solana network, while Pudgy Penguin NFTs exist on Ethereum. ETH and SOL will be required for auction payments and gas fees.

The Canary Exchange Traded Fund, listed by CBOE, aims to unlock a new phase for NFTs by buying PENGU and Pudgy Penguins directly from the market. This is the first institutional application with NFTs in its composition, allowing real NFT purchases stored in cold wallets. The ETF reduces supply, increases visibility, and validates NFTs as a legit asset class. This could change the game by allowing institutions to buy NFTs without a wallet, regulate capital flowing into digital collectibles, and Pudgy becoming a friendly on-ramp to the NFT ecosystem. The approval of this ETF could begin the next chapter in the NFT space, as it could lead to the entire NFT market winning.

Following the CBOE's filing of the token application 19b-4, the following sequence of events will determine the approval of the $PENGU and Pudgy Penguins NFTs ETF. The SEC has initiated a formal review process for the registration structure, with a decision expected in Q4-2025 to Q1-2026. The CBOE has proposed rule changes, and the SEC has up to 240 days to respond, with the final decision deadline expected around the end of February 2026.

The first ETF to include NFTs, is expected to receive approval due to serious policy relationships, CBOE backing, strong reputations from Igloo & Canary Capital, and Pudgy Penguins IP's global retail reach and expansion. Decision deadlines for other Crypto Exchange Traded Funds are due in October 2025, and recent president executive-level signaling and a growing pro-crypto sentiment may increase the chances of approval. This may have a 60-70% chance of approval, which is higher than many expect.

The Memecoin ETF (ETFS) is entering SEC review through a 19b-4 filing, showcasing the wilder side of memecoins. Users on X have expressed their opinions, highlighting the novelty of the idea and the potential for institutional finance. The filing's importance for Pudgy Penguins' visibility is highlighted by the fact that only a few cryptocurrencies, like BTC, SOL, XRP, and DOGE, have reached this stage in the registraion process. This wilder trend in crypto continues to amaze users.

A significant turning point in the journey of token has been reached with the filing of Form 19b-4, particularly in light of the noteworthy interaction between the U.S. SEC and the fund managers looking to offer spot Solana ETFs. The filing has a good chance of receiving a node from the agency, according to researcher Eric Balchunas.

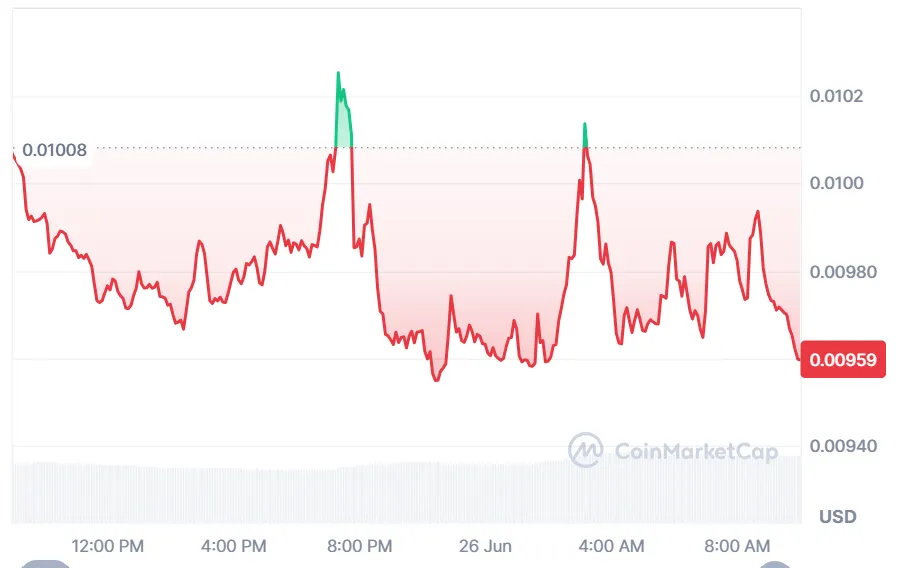

Additionally, in line with President Donald Trump's direction that the US lead the world in the adoption of digital assets, the agency has been trying to establish clear crypto standards. The good news caused the price to increase by 2% on Wednesday, reaching a value of roughly $0.009732.

Source: coinmarketcap

One of the most valued Solana-based memecoins is still the mid-cap one, which has a fully diluted valuation of over $745 million and a 24-hour average trading volume of nearly $124 million. Additionally, this memecoin can be traded on reputable cryptocurrency exchanges (CEX) and has a high level of on-chain liquidity.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.